The US dollar (USD) hit its highest levels in more than a month on Monday amid worries over China’s economy.

The US dollar (USD) hit its highest levels in more than a month on Monday amid worries over China’s economy, while Wall Street struggled for any clear picture ahead of fresh data on consumer appetite.

The dollar index, which tracks the greenback versus a basket of six currencies, was last up 0.28% at 103.133, after hitting its highest level since July 7.

The dollar surged on news that China’s new bank loans tumbled in July even as policymakers cut interest rates. Investors also feared that trouble at the nation’s largest private property developer, Country Garden, could have a chilling effect on home buyers and financial institutions.

Country Garden’s shares plunged 18% to a record low on Monday after its onshore bonds were suspended for the first time.

Meanwhile, two Chinese listed companies said over the weekend they had not received payment on maturing investment products from asset manager Zhongrong International Trust Co.

“A lot of traders are focusing again on China,” said Edward Moya, senior market analyst at OANDA. “I think there’s so much concern with just their growth outlook, with their current property crisis, and I think one of the biggest wealth managers not being able to make (their) debt obligations is a big red flag.”

The three major U.S. indexes were up slightly, as a 7% surge in chipmaker Nvidia (NVDA.O) helped push megacap growth stocks higher.

The Dow Jones Industrial Average rose 26.23 points, or 0.07%, to 35,307.63, the S&P 500 gained 25.67 points, or 0.58%, to 4,489.72 and the Nasdaq Composite added 143.48 points, or 1.05%, to 13,788.33.

The session began in the shadow of last week’s global equity sell-off, with the MSCI world equity index, which tracks shares in 45 nations, last down 0.12%.

Oil prices were down on Monday also on China worries, as concerns about the nation’s ability to bounce back to pre-pandemic levels outweighed gains previously posted on tighter supply.

Brent crude ended the day down 0.68% at $86.22 a barrel. U.S. crude was down 0.87% at $82.47 per barrel.

Safe havens in the U.S. also looked more appealing after voters in Argentina surprised markets by pushing a radical libertarian outsider candidate into first place, placing pressure on the country’s bonds.

In the aftermath, the country’s central bank planned to hike interest rates by 21 percentage points to 118% and devalued the nation’s currency until the nation’s formal October election.

The safe haven appetite drove up yields on benchmark 10-year U.S. Treasury bonds to a nine-month high. Benchmark 10-year yields hit 4.215%, the highest since Nov. 8, before falling back to 4.186%.

Gains for the dollar and U.S. Treasuries weighed on gold prices, which dipped to a more than one-month low on Monday. Spot gold prices were last down 0.36% at $1,906.20 an ounce.

Fresh economic data this week includes U.S. retail sales on Tuesday. Consumers are forecast to show a 0.4% pickup in spending, but it could swing higher thanks in part to Amazon’s Prime Day. U.S. retail giants are also due for quarterly reports this week.

A strong spending report could challenge the market’s benign outlook for U.S. rates, with futures implying a 70% chance the Federal Reserve is done hiking in its bid to tame inflation. The market also has more than 120 basis points of cuts priced in for next year starting from around March.

Courtesy: Reuters

Security forces kill four terrorists in DI Khan IBO: ISPR

- 3 hours ago

Senate passes resolution rejecting Israeli statement, reaffirms support for Palestine

- 3 hours ago

UN chief decries global rise of ‘rule of force’

- a day ago

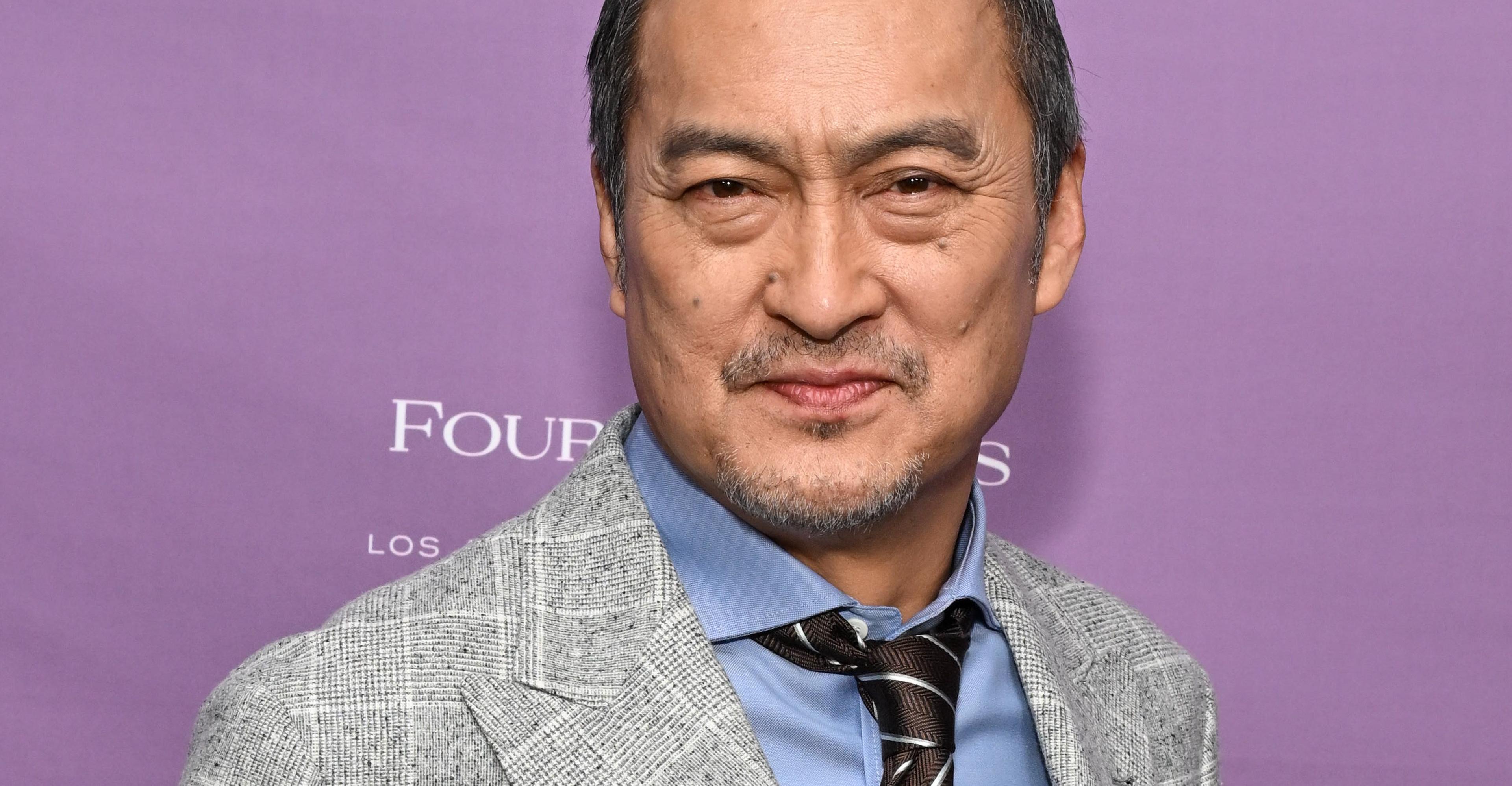

Ken Watanabe didn’t think a kabuki movie would work

- 13 hours ago

Three Federal Constabulary personnel martyred in terrorist attack in KP’s Karak

- a day ago

Met office forecasts dry weather in most parts of country

- 3 hours ago

Six cops including DSP martyred in Kohat attack

- 3 hours ago

Imran Khan’s sister Noreen Niazi injured after falling into under-construction sewer line

- 2 hours ago

Nintendo’s next big Pokémon presentation is on February 27th

- 13 hours ago

The Pixel 10A and Soundcore Space One are just two of the best deals this week

- 4 hours ago

Iran says any US attack including limited strikes would be ‘act of aggression’

- a day ago

Gold prices continue to surge in Pakistan, global markets

- 3 hours ago