Business

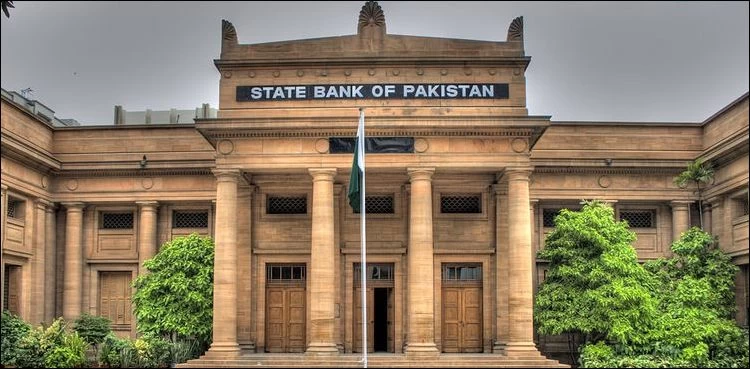

State Bank announces monetary policy, maintains interest rate

State Bank of Pakistan (SBP) has announced the monetary policy for the next two months maintaining the interest rate at 7 per cent.

According to the State Bank of Pakistan (SBP), the Monetary Policy Committee (MPC) decided to maintain the policy rate at 7 per cent. Since its last meeting in March, the MPC was encouraged by the further upward revision in the FY21 growth forecast to 3.94 per cent.

Since its last meeting in March, the MPC was encouraged by the further upward revision in the FY21 growth forecast to 3.94 per cent.

The MPC noted that this confirms the strength of the broad-based economic rebound underway since the start of the fiscal year, on the back of targeted fiscal measures and aggressive monetary stimulus. This positive momentum is expected to persist, translating into higher growth next year.

Inflation rose to 11.1 per cent (y/y) in April, propped up by the lingering impact of this February’s electricity tariff increase as well as a pick-up in month-on-month food prices, partly driven by the usual seasonality around Ramzan.

The MPC noted that supply shocks to food and energy still dominate, with a small number of energy and food items in the CPI basket accounting for about three-fourths of the rise in inflation since January. The MPC also observed that although core inflation in urban areas has risen by around 1.5 percentage points during this period, available evidence suggests that demand-side pressures on inflation continue to be relatively contained.

As previously forecast, the headline year-on-year inflation rate is likely to remain elevated in the coming months due to the recent the electricity tariff hike, pushing the average for FY21 close to the upper end of the announced range of 7-9 per cent. As supply shocks dissipate thereafter, inflation is expected to gradually fall toward the 5-7 per cent target range over the medium term.

In light of the foregoing considerations, the MPC was of the view that the current significantly accommodative stance of monetary policy remains appropriate to ensure the recovery becomes firmly entrenched and self-sustaining.

The latest National Income Accounts data confirm that the economy has rebounded strongly from last year’s severe Covid-shock, led by services and industry. The industrial sector is estimated to have grown 3.6 per cent during FY21, driven by construction and large-scale manufacturing, especially the food, cement, textile and automobile sectors.

The strong rebound is also reflected in exceptionally strong growth recorded in multiple high-frequency indicators across all three quarters of the year, including sales of fast-moving consumer goods and POL products. The agriculture sector is estimated to have grown 2.8 per cent, with the production of three important crops―wheat, rice and maize―rising to record highs and that of sugar cane to its second-highest ever level. Buoyed by the strong performance in commodity-producing sectors, services are estimated to have rebounded from last year’s contraction to register a growth of 4.4 per cent, led by wholesale and retail trade.

On the monetary side, the aggressive stimulus of 5 per cent of FY20 GDP was provided through one of the largest interest rate cuts in the world, time-bound liquidity relief to solvent borrowers in the form of principal deferment and loan restructuring, as well as new and temporary refinance facilities to prevent layoffs (Rozgar scheme), support health facilities, and promote investment (TERF).

According to the press release, unlike several previous growth upturns in Pakistan, the current economic recovery has been achieved without compromising external stability. At $0.8 billion, the current account has remained in surplus through the first ten months of FY21 for the first time in 17 years. In recent months, imports have picked up with the economic recovery, rising international commodity prices, as well as one-off shipments of wheat and sugar to quell temporary domestic shortages. However, this is being largely offset by record remittances, which rose to all-time highs in April on both a monthly ($2.8 billion) and cumulative basis ($24.2 billion).

Exports have grown by almost 14 per cent (y/y) so far this year, mainly due to high-value-added textiles and favourable prices. In March, Pakistan completed the combined 2nd-5th reviews of the IMF program and returned to international capital markets by raising $2.5 billion through an oversubscribed Eurobond, issued at yields below the initial price guidance, noted SBP.

SBP’s foreign exchange reserves rise to almost $16 billion, a four-year high.

As per SBP, ss envisaged in this year’s budget, fiscal consolidation has progressed well through the first three-quarters of FY21. At 3.5 per cent of GDP, the fiscal deficit is 0.6 percentage points lower than last year, despite higher interest payments and Covid-related expenses. Led by a rebound in sales tax and direct taxes, FBR tax collection (net of refunds) has increased by 14 per cent. Restrictions on supplementary grants and austerity measures have contained non-interest current expenditures, which grew by 6.7 per cent, only around half the rate of last year. As a result, the primary balance recorded a 1 per cent of GDP surplus, its highest level through the first three quarters in 12 years. Monetary and inflation outlook.

The MPC noted that financial conditions remain appropriately accommodative. Since the last meeting, market yields have declined in line with the forward guidance provided by the MPC and private sector credit has witnessed a notable uptick, consistent with previous growth upturns.

Cumulatively through April, the flow of private sector credit has grown by 43 per cent (y/y), led by fixed investment and consumer loans, primarily due to the low-interest-rate environment and SBP’s refinancing schemes.

-

Business 18 hours ago

Business 18 hours agoSaudi delegation to meet apex committee of SIFC today

-

Regional 1 day ago

Regional 1 day agoSC discards plea to cancel allotment in Bahawalpur

-

Pakistan 2 days ago

Pakistan 2 days agoPresident, PM express commitment to provide all facilities to Sikh Yatrees

-

Pakistan 2 days ago

Pakistan 2 days agoBus, Railway stations bustle as passengers return to cities after Eid vacations

-

Pakistan 2 days ago

Pakistan 2 days agoPunjab govt announces to fix price of Roti at Rs16

-

Pakistan 16 hours ago

Pakistan 16 hours agoLHC disposes of appeal of Imran Khan's security in jail

-

Regional 1 day ago

Regional 1 day agoSindh education removes ban on recruitment of teachers

-

Pakistan 1 day ago

Pakistan 1 day agoPunjab CM Maryam seeks comprehensive development plan for Murree