Rates may rise to 290 per dollar in the upcoming weeks.

Karachi: Pakistani rupee is expected to experience further weakness against the US dollar in the coming week due to increased demand for the American currency for import payments.

During the past week, the rupee maintained a range-bound trading pattern in the interbank market, concluding the week at 286.93 against the US dollar on Friday, compared to Monday's closing of 286.19

This resulted in a 0.25% decline against the greenback.

Tresmark, in its weekly commentary, stated that June typically witnesses heavy outflows due to defense-related payments, which could lead to increased volatility in rupee rates.

Considering the recent trade deficit of $2.1 billion, Tresmark revised the projected current account to a $470 million deficit.

They also highlighted that open market rates may remain distorted until there is positive news from the International Monetary Fund (IMF) or a steady stream of inflows, especially as importers are advised to settle payments through non-banking channels, potentially leading to increased grey market/hawala transactions.

With the government presenting the budget for the fiscal year 2023-24, deficit financing becomes a crucial aspect, focusing on borrowing as a means to bridge the funding gap.

Cold, partly cloudy weather expected over most parts of country

- 8 hours ago

Want a new job? Be (sort of) annoying.

- 20 hours ago

Pakistan military court sentences ex-spy chief Faiz Hameed to 14 years in prison

- 9 hours ago

The “Trump Gold Card,” briefly explained

- 20 hours ago

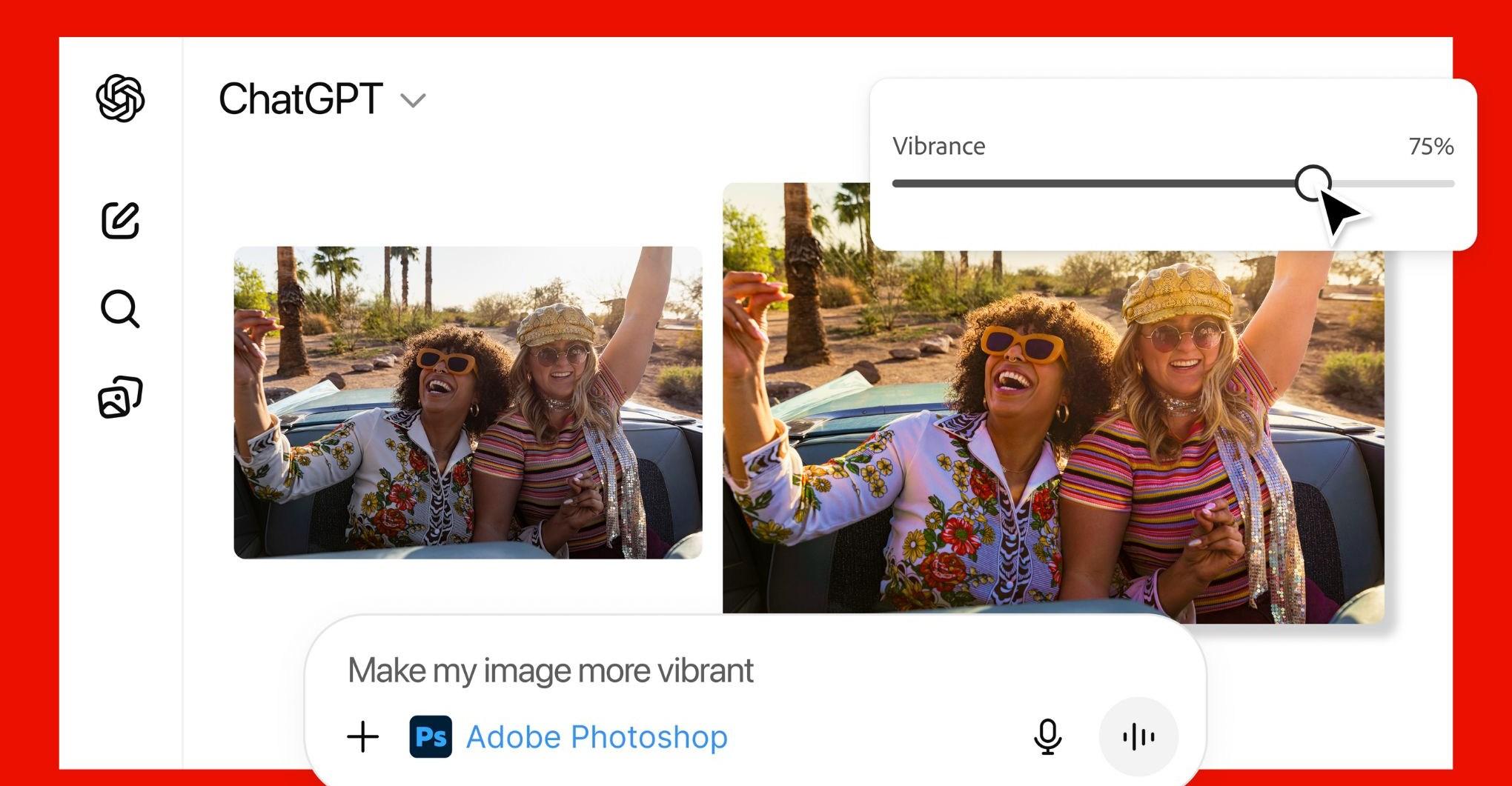

ChatGPT can now use Adobe apps to edit your photos and PDFs for free

- 13 hours ago

Pakistan win Under-19 Women T20 series

- 8 hours ago

Taylor Swift breaks down in Eras documentary over Southport attack

- 5 hours ago

PM Shehbaz emphasises to resolve disputes peacefully through dialogue, diplomacy

- 9 hours ago

The Supreme Court sounds surprisingly open to a case against a death sentence

- 11 hours ago

Gold prices jump in Pakistan, global markets

- 8 hours ago

Japan lifts tsunami warning after 6.7-magnitude earthquake

- 8 hours ago

Chris DeMarco excited to take over Liberty when Warriors duties end

- 21 hours ago