Federal Bureau of Revenue (FBR) will add online marketplace platform to tax net under this scheme.

Islamabad: Following the request of the International Monetary Fund (IMF), the registration of businessmen will start from April 1 in six major cities of Pakistan including Rawalpindi and Islamabad.

Under the Trader-Friendly Scheme, retailers from Islamabad, Karachi, Lahore, Quetta and Peshawar will start registering from April 1 and tax collection will begin from July 1, 2024.

Federal Bureau of Revenue (FBR) will add online marketplace platform to tax net under this scheme.

A senior FBR official, talking to private media, said that they want to bring one million retailers into the tax net, a special mechanism for small traders and shopkeepers is recommended in the SRO issued in this regard.

While explaining the scope of the Trader Friendly Scheme, it is said that this scheme is for every shop, store, warehouse, office or any other such place within the limits of civil areas or cantonments of these cities. It will not apply to companies which are a unit of a national level or international chain store.

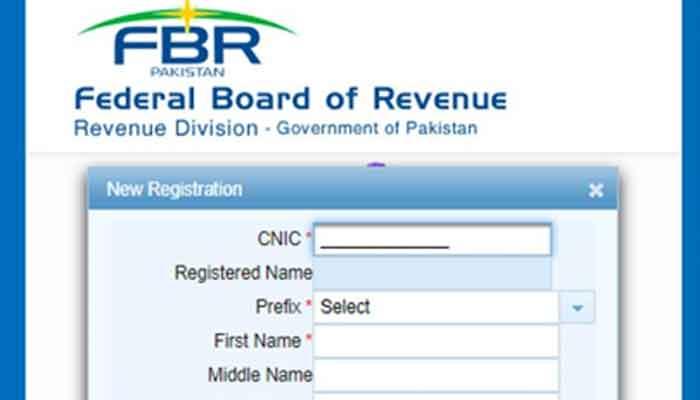

Under the Trader-Friendly Scheme, every trader and shopkeeper will have to apply for registration under Section 181 of the Ordinance and this can be done by April 30 through the Tax Easy app. A minimum monthly advance tax will be applicable to each person in respect of his income.

If the annual advance tax is nil then such a person will have to pay Rs1200 per annum but if for some reason the income of a person is exempted from tax then this will not be applicable if a person pays his advance tax together or the balance. If paid, his total advance tax will be reduced by 25%.

The false promise of a “no sugar” diet

- 2 hours ago

Can you fix a broken democracy without breaking it more?

- 2 hours ago

Everyone ignores this good news about democracy

- 2 hours ago

Lightning's Cooper out 2 games after dad's death

- 3 hours ago

Netflix’s F1 series Drive to Survive will stream on Apple TV, too

- 4 hours ago

Dodgers' Sasaki hit hard, struggles in spring debut

- 3 hours ago

Stars' Rantanen out weeks after Olympic injury

- 3 hours ago

The most important line from Trump’s State of the Union

- 2 hours ago

Cricut’s most popular cutting machine now takes up less space in your crafting room

- 4 hours ago

The Pentagon’s battle with Anthropic is really a war over who controls AI

- 2 hours ago

FTC declines to enforce a kids privacy law for data collected to verify users’ ages

- 4 hours ago

Brazil vs. US: Two insurrections, different results

- 2 hours ago