Pakistan

PTI govt mulls introducing new policy to bring more in tax net, exempts salaried class from new tax

In an attempt to generate more revenues, the federal government is planning to bring new policy with the help of the Federal Board of Revenue (FBR).

The government says no new tax will be imposed on salaried class.

According to budget document, new proposed tax policy would enhance tax base after identifying new taxpayers, gradually eliminate relevant sections of tax exemptions and incentives, and focus on reduction in tax ratios.

“We shall protect the exiting taxpayers while avoiding further burden on outstanding amounts they have.”

The government is going to revive tax assessment scheme in its real form and each taxpayer would submit tax returns on own.

The FBR will consider tax returns as assessment orders if it lacks information about taxpayer. Otherwise the returns would be sent for audit.

Under the self assessment scheme, Automated Risk Based Selection Procedure will be followed to select returns for audit. The FBR will select external auditors under e-Audit system.

The audit process would follow strict procedures and any intentional concealing of information about tax would be considered an offence with jail imprisonment.

The FBR will take to task all those officials who intimidate taxpayers.

The income tax and sales tax will be considered primary instruments for collecting taxes.

The tax machinery will be further activated to act against people avoiding tax payments or coming into tax net.

“The information technology will be used up to the full extent to identify new taxpayers and access them electronically.”

The document further says the rich class would be brought under discipline for tax collection and tax exemptions available to power segment of society would be abolished.

-

Pakistan 15 hours ago

Pakistan 15 hours agoImran Khan’s interim bail extended in three cases

-

Sports 16 hours ago

Sports 16 hours agoVideo goes viral of meeting Babar Azam, Shaheen Afridi

-

Pakistan 1 day ago

Pakistan 1 day agoUse of plastic bags banned across Punjab

-

Pakistan 12 hours ago

Pakistan 12 hours agoCourt approves plea of Bushra Bibi, Imran Khan medical checkup

-

Pakistan 2 days ago

Pakistan 2 days agoBy-elections: Two exams of intermediate postponed

-

Pakistan 1 day ago

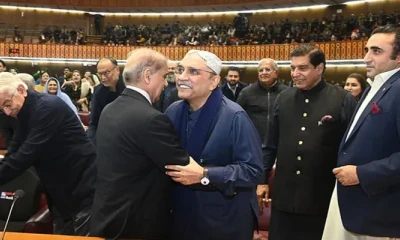

Pakistan 1 day agoJoint session of Parliament: Zardari's address, opposition protests

-

Sports 1 day ago

Sports 1 day agoBabar Azam wonders amid differences with Shaheen Afridi

-

Pakistan 2 days ago

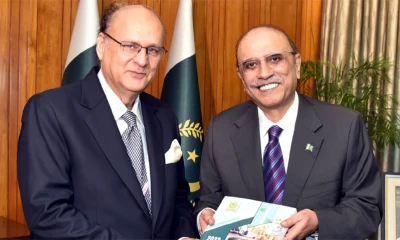

Pakistan 2 days agoPresident Zardari to address in joint session of Parliament