The US Dollar (USD) slid from a 12-week peak on Monday after Federal Reserve Chair Jerome Powell left open the possibility of further rate hikes.

The US Dollar (USD) slid from a 12-week peak on Monday after Federal Reserve Chair Jerome Powell left open the possibility of further rate hikes, while the China-sensitive euro edged up in the wake of Beijing halving its stamp duty on stock trading.

The dollar index, which measures the U.S. currency against six peers, edged 0.06% lower at 104.11, after hitting its highest since early June on Friday. The index is up over 2% in August and set to snap a two-month losing streak.

In an eagerly awaited speech at the annual Jackson Hole Economic Policy Symposium, Powell promised on Friday to move with care at upcoming meetings as he noted both progresses made on easing price pressures as well as risks from the surprising strength of the U.S. economy.

Markets anticipate an 80% chance of the Fed standing pat next month, the CME FedWatch tool showed, but the probability of a 25-basis point hike in November is now at 51% versus 33% a week earlier.

“It remains unlikely we get a hike from the Fed in September, said Chris Weston, head of research at Pepperstone. “But November is shaping up to be a ‘live’ event, where data points have the potential to throw interest rate expectations around.”

“When many other G10 central banks are already priced for an extended pause, the Fed potentially going again in November is supporting the dollar,” Weston said.

A series of strong U.S. economic data releases has helped ease worries of a recession but with inflation still above the Fed’s target, some investors are worried that the U.S. central bank will keep interest rates at elevated levels for longer.

With the Fed highlighting the importance of the upcoming U.S. economic data, investors’ focus this week will firmly be on reports on payrolls, core inflation and consumer spending.

“If the data doesn’t play ball, then further tightening should be expected,” said Rodrigo Catril, senior currency strategist at National Australia Bank.

Euro summer

Elsewhere, the euro, which has fallen 1.7% so far in August, rose 0.14% to $1.0809 after China halved the stamp duty on stock trading in the latest attempt to boost the struggling market in the world’s second-biggest economy.

But the single currency stood near an almost 11-week low hit on Friday after European Central Bank President Christine Lagarde emphasised that policy needed to be restrictive.

According to Refinitiv data, the market is now evenly split on whether there will be another rise in the 3.75% rate in September.

China’s yuan steadied against the dollar, buoyed by the Chinese central bank persistently setting stronger-than-expected daily-mid-points. The spot yuan was about flat at 7.2932 per dollar.

The China-sensitive Australian dollar rose 0.1% to $0.6408, having taken a beating this month as worries over China’s sputtering post-pandemic recovery weighed on sentiment.

“Market confidence will unlikely improve much until there are signs of China’s weakening economic momentum turning around,” said Tommy Wu, senior economist at Commerzbank.

The yen edged 0.02% lower to 146.48 per dollar, just shy of the more than nine-month low of 146.64 it touched on Friday as traders continue to watch out for any signs of intervention in the currency market from Japanese authorities.

The Bank of Japan will maintain its current ultra-easy policy as underlying inflation in Japan remains “a bit below” its target, the central bank’s governor said on Saturday.

Courtesy: Reuters

T20 World Cup: Pakistan warn England’s flaky batting to expect a trial by spin

- 16 گھنٹے قبل

What are gold rates in Pakistan, global markets today?

- 17 گھنٹے قبل

Super eight: spinners’ magic works as England beat Sri Lanka by 51 runs

- 2 دن قبل

Pakistan targets 7 TTP, ISKP hideouts in border operation

- 2 دن قبل

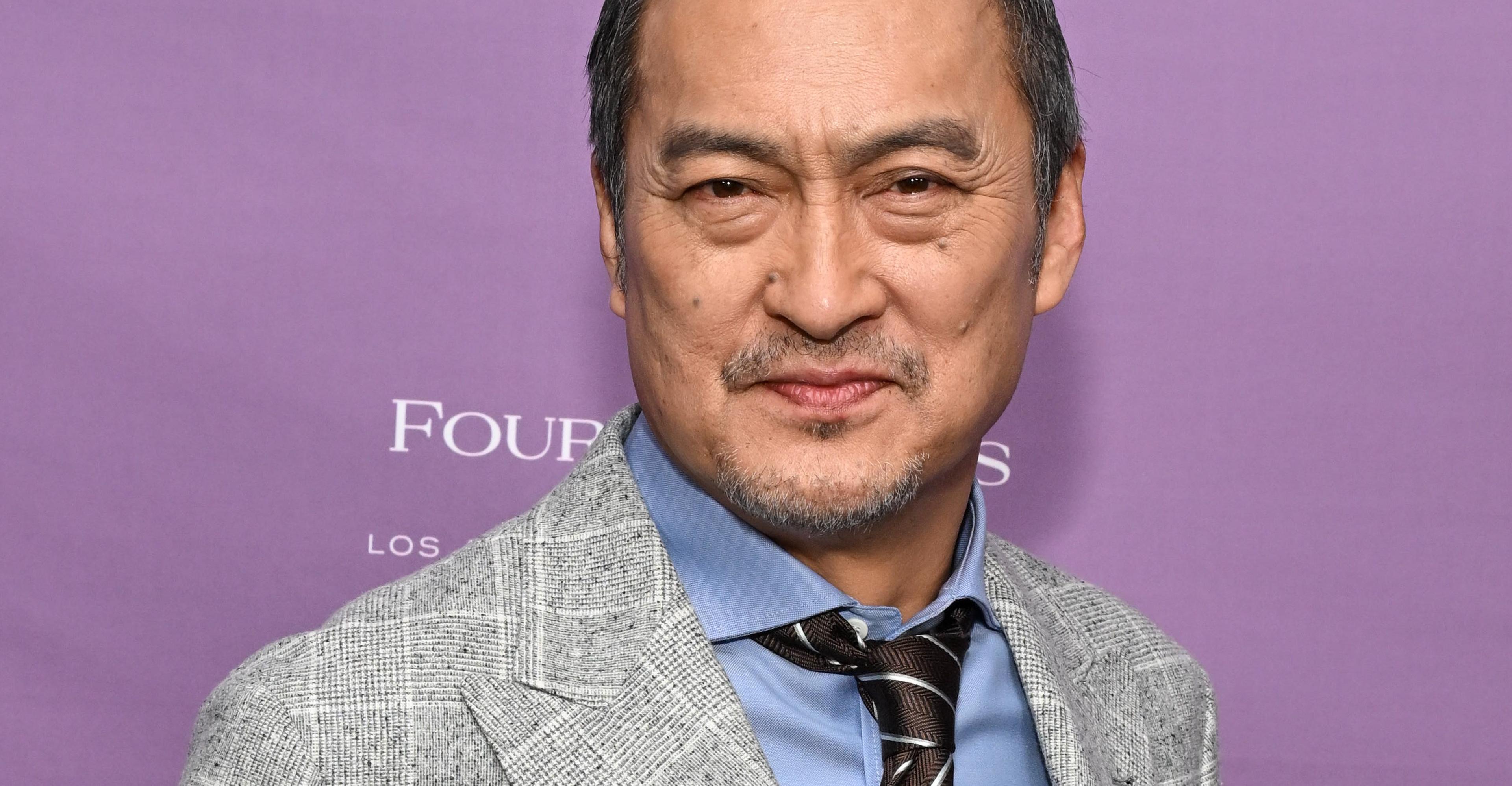

Ken Watanabe didn’t think a kabuki movie would work

- 4 گھنٹے قبل

President, PM urge Scouts to assist Govt in dealing with challenges

- 2 دن قبل

UN chief decries global rise of ‘rule of force’

- 14 گھنٹے قبل

Nintendo’s next big Pokémon presentation is on February 27th

- 4 گھنٹے قبل

Iran says any US attack including limited strikes would be ‘act of aggression’

- 16 گھنٹے قبل

Pakistan, Bangladesh to expand cooperation across diverse sectors

- 2 دن قبل

Three Federal Constabulary personnel martyred in terrorist attack in KP’s Karak

- 16 گھنٹے قبل

Security forces neutralise four Indian-sponsored terrorists in Pishin IBO: ISPR

- 16 گھنٹے قبل