Brent and US West Texas Intermediate crude futures gained 4% last week in volatile trade

Singapore (Reuters): Oil prices are expected to fall when trading resumes on Monday as Israel's retaliatory strike on Iran over the weekend bypassed Tehran's oil and nuclear infrastructure and did not disrupt energy supplies, analysts said.

Brent and US West Texas Intermediate crude futures gained 4% last week in volatile trade as markets priced in uncertainty around the extent of Israel's response to the Iranian missile attack on Oct. 1 and the US election next month.

Scores of Israeli jets completed three waves of strikes before dawn on Saturday against missile factories and other sites near Tehran and in western Iran, in the latest exchange in the escalating conflict between the Middle East rivals.

"The market can breathe a big sigh of relief; the known unknown that was Israel's eventual response to Iran has been resolved," Harry Tchilinguirian, group head of research at Onyx said on LinkedIn.

"Israel attacked after the departure of US Secretary of State Antony Blinken, and the US administration could not have hoped for a better outcome with US elections less than two weeks away."

Iran on Saturday played down Israel's overnight air attack against Iranian military targets, saying it caused only limited damage.

"Israel's not attacking oil infrastructure, and reports that Iran won't respond to the strike remove an element of uncertainty," Tony Sycamore, IG market analyst in Sydney, said.

"It's very likely we see a 'buy the rumour, sell the fact' type reaction when the crude oil futures markets reopen tomorrow," he said, adding that WTI may return to $70 a barrel level.

Tchilinguirian expects geopolitical risk premium that had been built into oil prices to deflate rapidly with Brent heading back towards $74-$75 a barrel.

UBS commodity analyst Giovanni Staunovo also expects oil prices to be depressed on Monday as Israel's response to Iran's attack appeared to have been restrained.

"But I would expect such downside reaction to be only temporary, as I believe the market didn't price a large risk premium," he added.

Second T20I: Green Shirts beat Australia by 90 runs

- 6 hours ago

Gadecki, Peers win another Australian Open title

- 7 hours ago

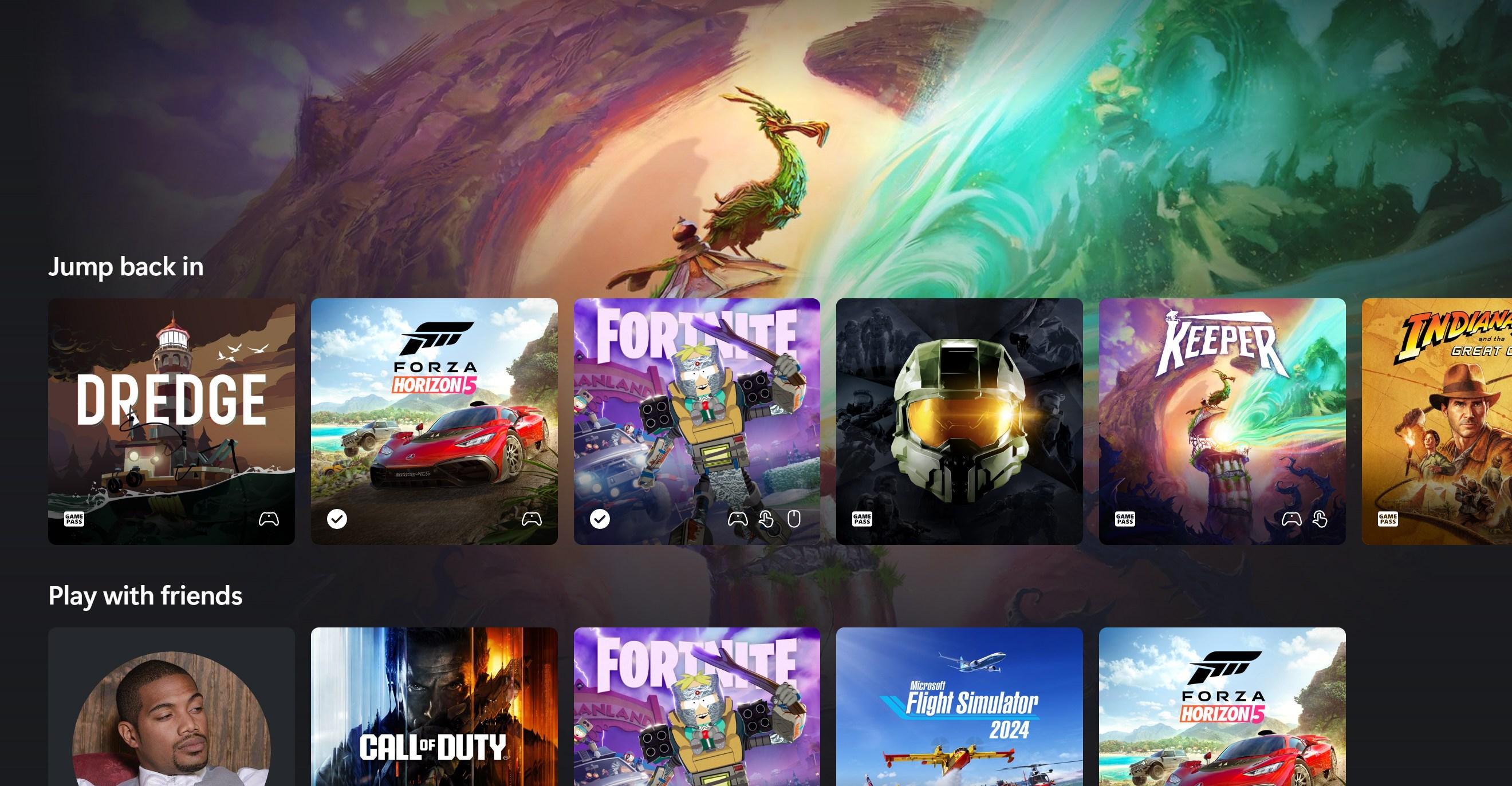

Xbox Cloud Gaming’s new design teases the future of Xbox console UI

- 19 hours ago

PM inaugurates Punjab Agriculture, Food and Drug Authority

- 8 hours ago

Catherine O'Hara, star of 'Schitt's Creek' and 'Home Alone,' dead at 71

- 7 hours ago

AJK President Sultan Mehmood Chaudhry passes away at 71

- 4 hours ago

Security forces kill 58 terrorists after coordinated attacks at ‘12 locations’ in Balochistan

- 8 hours ago

Gas leak caused blast in Iran's Bandar Abbas, Iranian media say

- 2 hours ago

Amazon’s ‘free, no hassle returns’ issue results in over $1 billion settlement

- 19 hours ago

NDMA forecasts rain, snowfall in hilly areas

- a day ago

Renowned digital creator Syed Muhammad Talha shifts focus to filmmaking

- 7 hours ago

The Supreme Court will soon decide if only Republicans are allowed to gerrymander

- 17 hours ago