China’s solar industry faces challenges but some companies stay ahead of time

Key segments in solar industry, such as polysilicon, wafers, and cells, saw substantial production increases—by 60%, 58.9%, and 32.2% respectively

Beijing: The first half of 2024 has been a turbulent period for China’s solar industry, with financial reports from 42 top Chinese photovoltaic (PV) companies highlighting falling profits, excessive production and fierce competition.

While the global PV market continued to expand, the Chinese solar sector struggled with declining profitability due to a mismatch between supply and demand, leading to price drops across key components like silicon materials, wafers, cells, and modules.

Despite these challenges, some companies, such as Trinasolar, have managed to navigate the storm with strategic shifts in focus. Trinasolar’s success came from its advanced n-type TOPCon technology, particularly its 210mm n-type i-TOPCon Vertex N series modules.

These high-efficiency products have allowed Trinasolar to stay profitable despite the overall industry slump, even though the company’s revenue fell by 12.99% year-on-year.

Trinasolar reported a net profit of 526 million yuan for the first half of 2024, standing out in a market where many other firms posted losses.

The financial performance of China’s top solar companies paints a grim picture overall. Revenue for the top 42 companies collectively dropped by 18.92%, with net profits plummeting by a staggering 88.80% compared to the same period in 2023. Several major players experienced losses exceeding 100%, a sharp contrast to last year’s strong earnings when stable pricing and growing demand sustained profitability. Smaller manufacturers, unable to absorb the financial pressure, were hit the hardest and were forced out of the market.

Key segments in the solar industry, such as polysilicon, wafers, and cells, saw substantial production increases—by 60%, 58.9%, and 32.2% respectively. However, this growth in capacity resulted in a significant year-on-year drop in module prices. While the global demand for solar energy surged, the imbalance between supply and demand led to shrinking profit margins. Overcapacity has created an environment where only companies with a clear technological edge or cost-efficiency strategies can survive.

Trinasolar, along with a few other leading PV manufacturers, has demonstrated resilience by focusing on innovation and high-performance products. The company’s 210mm technology applied in its Vertex modules is increasingly in demand across emerging markets like Pakistan, Saudi Arabia, and India. These countries are actively expanding their renewable energy capacities to reduce reliance on fossil fuels, providing Chinese solar companies with critical growth opportunities.

Market diversification has proven to be a crucial survival strategy for companies like Trinasolar. By establishing a strong presence in overseas markets and differentiating their offerings through advanced technologies, they have managed to maintain profitability even in the face of shrinking domestic margins. Trinasolar’s ability to tap into the growing demand for high-efficiency solar solutions in emerging markets has allowed it to stay competitive while many of its peers struggle.

As the second half of 2024 unfolds, Chinese solar manufacturers will face continued price pressures and likely further market consolidation. However, companies that prioritise innovation, cost management, and international expansion—like Trinasolar—are better positioned to weather these challenges and seize future growth opportunities.

Nintendo’s next big Pokémon presentation is on February 27th

- 5 hours ago

T20 World Cup: Pakistan warn England’s flaky batting to expect a trial by spin

- 17 hours ago

Three Federal Constabulary personnel martyred in terrorist attack in KP’s Karak

- 17 hours ago

Security forces neutralise four Indian-sponsored terrorists in Pishin IBO: ISPR

- 17 hours ago

Iran says any US attack including limited strikes would be ‘act of aggression’

- 17 hours ago

Pakistan targets 7 TTP, ISKP hideouts in border operation

- 2 days ago

Super eight: spinners’ magic works as England beat Sri Lanka by 51 runs

- 2 days ago

UN chief decries global rise of ‘rule of force’

- 15 hours ago

Pakistan, Bangladesh to expand cooperation across diverse sectors

- 2 days ago

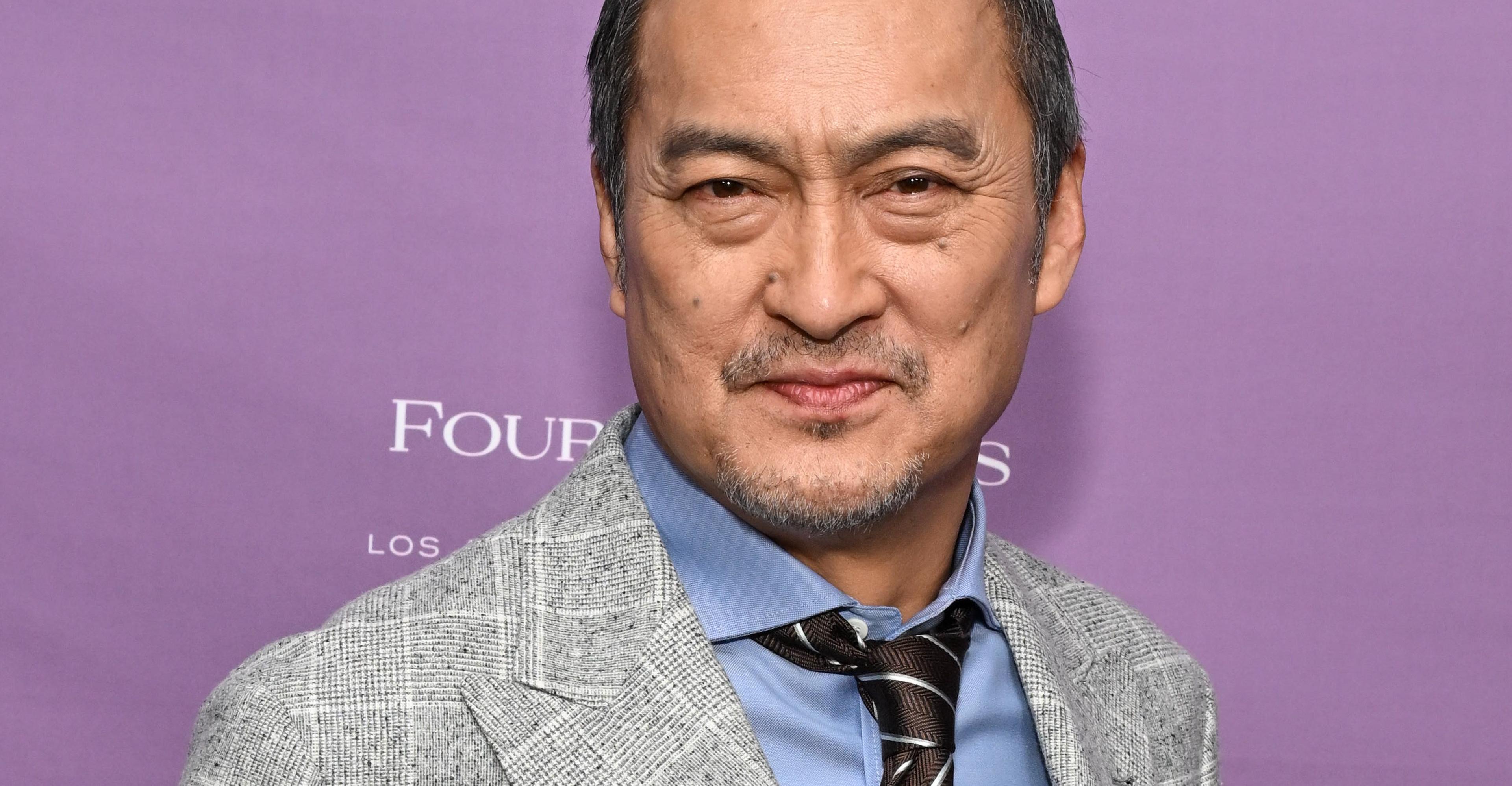

Ken Watanabe didn’t think a kabuki movie would work

- 5 hours ago

President, PM urge Scouts to assist Govt in dealing with challenges

- 2 days ago

What are gold rates in Pakistan, global markets today?

- 17 hours ago