On Saturday, powerful waves have been seen hitting the shores of Tonga after an undersea volcano erupted, following which the Pacific nation issued a tsunami warning.

Tsunami waves caused by a giant underwater volcanic eruption have hit the Pacific country of Tonga.

On Saturday, powerful waves have been seen hitting the shores of Tonga after an undersea volcano erupted, following which the Pacific nation issued a tsunami warning.

Video posted to social media showed large waves washing ashore in coastal areas.

Stay safe everyone ?? pic.twitter.com/OhrrxJmXAW

— Dr Faka’iloatonga Taumoefolau (@sakakimoana) January 15, 2022

The meteorological service said a tsunami warning had been put in force for all of Tonga.

The explosion of the Hunga Tonga Hunga Ha’apai volcano was the latest in a series of spectacular eruptions.

Earlier, the Matangi Tonga news site reported that scientists observed massive explosions, thunder and lightning near the volcano after it started erupting on Friday.

The site said satellite images showed a 5-kilometer (3 mile) -wide plume of ash, steam and gas rising up into the air to about 20 kilometers (12 miles).

The National Emergency Management Agency (NEMA) said some parts of New Zealand could expect “strong and unusual currents and unpredictable surges at the shore following a large volcanic eruption”.

As per US Emergency Alert Twitter page, a "hazardous tsunami" had been created by the eruption, and a tsunami warning had been issued for American Samoa as well.

Meanwhile, the US StormWatch account described the eruption as "one of the most violent" ever captured on satellite.

Tonga's Hunga Tonga volcano just had one of the most violent volcano eruptions ever captured on satellite. pic.twitter.com/M2D2j52gNn

— US StormWatch (@US_Stormwatch) January 15, 2022

UN chief decries global rise of ‘rule of force’

- a day ago

Gold prices continue to surge in Pakistan, global markets

- 2 hours ago

Iran says any US attack including limited strikes would be ‘act of aggression’

- a day ago

Six cops including DSP martyred in Kohat attack

- 3 hours ago

Three Federal Constabulary personnel martyred in terrorist attack in KP’s Karak

- a day ago

The Pixel 10A and Soundcore Space One are just two of the best deals this week

- 4 hours ago

Security forces kill four terrorists in DI Khan IBO: ISPR

- 3 hours ago

Met office forecasts dry weather in most parts of country

- 2 hours ago

Senate passes resolution rejecting Israeli statement, reaffirms support for Palestine

- 3 hours ago

Imran Khan’s sister Noreen Niazi injured after falling into under-construction sewer line

- 2 hours ago

Nintendo’s next big Pokémon presentation is on February 27th

- 13 hours ago

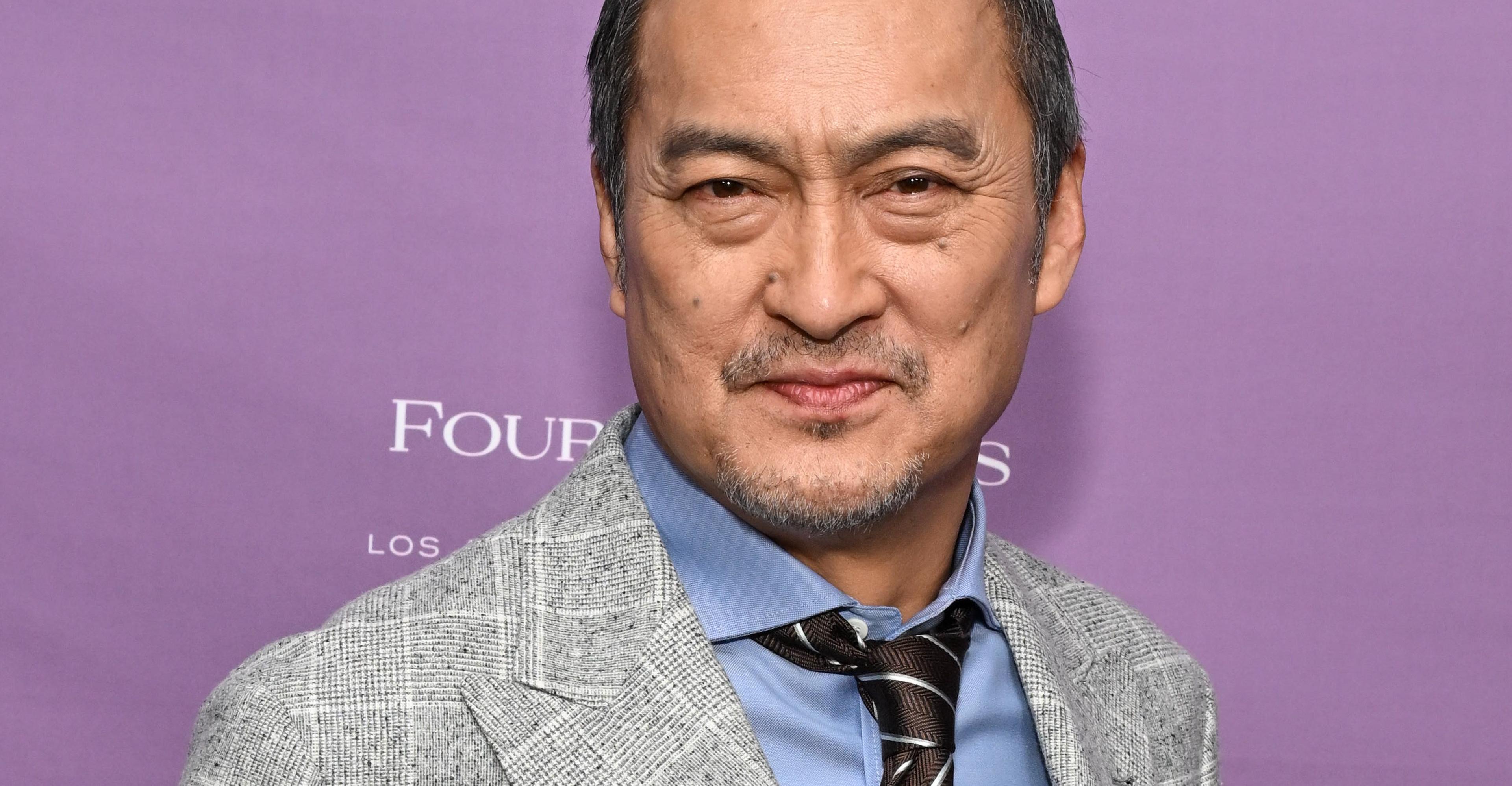

Ken Watanabe didn’t think a kabuki movie would work

- 13 hours ago