Business

SBP releases second quarterly report on Pakistan's economy for FY 2020-21

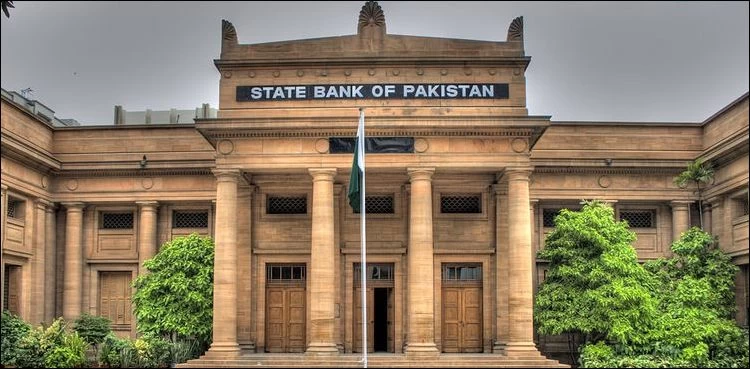

The State Bank of Pakistan Thursday released its Second Quarterly Report on The State of Pakistan’s Economy for the fiscal year 2020-21.

The report highlighted the strengthening of the economic recovery during the second quarter of the fiscal year. This was evident from the growing pace of industrial activity, the promising output of major Kharif crops (except for cotton), and a pick-up in the services sector during the review period.

According to the report, large-scale manufacturing (LSM) grew by 7.6 per cent during H1-FY21, with its growth in the second quarter accelerating to 10.4 per cent, the highest quarterly LSM growth since Q4-FY07.

The SBP report said that the construction and allied industries and food processing industries have played an important role in accelerating the pace of industrial activity.

In the construction sector, financial measures have been taken under the New Pakistan Housing Scheme under the government's aid package.

The report further stated that major Kharif crops in the agricultural sector have performed better than last year.

According to the report, the overall situation of cotton production will increase. Production of 7.7 million bales of cotton has negatively impacted the revised performance and the estimate represents the lowest production since FY 1986.

Per the report, timely and coordinated policy measures by the SBP and the government have played an important role in the situation in Karuna.

Construction, allied and food processing industries generated much of the momentum in industrial activity. The construction industry benefited from the favourable policy environment, which included the government’s fiscal incentives under the construction support package, the Naya Pakistan Housing Scheme, as well as financial measures from the State Bank.

Within agriculture, most of the major Kharif crops performed better than last year; this improvement was attributed mainly to increases in their areas under cultivation. The government’s support package for Rabi crops, comprising subsidies on key inputs, and an increase in the support price for wheat, are likely to bolster the overall crop sector growth. However, cotton exerted a drag on the overall agricultural performance, as the revised production estimate of 7.7 million bales represented the lowest output since FY86.

Nonetheless, due to the better output of other crops, the overall agriculture sector is expected to register positive growth.

On the whole, the recovery was rooted in the timely and well-calibrated policy response of the SBP and the government to counter the COVID-19 shock.

In the external sector, the current account posted a surplus of $1.1 billion during H1-FY21, driven by record-high workers’ remittances and reductions in services and primary income deficits. Remittances rose from all the major corridors, with strong growth recorded from the advanced economies as well as from the GCC.

Proactive policy measures by the government and SBP to encourage more inflows through formal channels, curtailed cross border travel in the face of Covid-19, altruistic transfers to Pakistan amid the pandemic, and orderly foreign exchange market conditions have contributed to the strength of remittances.

With the current account in surplus and sufficient external financing available, the SBP’s FX reserves increased by $1.3 billion and it's net forward liabilities also reduced by US$ 1.2 billion during H1-FY21. Moreover, the PKR appreciated 5.1 per cent against the US Dollar during the period.

Meanwhile, the newly launched Roshan Digital Accounts (RDAs) were eagerly received by overseas Pakistanis, as inflows into these accounts crossed the $1 billion mark in April 2021.

SBP said that overall national CPI inflation fell to 8.6 per cent during H1-FY21, from 11.1 per cent in the same period last year.

-

Pakistan 1 day ago

Pakistan 1 day agoAfter President’s visit, Pakistan-Iran joint declaration issued

-

Pakistan 2 days ago

Pakistan 2 days agoIranian President Raisi reaches Lahore

-

Pakistan 12 hours ago

Pakistan 12 hours agoPetition to file case against Punjab CM for wearing Police uniform

-

Pakistan 2 days ago

Pakistan 2 days agoUS reacts to Iran’s president visit in Pakistan

-

Sports 1 day ago

Sports 1 day agoPak vs NZ: Muhammad Rizwan, Irfan Khan ruled out of T20I series

-

Pakistan 2 days ago

Pakistan 2 days agoTraffic plan released as Iranian President to visit Lahore, Karachi today

-

Sports 1 day ago

Sports 1 day agoFourth T20I match: Imad can be part of Pakistan’s squad against New Zealand

-

Pakistan 2 days ago

Pakistan 2 days agoImran Khan not ready for deal, will face all cases: Aleema