The review report told that licensing and regulatory framework for digital banking has been given in the year 2022.

Islamabad: The Financial Stability 2022 Review Report issued by State Bank of Pakistan (SBP) stated that last year was difficult for Pakistan’s economy.

According to SBP, economic imbalances were aggravated by unfavorable external environment, double deficit, inflation, floods and delay in International Monetary Fund (IMF) program had an impact.

The review report stated that global commodity prices and interest rates also remained influential, while the financial sector performed well despite all the headwinds.

It has also been said in the report that financial sector assets were increased by 18.3 percent due to investment. Banks' asset growth was 19.1 percent, Islamic banking showed a growth rate of 29.6 percent, while the microfinance sector remained under pressure due to deficit.

According to State Bank, the ratio of non-performing loans decreased from 7.9 percent to 7.3 percent in 2022 while the second phase of the payment system was implemented in 2022.

The review report told that licensing and regulatory framework for digital banking has been given in the year 2022.

Moreover the report said that State Bank's comprehensive supervision and protection framework is working for financial stability. This supervision and protection framework has been further strengthened in the financial year 2022.

According to the bank, Financial Stability Review is the compliance of State Bank Act. Financial Stability Review is an examination of market, infrastructure, performance and risks of banks and financial institutions.

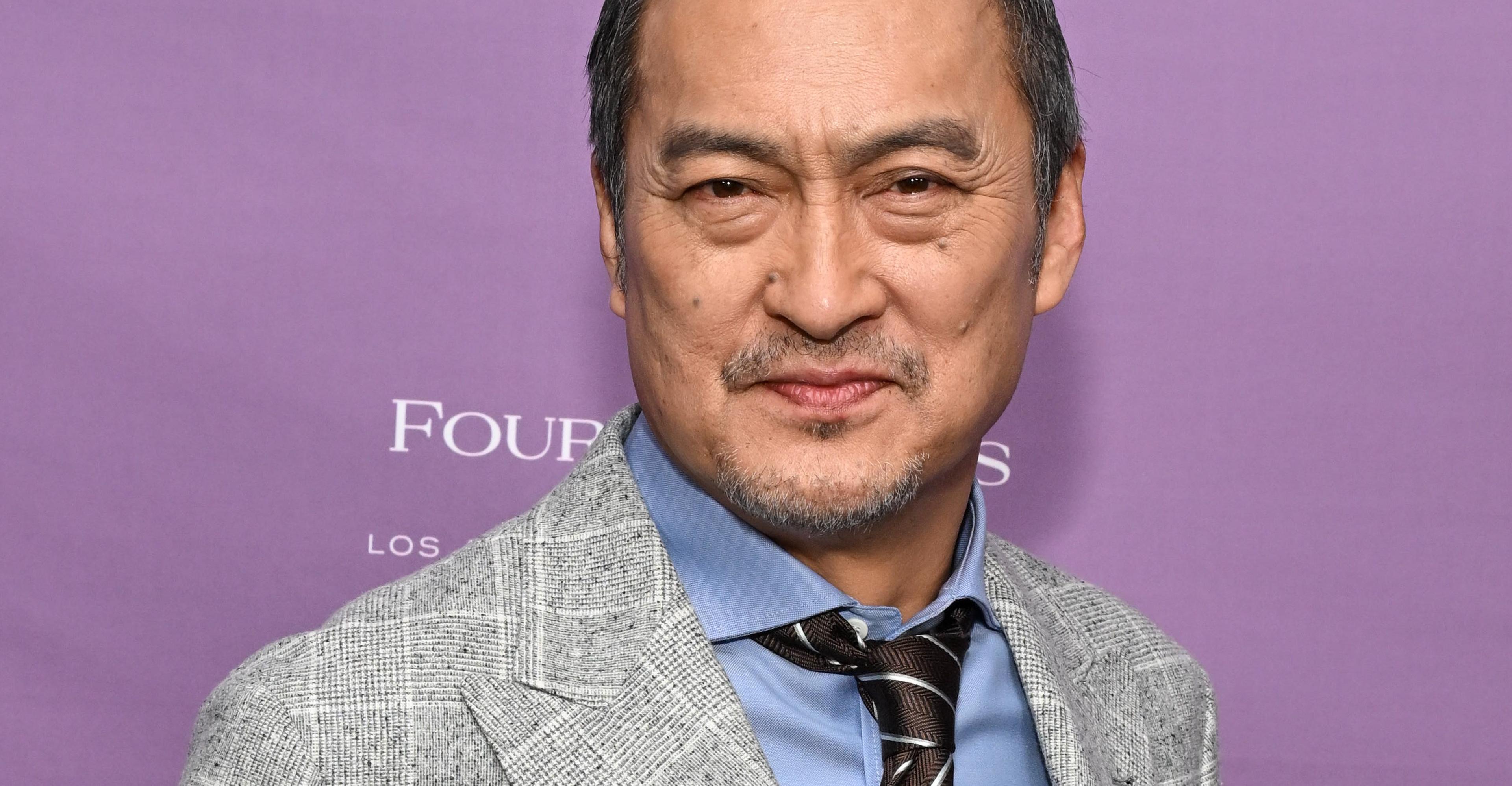

Ken Watanabe didn’t think a kabuki movie would work

- 6 hours ago

Pakistan, Bangladesh to expand cooperation across diverse sectors

- 2 days ago

Security forces neutralise four Indian-sponsored terrorists in Pishin IBO: ISPR

- 19 hours ago

Nintendo’s next big Pokémon presentation is on February 27th

- 6 hours ago

President, PM urge Scouts to assist Govt in dealing with challenges

- 2 days ago

What are gold rates in Pakistan, global markets today?

- 19 hours ago

Iran says any US attack including limited strikes would be ‘act of aggression’

- 18 hours ago

Three Federal Constabulary personnel martyred in terrorist attack in KP’s Karak

- 18 hours ago

UN chief decries global rise of ‘rule of force’

- 16 hours ago

Super eight: spinners’ magic works as England beat Sri Lanka by 51 runs

- 2 days ago

Pakistan targets 7 TTP, ISKP hideouts in border operation

- 2 days ago

T20 World Cup: Pakistan warn England’s flaky batting to expect a trial by spin

- 18 hours ago