The investment-to-GDP ratio is projected to rise from 13pc in 2024 to 16pc by 2029

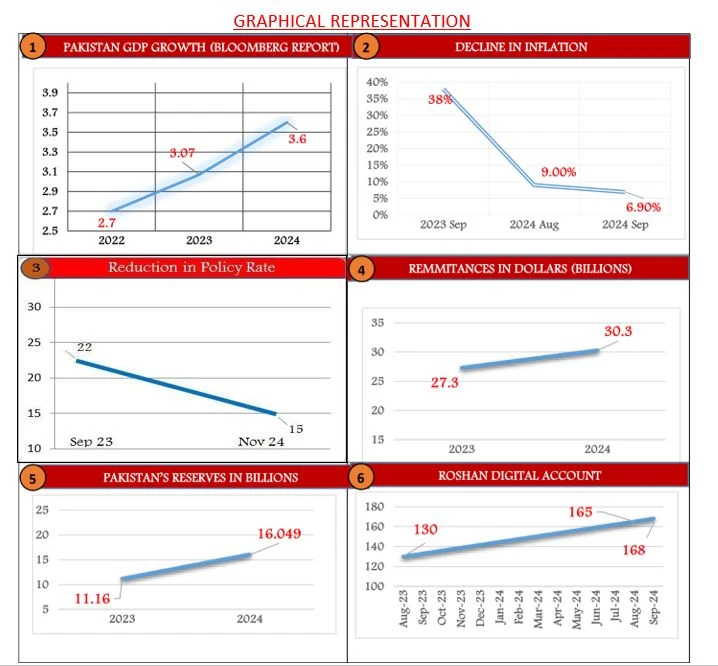

Lahore: The International Monetary Fund (IMF) has forecast Pakistan’s economy to grow by 3.2 per cent and Bloomberg by 3.6pc during the current fiscal year (FY2024-25), falling short of the government’s budget target but surpassing projections by two other leading multilateral organisations. It is expected to touch 4pc in FY 26.

This growth rate is expected to be accompanied by a single-digit inflation rate of 9.5pc and a current account deficit nearing 1pc.

The IMF, which recently approved a $7 billion bailout for Pakistan, expects the country’s growth rate to gradually improve to 4.5pc by 2029. In contrast, both the World Bank and Asian Development Bank project Pakistan’s growth rate for the current fiscal year at 2.8pc and inflation at the higher side of 10pc.

Forecast falls short of budget target, but surpasses projections by two leading multilaterals. Economic turnaround; highlights effective structural reforms & initiatives; on a solid path towards sustainable, long-term growth

The WEO forecasts Pakistan’s inflation, measured by the Consumer Price Index, at 9.5pc ((declined from 38% Sep 23 to 6.9% Sep 24) for the current year, decreasing to 6.5pc by 2029, down from 23.4pc in 2024. The current account deficit is expected to remain flat at 0.9pc of GDP this year and in 2029, compared to a low of 0.2pc last year.

The investment-to-GDP ratio is projected to rise from 13% in 2024 to 16% by 2029 with positive indicators and validation of effective policy measures. The Foreign Direct Investment (FDI) surged by 55.5% which increased investor confidence.

The country’s exports increased by 7.2% in the first quarter of FY25) as exports remained at $27.72bn in FY23 and $30.64bn in FY24. With a commendable rise of 10.54% in comparative analysis, the exports grew owing to growing demand and strategic trade agreements, reduced the trade deficit and supported local industries.

The reduction in the key policy rate from 22% in September 2024 to 15% in November reflected the improved economic health of the country.

The country’s remittances jumped from $27.3bn in 2023 to $30.3bn in 2024 with 10.7% growth indicating the strengthening foreign exchange reserves. The remittances grew 35% to $11.8bn in the first four months of FY25

Foreign exchange reserves in the State Bank of Pakistan (SBP) clock in at $11.175bn and $16.049bn with the commercial banks. Government debt has reduced from Rs1,426bn to Rs601bn in the comparative yearly analysis due to efficient austerity measures.

The government’s non-tax revenue upped by 550% to reach Rs3.05tn, while tax revenue jumped by 25% to reach Rs2.77tn. The Federal Board of Revenue (FBR)’s collection was Rs9.285tn in FY23, exceeding its expected target with substantial growth of 30% as compared to the previous fiscal year. The increase has been attributed to structural reforms.

The Pakistan Stock Exchange (PSX) crossed the historic level of over 93,000 with a 78.9% increase in November this year as investors' confidence took to new heights. Bloomberg has already recognized the PSX as one of the world’s top-performing markets.

The filing of tax returns also surged by 71% in the country which indicated improved fiscal health.

Overseas Pakistanis sent $130mn in August 23: $165mn in August 24 and $168m in September 2024 under the Roshan Digital Account (RDA).

The IMF also predicted the unemployment rate to decline to 7.5pc next year from 8pc in the current year, though it did not explain how these figures were determined, given that Pakistan’s last labour force survey was conducted in FY21.

JD Vance and the future of MAGA

- 6 hours ago

Vikes' Kelly to IR after 3rd concussion of season

- 7 hours ago

Harbaugh denies rift, on 'A-plus' terms with Lamar

- 7 hours ago

Commanders to start QB Johnson vs. Cowboys

- 7 hours ago

Sources: Fairbanks, Marlins agree to 1-year deal

- 7 hours ago

These great digital gifts will arrive just in time for Christmas

- 8 hours ago

Macdonald backs Hall, disagrees with suspension

- 7 hours ago

How to actually get kids off their phones

- 6 hours ago

T.J. Watt practices for 1st time since lung injury

- 7 hours ago

The Playbook: Shadow Reports, lineup locks for Christmas Day and all of Week 17

- 7 hours ago

How to consume the Epstein files responsibly

- 6 hours ago

WR Rice among four Chiefs players placed on IR

- 7 hours ago