The country’s statutory tax rate will be 9% for taxable income exceeding 375,000 UAE dirhams ($102,000), and zero for taxable income up to that amount “to support small businesses and startups

Dusbai: The United Arab Emirates will be introducing a federal corporate tax on business profits for the first time, the Ministry of Finance announced Monday.

The news represents a significant shift for a country that’s long attracted businesses from around the world thanks to its status as a tax-free commerce hub. Businesses will be subject to the tax from June 1, 2023.

The country’s statutory tax rate will be 9% for taxable income exceeding 375,000 United Arab Emirates dirhams ($102,000), and zero for taxable income up to that amount “to support small businesses and startups,” the ministry said, adding that “the UAE corporate tax regime will be amongst the most competitive in the world.”

Individuals will still not be subject to tax on their incomes from employment, real estate, equity investments or other personal income unrelated to a UAE trade or business, the ministry said. The tax also won’t be applied to foreign investors who don’t conduct business in the country.

As for what constitutes profit, corporate tax will apply on “the adjusted accounting net profit” of the business.

Free zone business, meanwhile — thousands of which exist in the country — can “continue to benefit from corporate tax incentives” as long as they “meet all necessary requirements,” the ministry said, without elaborating. Companies within the UAE’s many free zones have long enjoyed zero taxes and full foreign ownership, among other benefits.

“The UAE corporate tax regime has been designed to incorporate best practices globally and minimise the compliance burden on businesses,” state news agency WAM wrote.

“Corporate tax will be payable on the profits of UAE businesses as reported in their financial statements prepared in accordance with internationally acceptable accounting standards, with minimal exceptions and adjustments. The corporate tax will apply to all businesses and commercial activities alike, except for the extraction of natural resources which will remain subject to Emirate level corporate taxation.”

SOURCE: CNBC

How to figure out your finances after a breakup

- 10 hours ago

PM announces reward of Rs1.5m for each player of national hockey team

- 9 hours ago

World leaders are almost never killed in war. Why did it happen to Iran’s supreme leader?

- 19 hours ago

Pakistan targeting militant hideouts in Afghanistan: Tarar

- 9 hours ago

Lee navigates wild round to lead LPGA in China

- 9 hours ago

PM Shehbaz Sharif announces 14-point austerity plan

- 3 hours ago

Valve’s Steam Machine may not launch this year

- 21 hours ago

Berger in lead as rain takes teeth out of Bay Hill

- 9 hours ago

Special meeting on austerity policy: Federal Cabinet decides to forgo two months’ salaries

- 9 hours ago

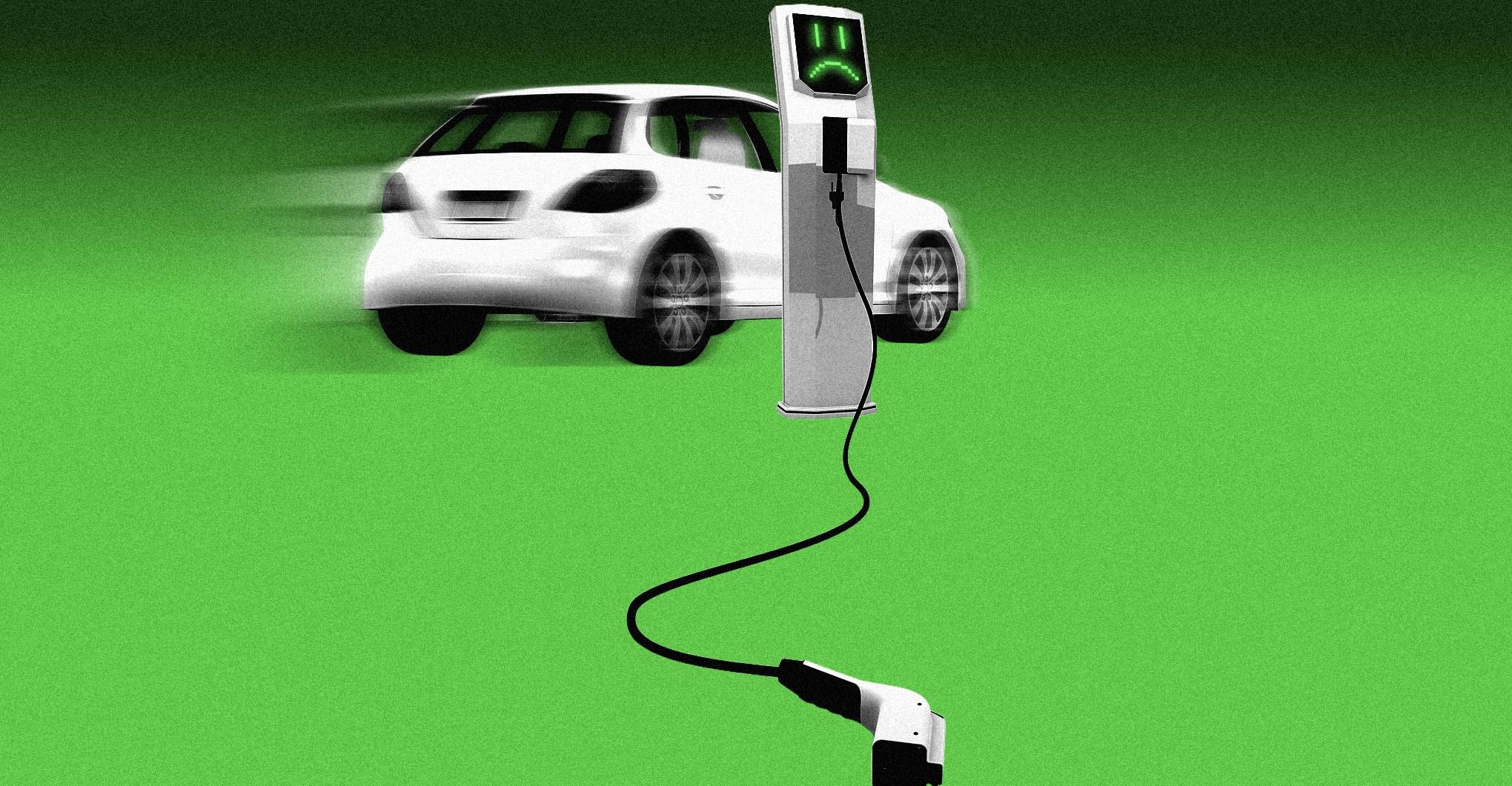

The uncomfortable truth about hybrid vehicles

- 12 hours ago

Downdetector and Speedtest sold to Accenture for $1.2 billion

- 12 hours ago

Pakistan Navy launches Operation Muhafiz-ul-Bahr to ensure maritime security

- 5 hours ago