Brent futures for January delivery fell $3.67 to $84.69 a barrel

Oil prices fell more than four per cent on Wednesday as the Group of Seven (G7) nations looked at a price cap on Russian oil above where it is currently trading and as gasoline inventories in the United States built by more than analysts' expected.

Brent futures for January delivery fell $3.67 to $84.69 a barrel, a 4.2% loss, by 11:07 a.m. ET (16:07 GMT). U.S. crude fell $3.56, or 4.4%, to $77.39 per barrel.

Both contracts had risen by over $1/bbl earlier in the session.

U.S. gasoline stocks rose by 3.1 million barrels, according to the Energy Information Administration. Analysts had estimated a build of 383,000 barrels.

"The build in gasoline is kind of a shock," said Phil Flynn, an analyst at Price Futures group. "The increase in gasoline supplies suggests that maybe we're seeing demand weakening or that gasoline is going on the rack ahead of the holidays."

EIA data also showed a 3.7 million barrel draw in Crude inventories, compared with analysts' expectations in a Reuters poll for a 1.1 million-barrel drop.

Prices were also hit by reports that the G7 price cap on Russian oil could be above the level it is trading.

G7 nations are looking at a price cap on Russian seaborne oil in the range of $65-70/bbl, according to a European official on Wednesday.

Meanwhile, Urals crude delivered to northwest Europe is trading around $62-$63/bbl, although it is higher in the Mediterranean at around $67-$68/bbl, according to Refinitiv data.

Because production costs are estimated at around $20 per barrel, the cap would still make it profitable for Russia to sell its oil and in this way prevent a supply shortage on the global market.

A senior U.S. Treasury official said on Tuesday that the price cap will probably be adjusted a few times a year.

The news added to demand concerns relating to top crude oil importer China, which has been grappling with a surge in COVID-19 cases, with Shanghai tightening rules late on Tuesday.

Also adding pressure was an OECD economic outlook that sees a deceleration in global economic expansion next year.

"On the bright side, the OECD does not envisage a global recession and maybe this helped oil prices and stocks strengthen further," said analyst Tamas Varga at PVM Oil Associates.

The market also awaits the minutes from the U.S. Federal Reserve's November policy meeting due at 1900 GMT for clues on possible economic contraction and further rate hikes, Varga said.

SOURCE: REUTERS

Iran says any US attack including limited strikes would be ‘act of aggression’

- 15 گھنٹے قبل

Security forces neutralise four Indian-sponsored terrorists in Pishin IBO: ISPR

- 15 گھنٹے قبل

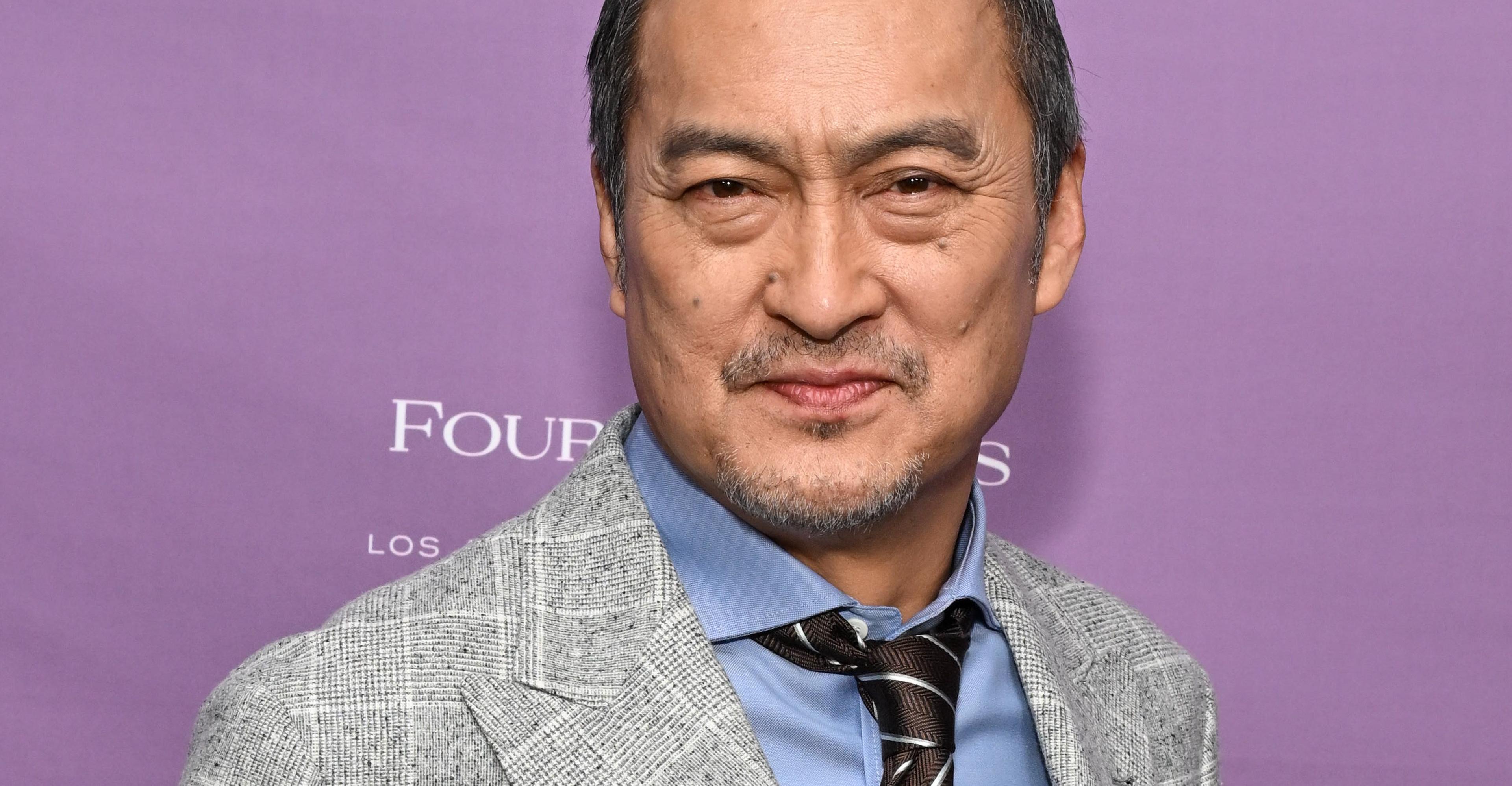

Ken Watanabe didn’t think a kabuki movie would work

- 3 گھنٹے قبل

President, PM urge Scouts to assist Govt in dealing with challenges

- 2 دن قبل

What are gold rates in Pakistan, global markets today?

- 15 گھنٹے قبل

Super eight: spinners’ magic works as England beat Sri Lanka by 51 runs

- 2 دن قبل

Three Federal Constabulary personnel martyred in terrorist attack in KP’s Karak

- 15 گھنٹے قبل

T20 World Cup: Pakistan warn England’s flaky batting to expect a trial by spin

- 15 گھنٹے قبل

UN chief decries global rise of ‘rule of force’

- 13 گھنٹے قبل

Nintendo’s next big Pokémon presentation is on February 27th

- 3 گھنٹے قبل

Pakistan targets 7 TTP, ISKP hideouts in border operation

- 2 دن قبل

Pakistan, Bangladesh to expand cooperation across diverse sectors

- ایک دن قبل