Kashif Anwar highlights the economic challenges faced by the business community and underscored the need to provide facilities and relief to existing taxpayers

Lahore: Lahore Chamber of Commerce and Industry (LCCI) President Kashif Anwar emphasized that those existing taxpayers, who are fulfilling their national obligations, should not be burdened with new laws.

He stressed that legislative efforts should focus on individuals outside the tax net.

The LCCI president made these remarks during a meeting with Chief Commissioner Inland Revenue, Amjad Farooq, at the Lahore Chamber of Commerce and Industry.

The meeting was attended by LCCI Senior Vice President Zafar Mahmood Chaudhry, Commissioners Inland Revenue Sahibzada Umer Razzaq, Nauman Malik, LCCI Executive Committee Members, and other officials.

Kashif Anwar highlighted the economic challenges faced by the business community and underscored the need to provide facilities and relief to existing taxpayers. He expressed concerns regarding recent government-issued SROs, including SROs 457(I)/2024, 350(I)/2024, and 1842(I)/2024, which have posed difficulties for businesses.

Regarding SRO 457(I)/2024, Anwar criticized the requirement for traders and shopkeepers to submit monthly advance tax under the Tajir Dost scheme. He proposed that advance tax collection should occur annually or bi-annually instead of monthly, as this would alleviate the burden on shopkeepers, reduce legal fees, and streamline business operations.

The LCCI president also questioned the imposition of tax based on rental value, suggesting that tax collection should be linked to commercial electricity meters' actual consumption, with incentives such as audit exemptions and reduced tax rates provided to registered retailers under the Tajir Dost Scheme.

Addressing SRO 1842(I)/2024, Anwar recommended increasing the threshold for mandatory integration with the POS system from one lakh rupees to five lakh rupees for retailers. He advocated for exemptions for single-shop retailers from POS integration requirements.

Anwar affirmed LCCI's support for the government's initiatives to formalize the economy and broaden the tax base, stressing the importance of stakeholder engagement in policy formulation.

In response, Chief Commissioner Inland Revenue, Amjad Farooq, assured that the registration process for the Tajir Dost scheme is simplified, with teams actively engaging traders. He clarified that registration under the scheme by June 30 will not incur liabilities, and registrants will receive a 25% advance tax discount. He acknowledged concerns regarding amnesty under the scheme and pledged clarity upon the bill's passage.

Farooq emphasized the FBR rate's use for valuation and expressed willingness to review the provision for monthly advance tax submission based on LCCI's input. He reassured that efforts are underway to minimize harassment and ensure smooth implementation of the scheme, citing significant voluntary returns filed in RTO Lahore this year.

Security forces neutralise four Indian-sponsored terrorists in Pishin IBO: ISPR

- 14 hours ago

President, PM urge Scouts to assist Govt in dealing with challenges

- 2 days ago

Super eight: spinners’ magic works as England beat Sri Lanka by 51 runs

- 2 days ago

UN chief decries global rise of ‘rule of force’

- 11 hours ago

What are gold rates in Pakistan, global markets today?

- 14 hours ago

Pakistan targets 7 TTP, ISKP hideouts in border operation

- 2 days ago

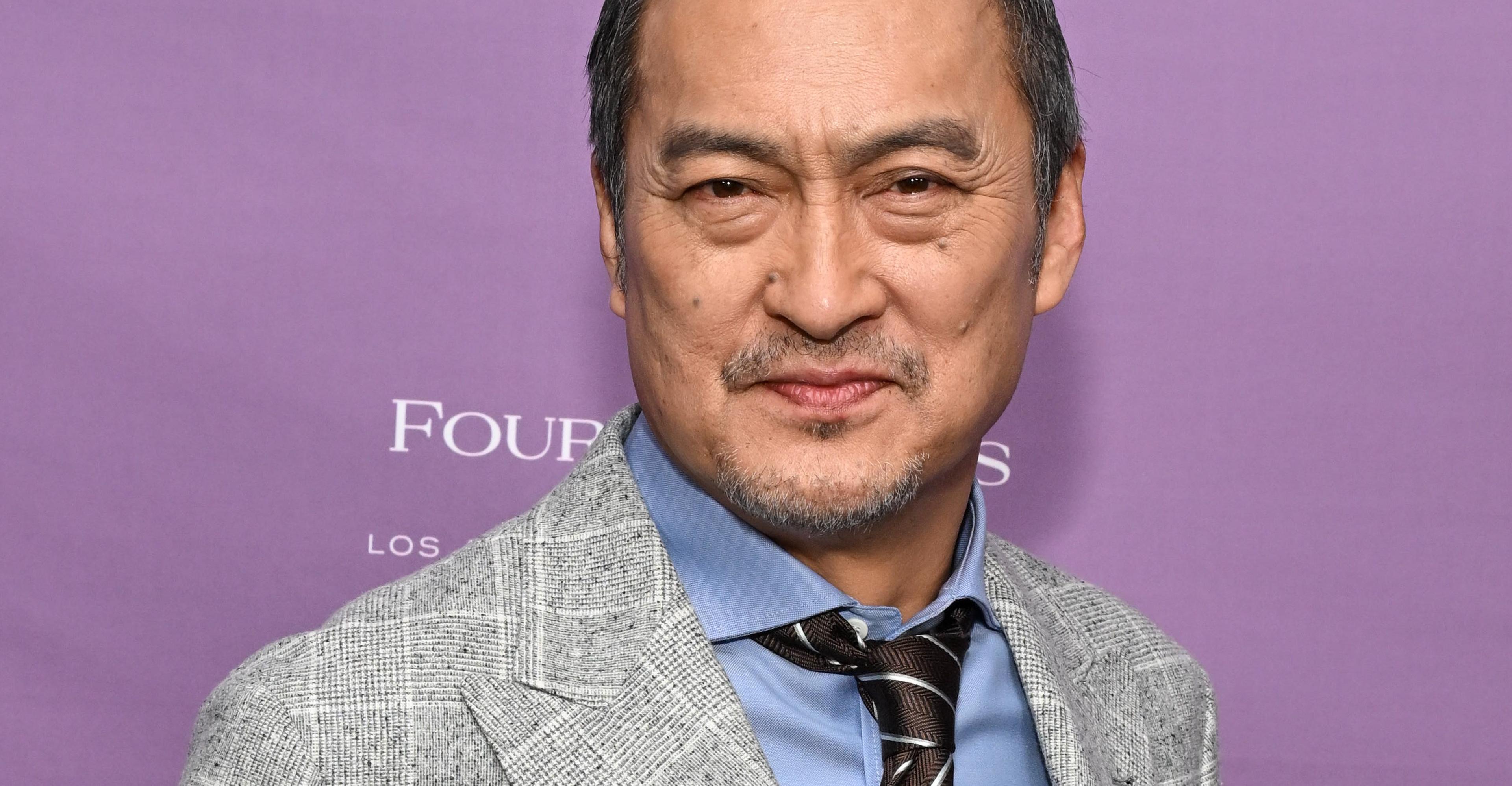

Ken Watanabe didn’t think a kabuki movie would work

- 2 hours ago

T20 World Cup: Pakistan warn England’s flaky batting to expect a trial by spin

- 14 hours ago

Nintendo’s next big Pokémon presentation is on February 27th

- 2 hours ago

Iran says any US attack including limited strikes would be ‘act of aggression’

- 14 hours ago

Pakistan, Bangladesh to expand cooperation across diverse sectors

- a day ago

Three Federal Constabulary personnel martyred in terrorist attack in KP’s Karak

- 14 hours ago