The move comes as the Federal Board of Revenue (FBR) has established tax rates for filers and non-filers in various categories, transactions, and sources of income for the fiscal year 2023-24.

Lahore: In an effort to promote the documentation of the economy and expand the tax net in Pakistan, non-filers will now be required to pay a higher tax rate of 30% on income from savings account profit, compared to the 15% rate for filers.

The move comes as the Federal Board of Revenue (FBR) has established tax rates for filers and non-filers in various categories, transactions, and sources of income for the fiscal year 2023-24. This decision comes at a critical time as Pakistan faces challenges of low revenue collection and high expenditure, while also navigating the conditions set by the International Monetary Fund (IMF) for the staff-level agreement on a $3 billion stand-by arrangement (SBA).

According to the notification issued by the FBR, the tax amount for non-filers will be double or even more than that of filers in certain cases. Additionally, there are specific transactions where filers are exempt from paying tax, unlike non-filers.

For prize bonds, the tax rate is 15% for filers and 30% for non-filers. Rent income is subject to a tax rate of 5-15% for filers and 10-15% for non-filers.

Here are the tax rates for other categories and business transactions:

Bonus shares: Filers 10%, non-filers 20%.

Auctioned property: Filers 5%, non-filers 10%.

Motor vehicle leasing: Filers 0%, non-filers 12%.

Motor vehicle registration: Filers Rs10,000 to Rs0.5 million [depending on engine capacity], non-filers Rs30,000 to Rs1.5 million.

Token tax on vehicles: Filers Rs800 to Rs10,000, non-filers Rs1,600 to Rs20,000.

Commission: Filers 12%, non-filers 24%.

Banking transactions: Filers 0%, non-filers 0.6%.

International debit card transactions: Filers 2%, non-filers 10%.

Property transactions: Filers 2%, non-filers 7%.

Specific services: Filers 3%, non-filers 6%.

General services: Filers 7%, non-filers 14%.

Power consumers with a monthly bill of at least Rs25,000: Filers 0%, non-filers 7.5%.

What are gold rates in Pakistan, global markets today?

- 14 hours ago

Security forces neutralise four Indian-sponsored terrorists in Pishin IBO: ISPR

- 14 hours ago

T20 World Cup: Pakistan warn England’s flaky batting to expect a trial by spin

- 14 hours ago

Iran says any US attack including limited strikes would be ‘act of aggression’

- 13 hours ago

Three Federal Constabulary personnel martyred in terrorist attack in KP’s Karak

- 13 hours ago

Pakistan targets 7 TTP, ISKP hideouts in border operation

- 2 days ago

UN chief decries global rise of ‘rule of force’

- 11 hours ago

Super eight: spinners’ magic works as England beat Sri Lanka by 51 runs

- 2 days ago

Nintendo’s next big Pokémon presentation is on February 27th

- an hour ago

President, PM urge Scouts to assist Govt in dealing with challenges

- 2 days ago

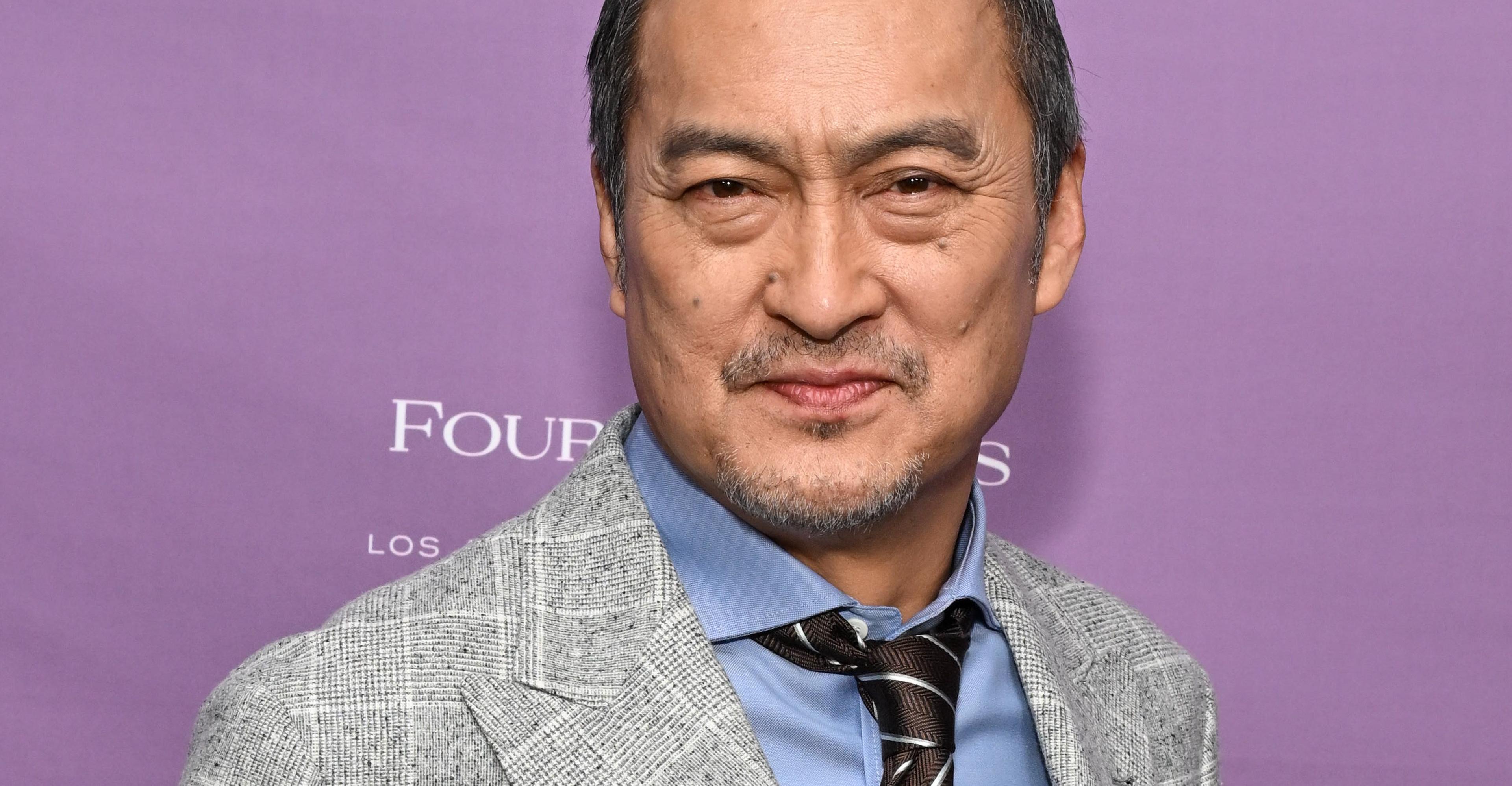

Ken Watanabe didn’t think a kabuki movie would work

- an hour ago

Pakistan, Bangladesh to expand cooperation across diverse sectors

- a day ago