Business

SBP deputy chief explains about charges levied on online funds transfer

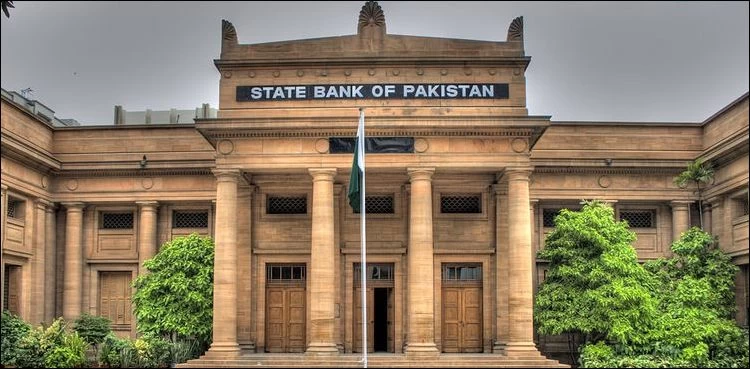

Karachi: State Bank of Pakistan (SBP), Deputy Governor has clarified regarding the charges imposed on online funds transfer.

Speaking with a news outlet, Sima Kamil said that before COVID-19, some banks used to charge Rs100 up to Rs400 for money transfers but during coronavirus, charges were removed for online money transfers.

However, the COVID situation has improved in the country after which the fee for the transfer of money has been reinstated.

SBP Deputy Governor said that online transactions up to Rs 25,000 in a month will be free while Rs10 will be charged for transactions of Rs 10,000 in addition to Rs 25,000.

Likewise, after withdrawal of Rs50,000 in total after a stipulated limit of Rs25,000 in a month, an additional Rs25 will be charged.

While a maximum of Rs 200 will be charged for a large transaction in a month.

The Deputy Governor said that even for online purchases of more than Rs25,000 in a month, transaction charges would be levied under the funds' transfer procedure while online payment of utility bills would not be charged for money transfer.

In response to a question, Sima Kamil said that there is no law that the bank does not accept a guarantee of an adult girl, not taking the bank guarantee of the adult girl is unacceptable.

She said that a housewife can open an account only on her identity card and no more than Rs500,000 transaction can be made in a housewife's account.

-

Pakistan 2 days ago

Pakistan 2 days agoTraffic plan released as Iranian President to visit Lahore, Karachi today

-

Pakistan 2 days ago

Pakistan 2 days agoCM Punjab approves establishment of Provincial Enforcement Authority

-

Sports 1 day ago

Sports 1 day agoPak vs NZ: Muhammad Rizwan, Irfan Khan ruled out of T20I series

-

Pakistan 17 hours ago

Pakistan 17 hours agoPetition to file case against Punjab CM for wearing Police uniform

-

Pakistan 2 days ago

Pakistan 2 days agoSaad Rafique announces to act against editing speech

-

Pakistan 1 day ago

Pakistan 1 day agoImran Khan nominates Hamid Raza as chairman PAC

-

Pakistan 2 days ago

Pakistan 2 days agoIranian President visits Quaid’s Mazar in Karachi

-

Pakistan 2 days ago

Pakistan 2 days agoIranian President Raisi reaches Lahore