It was a welcome reversal after last week's surprise sharp jump in jobless claims

New York (Reuters): The number of Americans filing new applications for unemployment benefits fell more than expected last week, calming fears the labor market was unraveling and reinforcing that a gradual softening remains intact.

Initial claims for state unemployment benefits fell 17,000 to a seasonally adjusted 233,000 for the week ended Aug. 3, the Labor Department said on Thursday, the largest drop in about 11 months. Economists polled by Reuters had forecast 240,000 claims for the latest week.

It was a welcome reversal after last week's surprise sharp jump in jobless claims, and most likely reflects a fading in the impact from temporary motor vehicle plant shutdowns and Hurricane Beryl. The prior week's tally was revised up slightly to 250,000 from the previously reported 249,000.

It also adds more evidence to the possibility that the severity of last week's worse-than-expected monthly payrolls report for July was partly an outsized blip due to the record number of people unable to work because of bad weather.

U.S. stocks gained following the release, while benchmark Treasury yields rose back above 4%. The U.S. dollar (.DXY), opens new tab also strengthened against a basket of currencies.

"The talk of an imminent recession seems wide of the mark," said Marc Chandler, chief market strategist at Bannockburn Global Forex.

Investors in interest rate futures contracts pared bets the Federal Reserve will start cutting borrowing costs next month with a bigger-than-usual 50-basis-point reduction to about a 58% probability from 70% before the release.

Claims have been on a roughly upward trend since June, with part of the rise blamed on volatility related to the motor vehicle plant shutdowns for retooling and disruptions caused by Hurricane Beryl in Texas. Unadjusted claims dropped 13,589 to 203,054 last week.

Claims fell sharply in Michigan and Missouri, states with a heavy presence of motor vehicle assembly plants which saw claims rise the prior week. Auto makers typically idle assembly lines in July to retool for new models.

Over the past few weeks overall claims have been hovering near the high end of the range this year, but layoffs remain generally low. Government data last week showed the layoffs rate in June was the lowest in more than two years. The slowdown in the labor market is being driven by less aggressive hiring as the Fed's interest rate hikes in 2022 and 2023 dampen demand.

The Fed also closely monitors how jobless rolls compare to the size of the labor force to gauge the health of the jobs market. Growth in the labor force has largely kept pace with the gradual rise of those claiming jobless relief and is about where it was before the coronavirus pandemic.

The U.S. central bank last week kept its benchmark overnight interest rate in the 5.25%-5.50% range, where it has been since last July, but policymakers signaled their intent to reduce borrowing costs at their next policy meeting in September.

However, the government's monthly nonfarm payrolls report last Friday showed job gains slowed markedly in July and the unemployment rate rose to 4.3%, alarming markets at that point that the labor market may be deteriorating at a pace that would call for strong action from the Fed.

The number of people receiving benefits after an initial week of aid, a proxy for hiring, increased 6,000 to a seasonally adjusted 1.875 million during the week ending July 27, the claims report showed, continuing an upward trend. That caused some economists to remain wary.

"Investors have to be careful not to read too much into one report like they did recently with the last payroll report," said Jeffrey Roach, chief economist at LPL Financial. "If the data deteriorates quickly from here, the Fed could take more decisive action in September and cut by a half of a percent."

WHOLESALE INVENTORIES RISE

The housing market, which has struggled amid high interest rates, saw some welcome news on Thursday. The average rate on the popular U.S. 30-year mortgage rate fell 26 basis points to 6.47% this week, its lowest level since May of last year, according to data from mortgage finance agency Freddie Mac.

Meanwhile, U.S. wholesale inventories increased in June, the Commerce Department's Census Bureau reported on Thursday, adding to economic growth in the second quarter. Wholesale inventories rose 0.2% in June as previously estimated. Stocks at wholesalers advanced by 0.5% in May.

Economists polled by Reuters had expected that inventories, a key part of gross domestic product, would rise by an unrevised 0.2%. Inventories edged up 0.1% on a year-on-year basis in June.

The economy grew at a 2.8% pace in the second quarter. That was double the growth pace in the first quarter. Private inventory investment added 0.82 percentage point to GDP growth in the April-June period after being a drag for the two previous quarters, which more than offset a 0.72 percentage point hit from a wider trade gap.

Wholesale motor vehicle inventories rose 0.8% in June. Excluding autos, wholesale inventories advanced 0.1%. This component goes into the calculation of GDP.

Sales at wholesalers fell 0.6% in June after rising 0.3% in May. At June's sales pace it would take wholesalers 1.37 months to clear shelves, up from 1.35 months in May.

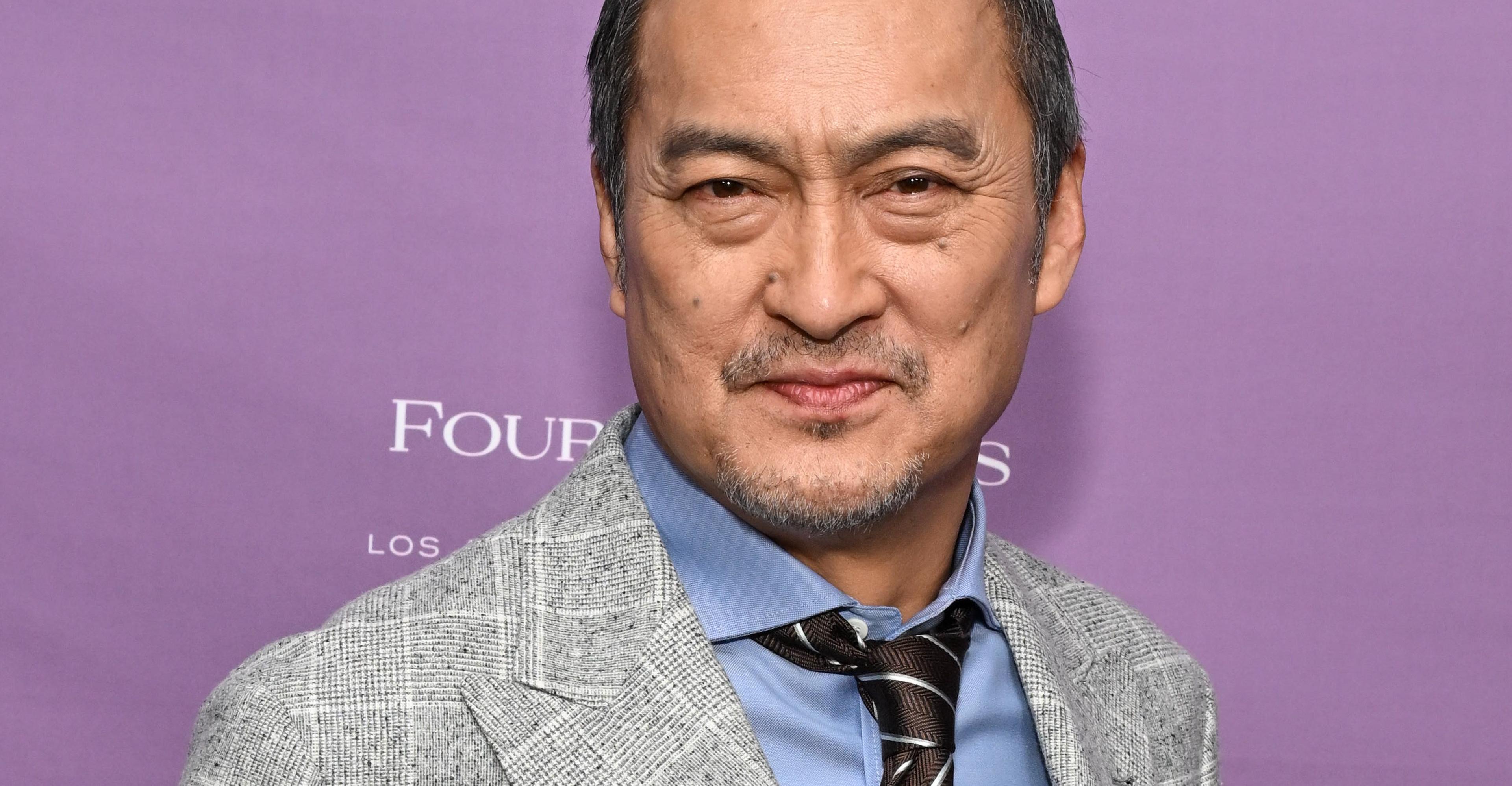

Ken Watanabe didn’t think a kabuki movie would work

- 17 hours ago

Pakistan set 165-run target for England in Super 8 clash

- an hour ago

USS Gerald Ford, world’s largest aircraft carrier, at US base on Crete

- 2 hours ago

Gold prices continue to surge in Pakistan, global markets

- 6 hours ago

Security forces kill four terrorists in DI Khan IBO: ISPR

- 6 hours ago

The Pixel 10A and Soundcore Space One are just two of the best deals this week

- 8 hours ago

Imran Khan’s sister Noreen Niazi injured after falling into under-construction sewer line

- 6 hours ago

Met office forecasts dry weather in most parts of country

- 6 hours ago

Pakistan, Qatar review trade & economic cooperation

- 2 hours ago

Six cops including DSP martyred in Kohat attack

- 6 hours ago

Nintendo’s next big Pokémon presentation is on February 27th

- 17 hours ago

Senate passes resolution rejecting Israeli statement, reaffirms support for Palestine

- 7 hours ago