Price of yellow metal per tola was up by Rs2,500, settling at Rs269,900

Karachi: Gold prices jumped in the local bullion markets in the country on the first business day on Monday in line with the surgae in the international market.

The price of yellow metal per tola was up by Rs2,500, settling at Rs269,900.

According to rates shared by the All-Pakistan Gems and Jewelers Sarafa Association (APGJSA), 10-gram gold was sold at Rs231,396 after an increase of Rs2,144,

On Saturday, gold price per tola declined by Rs300 to settle at Rs267,400. The international rate of gold increased by $25 to settle at $2,587 per ounce.

Gold gains over 1% as dollar rally stalls

Gold prices rose more than 1% on Monday after last week’s sharp declines, as a rally in the dollar paused, while market players awaited comments from Federal Reserve officials this week for more clues on the US interest rate path.

Spot gold firmed 1.2% to $2,591.16 per ounce by 0444 GMT, after falling to its worst week in more than three years on Friday. US gold futures were up 1% at $2,595.70.

The dollar was flat after rising 1.6% last week. A weaker dollar makes bullion less expensive for buyers holding other currencies.

“Gold prices are due for a slight recovery following recent bout of hefty sell-offs and we may expect some drift higher with some rollover in the dollar,” said IG market strategist Yeap Jun Rong.

“We can expect less-dovish rhetoric from US policymakers in December, as the Fed sets the stage for a potential rate hold in January. This has not been fully priced in by markets yet, so any need for recalibration may still pose an obstacle for gold.”

At least seven US central bank officials are due to speak this week. Strong US economic and inflation data continue to reshape the debate among Fed policymakers over the pace and extent of rate cuts as investors last week further downgraded their expectations for a rate reduction in December.

Data on Friday showed that US retail sales increased slightly more than expected in October, highlighting the economy’s resilience.

Higher interest rates reduce the appeal of holding non-yielding bullion.

Investors also took stock of news that President Joe Biden’s administration has allowed Ukraine to use US-made weapons to strike deep into Russia, in a significant reversal of Washington’s policy in the Ukraine-Russia conflict. Spot silver rose 1.5% to $30.67 per ounce, platinum was up 1.6% at $953.90 and palladium climbed 2.1% to $970.36.

Pakistan targets 7 TTP, ISKP hideouts in border operation

- 2 days ago

T20 World Cup: Pakistan warn England’s flaky batting to expect a trial by spin

- 19 hours ago

UN chief decries global rise of ‘rule of force’

- 17 hours ago

Pakistan, Bangladesh to expand cooperation across diverse sectors

- 2 days ago

Security forces neutralise four Indian-sponsored terrorists in Pishin IBO: ISPR

- 19 hours ago

Super eight: spinners’ magic works as England beat Sri Lanka by 51 runs

- 2 days ago

Iran says any US attack including limited strikes would be ‘act of aggression’

- 19 hours ago

Three Federal Constabulary personnel martyred in terrorist attack in KP’s Karak

- 19 hours ago

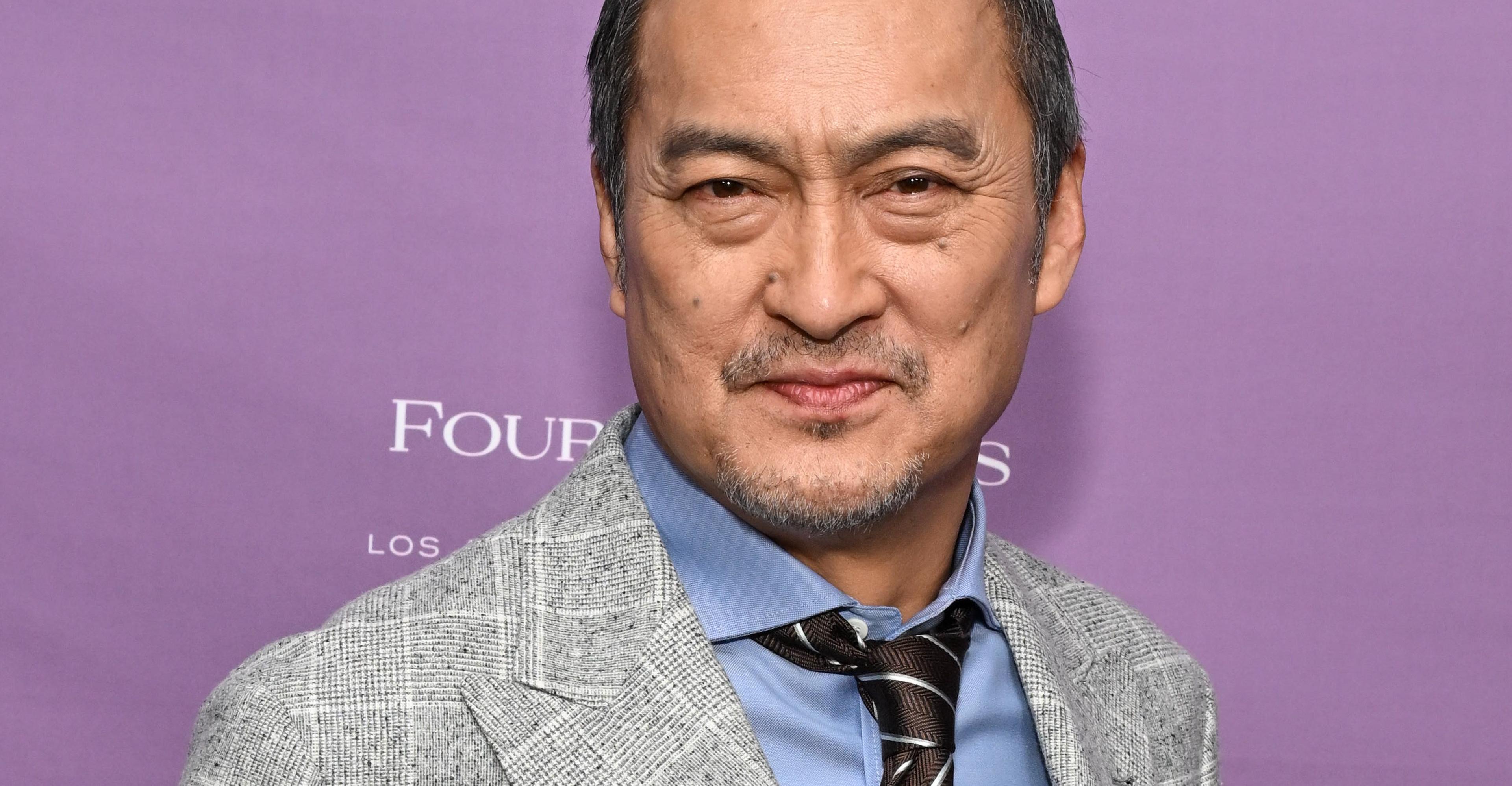

Ken Watanabe didn’t think a kabuki movie would work

- 7 hours ago

What are gold rates in Pakistan, global markets today?

- 20 hours ago

President, PM urge Scouts to assist Govt in dealing with challenges

- 2 days ago

Nintendo’s next big Pokémon presentation is on February 27th

- 7 hours ago