Business

Moody’s terms impressive growth in Pakistan’s Islamic banking assets as “Credit Positive”

Karachi: The international credit rating agency Moody’s has termed the impressive growth in Pakistan's Islamic banking assets as credit positive for banks due to ongoing reforms and increasing policy effectiveness.

Moody’s has improved its rating for Pakistan’s banking sector as stable and said that Islamic banking in country has substantial growth potential.

As per an official report, “Deposit-based funding and good liquidity buffers also remain strengths, while the probability of government support in a crisis is high”.

“The growth is credit positive for Pakistani banks because it attracts customers from the previously unbanked population, which creates new business opportunities and boosts banks' financial performance,” said Moody’s.

It said stable outlook for Pakistan's banking system reflects banks' solid funding and liquidity.

Moody’s further stated, “We believe that all rated banks will benefit from the increase in Islamic banking penetration, especially Habib Bank Ltd. (HBL, B3 stable, caa11), which, at year-end 2020, had a 7.5% market share of Pakistan's Islamic banking assets and MCB Bank Limited (B3 stable, b3) which had a 3.3% market share, the largest shares among their rated peers”.

Last week, the State Bank of Pakistan (SBP), released its quarterly Islamic Banking Bulletin for December 2020 according to which Shariah-compliant banking assets grew 30 percent.

“The growth is credit positive for Pakistani banks because it attracts customers from the previously unbanked population, which creates new business opportunities and boosts banks' financial performance,” said Moody’s in a statement.

Meanwhile, Islamic deposits have had witnessed a 22 percent annual compound growth rate since June 2013.

Furthermore, Islamic financing also grew faster than conventional loans and were Rs 1.9 trillion, or 23pc of Pakistani banks' total loans at year-end 2020.

-

Pakistan 2 days ago

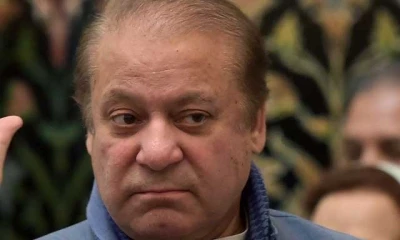

Pakistan 2 days agoNawaz Sharif returns home after China tour

-

Pakistan 2 days ago

Pakistan 2 days agoSC adjourns hearing IHC judges’ letter case till May 7

-

Pakistan 1 day ago

Pakistan 1 day agoPM Shehbaz, Zardari pays tribute on Labour Day

-

Business 2 days ago

Business 2 days agoPetrol, diesel prices likely to drop from May 1

-

Regional 2 days ago

Regional 2 days agoPunjab govt makes transfer, posting of senior officers

-

Pakistan 1 day ago

Pakistan 1 day agoInt'l Labour Day being observed across country today

-

Sports 2 days ago

Sports 2 days agoEngland announce squad for series against Pakistan

-

Pakistan 1 day ago

Pakistan 1 day agoGovernor KP Ghulam Ali meets Nawaz Sharif