- Home

- Technology

- News

US ETF launch: Bitcoin climbs all-time high above $66,000

Crypto giant Bitcoin reached a fresh all-time high on Wednesday as investors celebrated the successful launch of the first US bitcoin futures exchange-traded fund.

The world’s largest cryptocurrency climbed about 3% to $66,390.75 by 11:20am ET, topping a previous record of $64,899 set in mid-April.

“The key here is whether we are able to establish support above $65,000. If we can, the classic Q4 crypto rallies we’ve seen in most years could take bitcoin towards some of the loftier price predictions we’ve seen over the past several months. If sell pressure takes over, though, our next leg up could take a while to materialize,” said Jesse Proudman, CEO of crypto robo-advisor Makara.

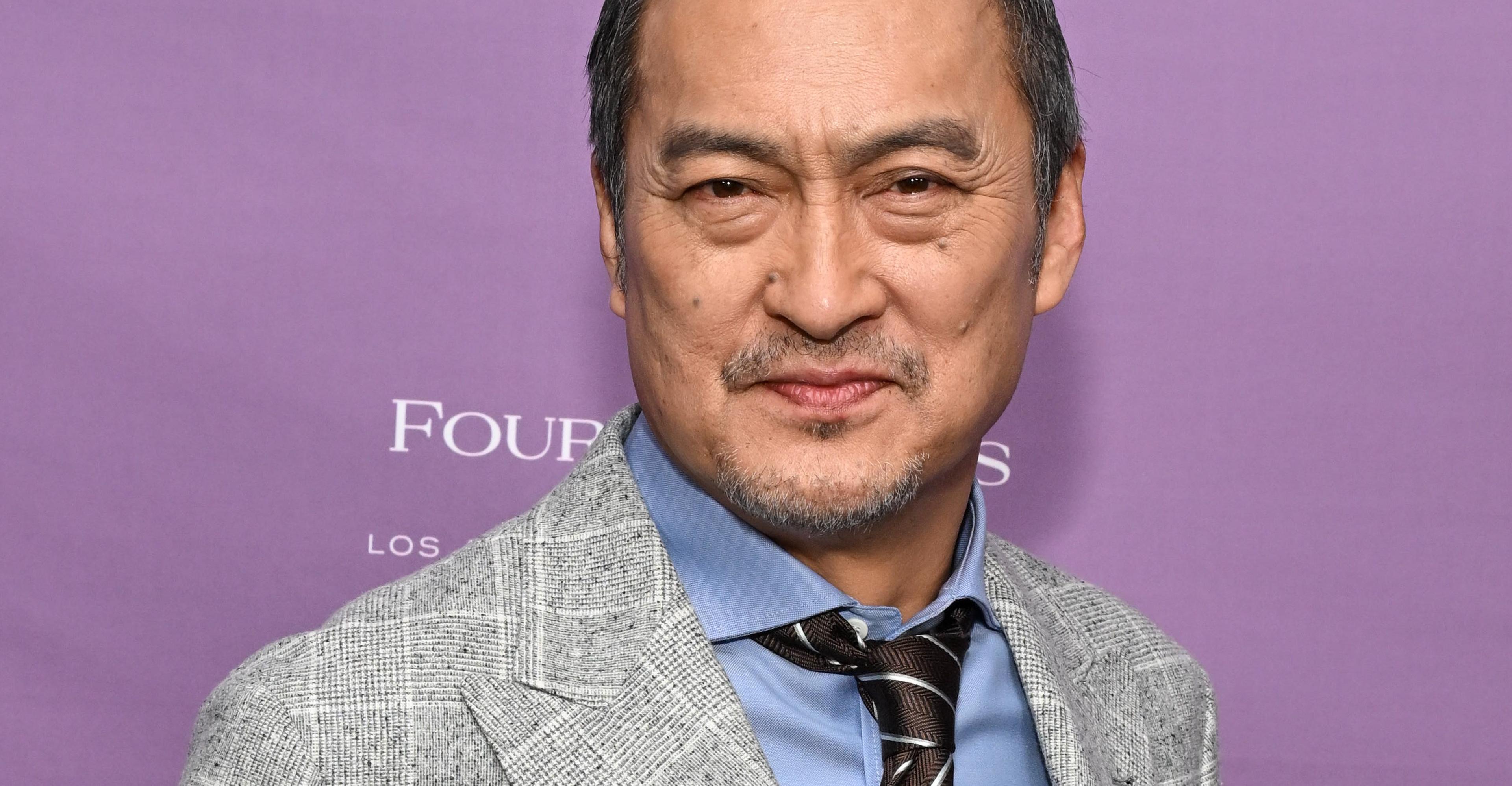

Bullish comments from a legendary trader boosted sentiment Wednesday. Billionaire investor Paul Tudor Jones called crypto his preferred inflation hedge over gold.

“Bitcoin would be a great hedge. Crypto would be a great hedge,” Jones told CNBC’s “Squawk Box” on Wednesday. “There’s a plan in place for crypto and clearly it’s winning the race against gold at the moment ... I would think that would also be in very good inflation hedge. It would be my preferred one over gold at the moment.”

Ethereum also rose roughly 6% to cross back over the $4,000 level. The world’s second-largest cryptocurrency traded at $4,022.27 approaching its all-time intraday high of 4,380 in May.

The ProShares Bitcoin Strategy ETF, which tracks bitcoin futures contracts speculating on the future price of the cryptocurrency, rose nearly 5% on its first day of trading Tuesday.

Not everyone in the crypto market was impressed. Several bitcoin investors want an ETF that tracks spot prices rather than futures.

Novice investors have had to get to grips with terms like “contango,” where the futures price of a commodity is higher than its spot price, and “backwardation,” which is essentially the opposite.

“More products are great, but I just don’t see the point of investing in futures-based bitcoin ETFs when you can buy the asset in the spot market,” said Jodie Gunzberg, managing director of CoinDesk Indexes.

“It’s not like oil or cattle that is impossible to hold physically for most investors. It’s more like gold that can be easily held. Except the cost is more like oil.”

Still, it’s a landmark for the nascent crypto industry, which has long been pushing for greater acceptance of Bitcoin and other digital currencies on Wall Street.

SOURCE: CNBC

£190m graft case: IHC to hear Imran, Bushra’s pleas for sentence suspensions on March 11

- 13 گھنٹے قبل

Cognizant Classic 2026: How to watch, PGA schedule on ESPN

- ایک دن قبل

Gold prices fall in Pakistan, global markets

- 14 گھنٹے قبل

South Africa beat West Indies by nine wickets in Super Eight stage of T20 World Cup

- 9 گھنٹے قبل

Iran enters third round of nuclear talks with ‘seriousness and flexibility’

- 14 گھنٹے قبل

Strikes in Afghanistan executed to ensure safety of Pakistani citizens, prevent terrorist attacks: FO

- 9 گھنٹے قبل

The Epstein files Trump’s DOJ is withholding

- ایک دن قبل

Taara Beam provides 25Gbps connectivity over invisible beams of light

- ایک دن قبل

TGL doubleheader highlights: New York loses back-to-back matches

- 12 گھنٹے قبل

.jpg&w=3840&q=75)

Pakistan committed to peaceful resolution of disputes: Ishaq Dar

- ایک دن قبل

PM Shehbaz unveils PSDP data portal for transparent governance

- ایک دن قبل

The Supreme Court will decide if marijuana users may be barred from owning guns

- ایک دن قبل