Shahbaz Sharif directs federal agency to bring 4.9 million wealthy individuals into the tax net

Islamabad: Prime Minister Shehbaz Sharif on Thursday directed the Federal Board of Revenue (FBR) to bring 4.9 million wealthy individuals into the tax net without burdening the poor.

To review the reforms of FBR and digitization efforts, PM chaired a high-level meeting where matters of Inland Revenue and Customs were also among the agenda.

An FBR spokesperson noted that the digitisation process, overseen by international consultants McKinsey, is showing promising initial results. PM Sharif highlighted a significant discovery: "In the last four months, Rs800 billion tax refund fraud was detected. We will further improve the tax refund system." He also expressed concern over delays in some FBR reform projects, calling them "extremely regrettable."

The briefing revealed that 83,579 tax-related cases worth Rs3.2 trillion are pending in courts and tribunals. Since the current government took office, 63 cases worth Rs44 billion have been resolved in the past four months.

Advanced technology has identified 4.9 million individuals capable of paying taxes. PM Sharif directed the FBR to prioritize taxing the wealthy while sparing the poor.

The meeting also discussed the FBR's trader-friendly mobile application, which has registered 150,000 retailers since April 2024. PM Sharif urged continued consultations with retailers to improve the system.

The Prime Minister called for an increase in the number of appellate tribunals to 100 to speed up tax case resolutions and the establishment of a performance dashboard for these tribunals. He emphasized no delays in sales tax refunds and urged a strategy to recover past illegal refunds. The Fraud Detection and Investigation Department of the FBR must be fully digitised, he asserted.

PM Sharif directed that all ongoing FBR reform projects be integrated into a central system using advanced technology and skilled personnel. He assured there would be no delay in funding upgrades for the customs system and asked the FBR to present strategies for new system software and reforms in the Pakistan Revenue Automation Authority (PRAL).

The FBR announced the implementation of the Integrated Transit Trade Management System (ITTMS) at the Pakistan-Afghanistan borders of Torkham and Chaman, starting in October 2024. The development of the Automated Entry-Exit System (AEES), based on advanced scanning technology, has also begun. Initially, AEES will be implemented at Karachi's four ports and the airports in Karachi, Multan, and Peshawar, with plans to extend it to Gwadar port.

Lastly, the FBR introduced the Single Sales Tax Return system, already in place for the telecom sector, which will connect FBR with revenue authorities nationwide. PM Sharif mandated that this system be applied to all taxpayers by October 2024.

Nintendo’s next big Pokémon presentation is on February 27th

- 12 hours ago

Gold prices continue to surge in Pakistan, global markets

- 2 hours ago

Iran says any US attack including limited strikes would be ‘act of aggression’

- a day ago

Met office forecasts dry weather in most parts of country

- 2 hours ago

Senate passes resolution rejecting Israeli statement, reaffirms support for Palestine

- 3 hours ago

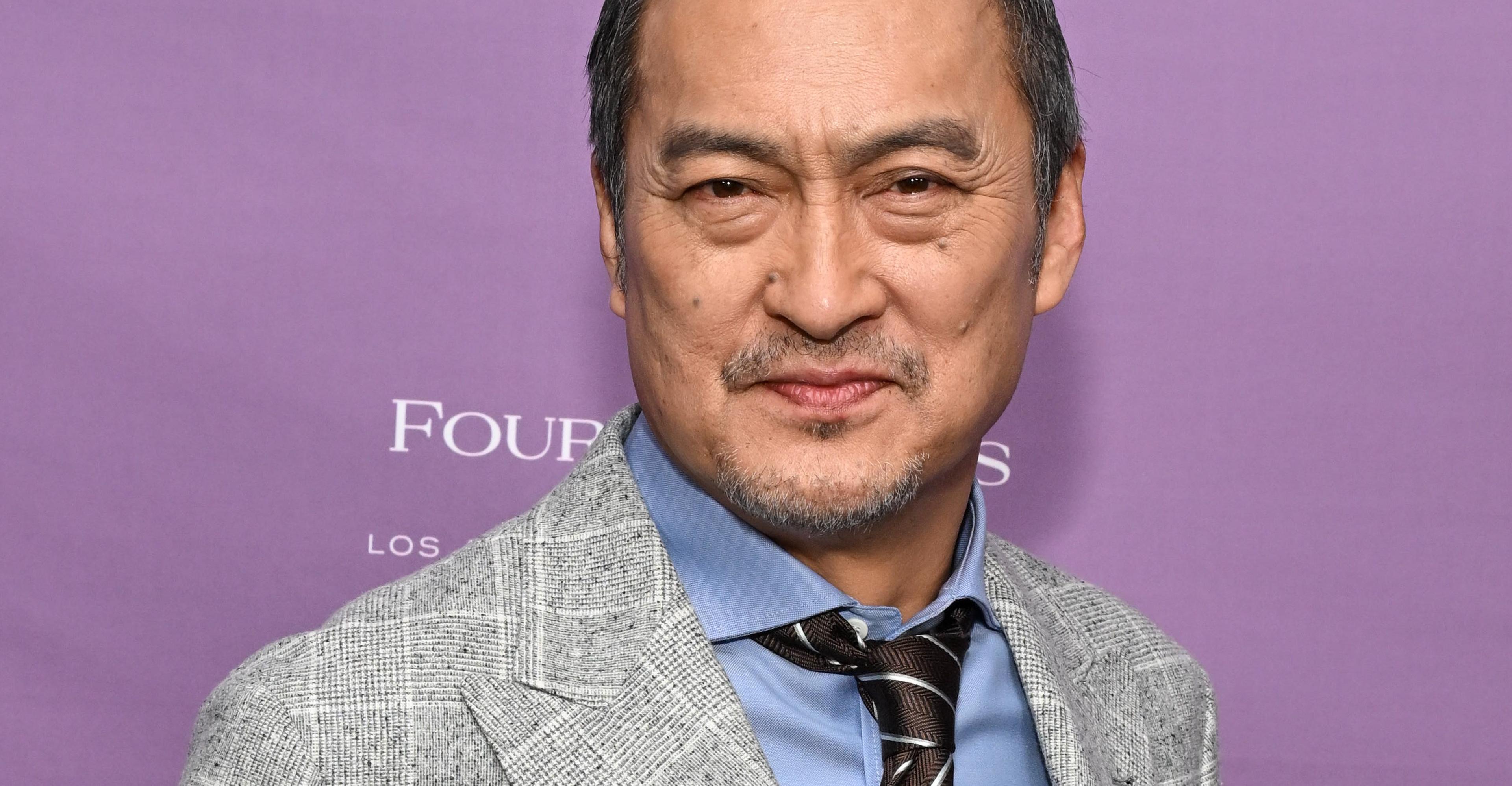

Ken Watanabe didn’t think a kabuki movie would work

- 12 hours ago

Security forces kill four terrorists in DI Khan IBO: ISPR

- 2 hours ago

UN chief decries global rise of ‘rule of force’

- a day ago

Imran Khan’s sister Noreen Niazi injured after falling into under-construction sewer line

- 2 hours ago

The Pixel 10A and Soundcore Space One are just two of the best deals this week

- 3 hours ago

Six cops including DSP martyred in Kohat attack

- 2 hours ago

Three Federal Constabulary personnel martyred in terrorist attack in KP’s Karak

- a day ago