US tariffs, its impact on textile exports: a closer look at Pakistan's struggling industry

Textile sector’s ability to adapt and overcome challenges will play pivotal role in maintaining Pakistan’s position as one of the world’s leading exporters

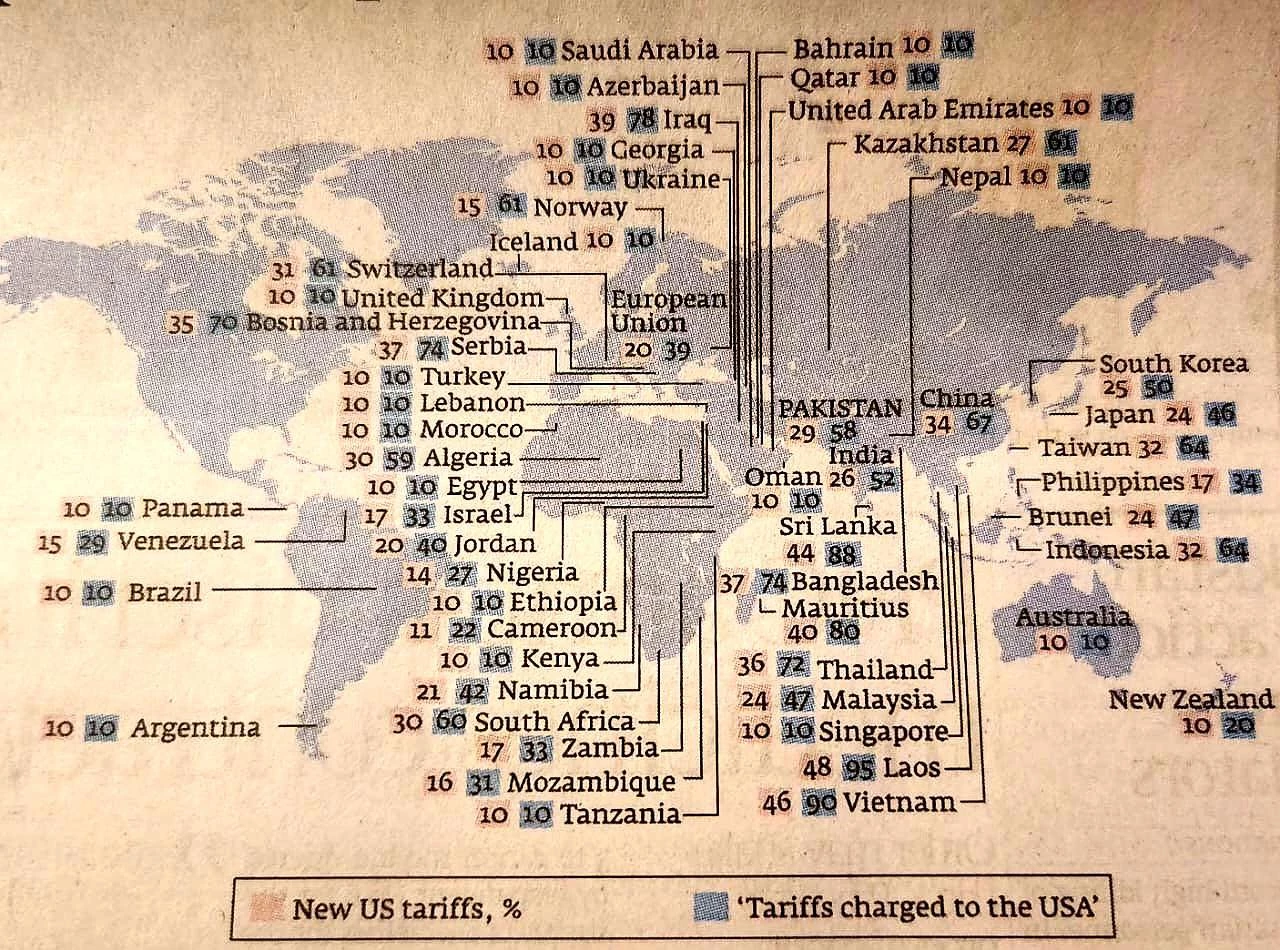

In recent years, the global trade landscape has been profoundly influenced by tariff policies, particularly those imposed by the United States under Donald Trump’s administration. One of the most affected sectors, both globally and in Pakistan, has been the textile industry. As tariffs continue to rise, the consequences for Pakistan, whose textile sector accounts for a massive 91 percent of its total exports to the US, are becoming more pronounced.

US Tariff Changes Under Trump’s Administration

The US government, under Donald Trump, made significant moves in reshaping its trade policies. The core objective was to ‘put America first’ and reduce trade deficits with foreign nations. The administration’s use of tariffs was a key tool in this strategy, most notably in its trade disputes with China and other trading partners.

The most notable tariff increases were seen in:

China

In 2018, Trump’s administration imposed tariffs on over $370 billion worth of Chinese imports. These tariffs, which initially started at 10 percent, were later raised to 25 percent on various goods, including textiles, electronics, and machinery.

European Union (EU)

Trump’s trade policies also led to the imposition of tariffs on steel and aluminum imports from the EU, along with tariffs on European luxury goods like wines and motorcycles.

Mexico and Canada

The United States also imposed tariffs on steel and aluminum products from Canada and Mexico, although these were lifted after the signing of the USMCA (United States-Mexico-Canada Agreement) in 2020.

Pakistan

In the case of Pakistan, the textile industry faced increased tariffs on certain goods, though Pakistan’s exports were not hit with blanket tariffs the way China’s were. Nonetheless, the US has long maintained tariffs on textile products, particularly those from developing nations like Pakistan, which impacted the competitiveness of Pakistani goods.

Pakistan's Textile Sector: A Cornerstone of Exports to US

Pakistan’s textile sector is the backbone of its export economy. The industry generates around $14 billion annually, and textiles alone constitute 91% of total exports to the United States. In 2024, this number is expected to approach $5 billion. Pakistan's textile exports range from garments to home textiles, fabrics, and raw cotton products.

However, tariffs and other trade barriers imposed by the US have created an increasingly difficult environment for Pakistani exporters. Though textile exports to the US have been resilient, the pressure is mounting, particularly with the continued imposition of tariffs and the rise of cheaper alternatives from other countries.

Impact of US Tariffs on Pakistan’s Textile Industry

The textile sector’s exposure to US tariffs has been a source of ongoing concern for Pakistan. Although the US does not impose the same level of tariffs on Pakistani textiles as it does on Chinese goods, certain products still face significant barriers to entry in the American market.

Overall Tariff Rates on Pakistani Textiles

On average, US tariffs on textile imports from Pakistan have ranged from 7-25 percent, depending on the specific category of goods. This is a considerable rate, particularly when compared to other countries that benefit from free trade agreements or preferential trade terms with the US. In contrast, countries like Vietnam and Bangladesh, which are also major textile exporters, face lower tariff rates due to more favorable trade agreements.

GSP (Generalized System of Preferences)

Pakistan has historically benefited from the US GSP program, which allows duty-free access to certain products. However, the Trump administration put forth efforts to reduce Pakistan’s access to GSP benefits, primarily due to the country’s human rights record and labor-related concerns. This loss of GSP status led to an immediate increase in tariffs for affected products, including textiles.

Impact on Competitiveness

With tariffs imposed by the US, Pakistani textile manufacturers are at a competitive disadvantage compared to other exporters like Bangladesh, India, and Vietnam. These nations benefit from more favorable tariff structures or trade agreements with the US, making it harder for Pakistan’s manufacturers to compete on price.

Counter-Tariffs Imposed on US Goods by Other Countries

While the US has implemented tariffs on foreign goods, many countries, including Pakistan’s trade partners, have retaliated with tariffs on American products, which has exacerbated the global trade tensions.

China

One of the most significant retaliations came from China, which imposed tariffs on $110 billion worth of US goods, including agricultural products like soybeans, cars, and aircraft. These actions were part of the trade war between the two countries, which saw significant impacts on the US economy, especially in agriculture and manufacturing.

European Union

The EU imposed tariffs on a wide range of American products, including whiskey, motorcycles, and aerospace products. These retaliatory measures were a response to the US tariffs on steel and aluminum and were aimed at reducing the trade imbalance between the two economies.

India

India, in response to the US withdrawing special trade privileges under the GSP program, imposed tariffs on a range of US goods, including almonds, apples, and electronics.

Pakistan’s Response

Pakistan, in particular, has been cautious in retaliating against US tariffs, largely because of its dependence on the American market for textile exports. However, the country has lobbied for reduced tariffs and better trade access, particularly through multilateral organizations like the World Trade Organization (WTO).

Future of Pakistan’s Textile Exports to US

Looking ahead, Pakistan’s textile sector faces a mixed future. On the one hand, the US remains the single largest market for Pakistani textiles. On the other hand, the rise of competing nations with more favorable trade terms, alongside the impact of tariffs, presents significant challenges.

There are a few key factors that may influence the future trajectory of textile exports:

Diversification of Export Markets

Pakistan is increasingly looking to diversify its export markets to reduce dependence on the US and mitigate the risks of fluctuating tariffs. Countries in the European Union, the Middle East, and Asia have become more attractive for Pakistani textile exporters.

Technological Upgrades

Pakistan’s textile industry has started to embrace new technologies, such as automation and digital printing, which could enhance product quality and reduce manufacturing costs. This could make Pakistani textiles more competitive in the global market, even in the face of tariffs.

Free Trade Agreements (FTAs)

Pakistan’s government is actively pursuing Free Trade Agreements with countries like China, the United Kingdom, and the European Union. These agreements may help mitigate the negative impact of US tariffs and open new markets for Pakistan’s textile exports.

The US tariffs, particularly those imposed under the Trump administration, have had a significant impact on Pakistan’s textile sector, which remains highly dependent on exports to the US The ongoing trade tensions and retaliatory measures from other countries have created a challenging environment for textile manufacturers. However, with strategic diversification, technological advancements, and improved trade relations, Pakistan’s textile sector can still navigate these turbulent waters and continue to thrive on the global stage.

Moving forward into 2025, the textile sector’s ability to adapt and overcome these challenges will play a pivotal role in maintaining Pakistan’s position as one of the world’s leading exporters of textiles. However, the lessons learned from the Trump administration's tariff policies will remain a defining factor in shaping the future of international trade for years to come.

Westminster International School holds first TEDx event in Islamabad

- 7 hours ago

Christian Gonzalez vs. JSN? Will Campbell vs. DeMarcus Lawrence? Sorting five key Super Bowl matchups

- 20 hours ago

Who you calling old? At the 2026 Olympics, age is just a number

- 20 hours ago

CM Maryam Nawaz praises people of Lahore for following safety SOPs during Basant

- 10 hours ago

Road to $1M paydays: How WNBA salaries evolved with each CBA

- 20 hours ago

An epic Rookie of the Year race? 2026 predictions for MLB's top prospects

- 20 hours ago

How Laila Edwards carved her own path as USA Hockey's first Black player

- 20 hours ago

From Harden and JJJ to Vucevic: Fantasy reaction to the latest NBA trades

- 20 hours ago

President Zardari calls for collective resolve against terrorism

- 10 hours ago

DPM Ishaq Dar, Turkish Foreign Minister discuss bilateral ties

- 13 hours ago

✨ Top 10 MLB prospect rankings for every team

- 20 hours ago

Our full list of Super Bowl LX picks: 58 experts predict the final score of Seahawks-Patriots

- 20 hours ago