- Home

- Technology

- News

Binance CEO announces crypto industry recovery fund

Changpeng Zhao says he wants to form an organization that could “establish best practices” across the industry

The CEO of the largest online exchange for trading cryptocurrency said Wednesday that he’s establishing a recovery fund to help people in the industry while saying the sector “will be fine.”

“We want the strong industry players today to protect the good industry players who might just be hurt short term,” Binance CEO Changpeng Zhao said during an interview with CNBC’s Dan Murphy at Abu Dhabi Finance Week.

“That’s not to say we can save everybody. If a project is mismanaged on multiple fronts we won’t be able to help them anyway.”

Zhao said cryptocurrency had “shown extreme resilience,” suggesting he didn’t expect recent turbulence in the industry to cause long-term damage. He did not specify an exact figure for the size of the recovery fund.

His comments come just a week after Binance backed out of a deal to rescue rival exchange FTX, which declared bankruptcy Friday.

The price of bitcoin dropped below $17,000 for the first time since 2020 and there are concerns the so-called “crypto contagion” could lead to the downfall of other big industry names, such as Crypto.com. The company’s CEO denied the claims and said the platform was “performing business as usual.”

“Short term there’s a lot of pain but long term it’s accelerating the efforts we’re making to make this industry healthier,” Zhao said.

The CEO on Monday said Binance had seen a “slight increase in withdrawals” in the last week, but he said this was in line with other dips in the market.

“Whenever prices drop, we see an uptick in withdrawals,” Zhao said. “That’s quite normal.”

Regulations will help, but they won’t fix everything

Zhao said he wants to form an organization that could “establish best practices” across the industry, which is known for its lack of regulation.

“Regulations need to be adapted for this industry,” Zhao said. “Regulation won’t fix all of this, it will reduce it. It’s important but we’ve got to have the right expectations,” he added.

Zhao reflected on how there were elements of traditional finance that could help the cryptocurrency market to become more regulated and better trusted, but practices would need to be adapted to be fit for purpose.

The “transparency” and “audit” aspects of traditional finance could benefit the crypto industry, but there are “subtle but very important” differences that would need to be made, according to the CEO.

“Too many regulators are more of a traditional mindset, they need to get a crypto mindset,” he said

The comments echo those made by Ripple CEO Brad Garlinghouse, who said the idea that crypto is “not regulated is overstated,” but that “transparency builds trust.”

“Crypto has never just been sunshine and roses and as an industry, it needs to mature,” Garlinghouse said on CNBC’s “Squawk Box Europe” Wednesday.

Economist Nouriel Roubini took a different line in his Abu Dhabi Finance Week interview and described crypto and some of its major players as an “ecosystem that is totally corrupt.”

The New York University professor said there were “seven Cs of crypto”: “Concealed, corrupt, crooks, criminals, con men, carnival barkers,” and finally, Changpeng Zhao himself.

SOURCE: CNBC

Nintendo’s next big Pokémon presentation is on February 27th

- 15 hours ago

Security forces kill four terrorists in DI Khan IBO: ISPR

- 5 hours ago

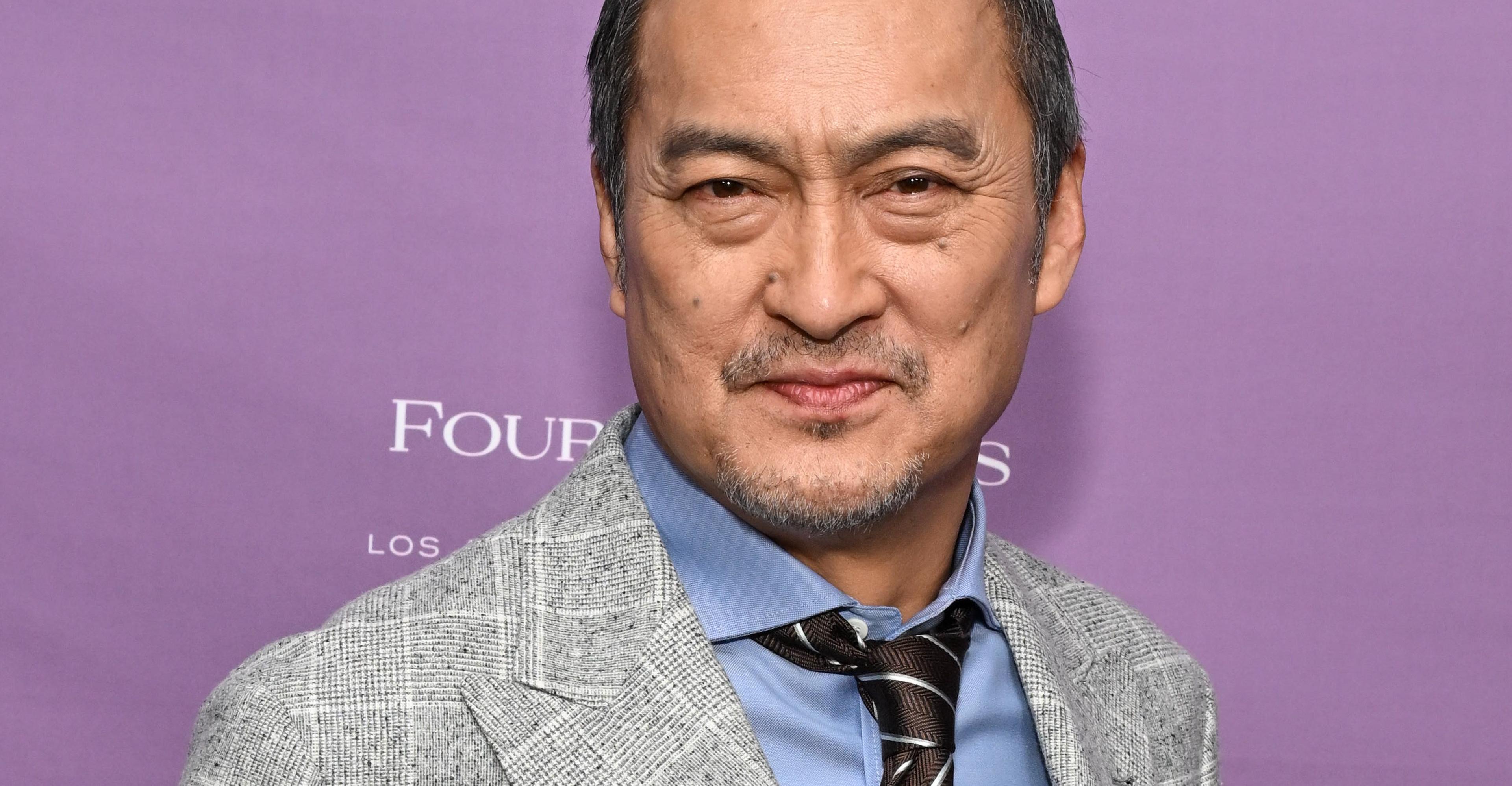

Ken Watanabe didn’t think a kabuki movie would work

- 15 hours ago

Pakistan, Qatar review trade & economic cooperation

- 29 minutes ago

Senate passes resolution rejecting Israeli statement, reaffirms support for Palestine

- 6 hours ago

Pakistan set 165-run target for England in Super 8 clash

- 11 minutes ago

Six cops including DSP martyred in Kohat attack

- 5 hours ago

USS Gerald Ford, world’s largest aircraft carrier, at US base on Crete

- 21 minutes ago

The Pixel 10A and Soundcore Space One are just two of the best deals this week

- 6 hours ago

Met office forecasts dry weather in most parts of country

- 5 hours ago

Imran Khan’s sister Noreen Niazi injured after falling into under-construction sewer line

- 5 hours ago

Gold prices continue to surge in Pakistan, global markets

- 5 hours ago