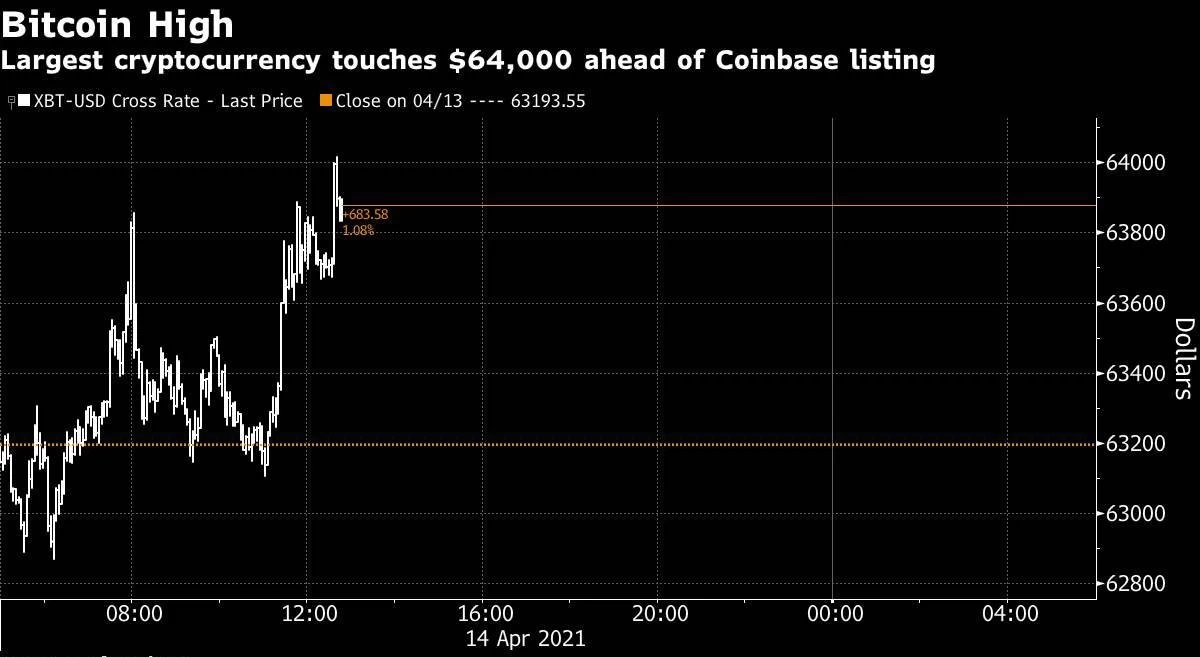

Bitcoin surged above the $63,000 mark for the first time since March, approaching record highs. The world's biggest and best-known the cryptocurrency climbed as much as 1.6 per cent to $64,207 in Asia trading.

According to a foreign news agency, the bitcoin price exceeded the $63,000 benchmark, which is more than Rs9.7 million in Pakistani rupees.

The cryptocurrency exchange Coin Base is preparing to launch its shares in Wall Street's Nasdaq Index.

According to expert, a good start for the Coin Base in Nasdaq is the first formal link between a traditional financial avenue and an alternative cryptocurrency.

The Swiss expert added that a successful rise in the Nasdaq should also be a process for traditional investors to accept corrupt currencies, but stock markets are still worried about inflation.

Coinbase’s public debut this week is also boosting the digital coins of other cryptocurrency exchanges, such as Binance Coin, which has jumped to become the third-most valuable cryptocurrency behind Bitcoin and Ether.

Earlier, Bitcoin surged above $60,000 for the first time since March, approaching record highs. The world's biggest and best-known cryptocurrency hit $61,222.22 on Saturday, its highest in nearly a month.

Early Saturday morning, as the cryptocurrency was floating around its weekend high, Tesla and SpaceX CEO Elon Musk tweeted "...going to the moon very soon," in an apparent reference to popular Bitcoin slang "to the moon."

… going to moon very soon

— Elon Musk (@elonmusk) April 10, 2021

Bitcoin rose above $60,000 to approach record highs on the weekend, breaking out of a two-week tight range and propelled by talk of constrained new supplies against evidence of wider adoption.

It crossed the $60,000 mark for the first time on March 13, hitting a record $61,781.83 on Bitstamp exchange, just after U.S. President Joe Biden signed his $1.9 trillion fiscal stimulus package into law.

The cryptocurrency is up over 700% from a year ago when a single bitcoin was below $7000. This year, bitcoin is up over 100% after a February rally brought the cryptocurrency over $50,000 for the first time.

Bitcoin's stunning gains this year have been driven by its mainstream acceptance as an investment and a means of payment, accompanied by the rush of retail cash into stocks, exchange-traded funds and other risky assets.

A few days ago, the world's richest man Alan Musk's car company Tesla said that in January 2021 it bought $1.5 billion worth of cryptocurrency. After the Tesla announcement, the price of bitcoin increased significantly and one Bitcoin touched the limit of $44,000.

Mr Musk, a well-known Bitcoin enthusiast earlier made the unexpected announcement in a tweet.

Bitcoin has been on a dramatic rise since March last year, when it stood at $5,000, spurred by online payments giant PayPal saying it would allow account holders to use cryptocurrency.

Last month Elon Musk's electric carmaker Tesla invested $1.5 billion in the virtual unit, while Twitter chief Jack Dorsey and rap mogul Jay-Z said they are creating a fund aimed at making Bitcoin “the internet's currency”.

Others jumping on the bandwagon include Wall Street player BNY Mellon, investment fund giant BlackRock and credit card titan MasterCard.

Bitcoin, which was launched back in 2009, hit the headlines in 2017 after soaring from less than $1,000 in January to almost $20,000 in December of the same year.

The virtual bubble then burst in subsequent days, with bitcoin's value then fluctuating wildly before sinking below $5,000 by October 2018.

However, the last year's rise has been more steady, with investors and Wall Street finance giants wooed by dizzying growth, the opportunity for profit and asset diversification, and a safe store of value to guard against inflation.

Bitcoins are traded via a decentralised registry system known as a blockchain.

The system requires massive computer processing power to manage and implement transactions.

That power is provided by “miners”, who do so in the hope they will receive new bitcoins for validating transaction data

Tesla CEO Elon Musk, says Tesla's cars can now be bought with a bitcoin.

You can now buy a Tesla with Bitcoin

— Elon Musk (@elonmusk) March 24, 2021

Mr Musk tweeted Tesla would be running its own internal software to handle Bitcoin payments, which "operates Bitcoin nodes directly".

Further, in a statement, he said: "Bitcoin paid to Tesla will be retained as Bitcoin, not converted to fiat [government-controlled] currency"

It should be noted that like Euro and Dollar, Bitcoin is also a currency but it is only in virtual or digital form. The virtual-digital currency can be purchased with cash, credit or debit cards and wire transfers, but first, the buyer needs to create a bitcoin 'vault'.

The vault creates an identity called a wallet ID and holds bitcoin similarly to cash or credit cards in your wallet.

Regarding the use of bitcoins for Tesla's vehicles, Elon Musk said on Twitter that the facility to pay with bitcoins will be available in countries other than the United States by the end of this year.

Elon Musk continues to innovate his work through technology. However, Tesla recently bought Bitcoins worth $ 1.5 billion.

Bitcoin's value rapidly moves up and down - meaning the cryptocurrency price of the car could change day to day.

Tesla— an American electric vehicle and clean energy company that produce electric cars, battery energy storage from home to grid-scale, solar panels and solar roof tiles, as well as other related products and services.

PM directs strict action against hoarders of petroleum products

- 8 گھنٹے قبل

Britney Spears arrested on suspicion of DUI

- 14 گھنٹے قبل

Gold rises as Middle East conflict spurs safe-haven demand

- 13 گھنٹے قبل

Iran to expand attacks in days to come: military

- 13 گھنٹے قبل

Nvidia’s spending $4 billion on photonics to stay ahead of the curve in AI

- 15 گھنٹے قبل

Pokémon Pokopia is an expansive adventure disguised as a cozy life sim

- 15 گھنٹے قبل

Oil falls but set for steepest weekly gain since 2022

- 13 گھنٹے قبل

The giant loophole that lets Big Dairy keep baby cows in solitary confinement

- ایک دن قبل

‘There will be nerves’: India face New Zealand for T20 World Cup glory

- 12 گھنٹے قبل

Pakistan qualify for Hockey World Cup after eight years

- 8 گھنٹے قبل

Tehran hit by heavy bombing on day seven of US-Israel war on Iran

- 13 گھنٹے قبل

Justice Department releases missing Epstein records containing sexual allegations against Trump

- 14 گھنٹے قبل