Brent crude futures for January tumbled $4.07, or 4.7pc, to $82.93 a barrel

Oil prices plunged on Monday to their lowest since early January, after the Wall Street Journal reported that Saudi Arabia and other OPEC oil producers are considering a half-million barrel daily output increase.

Brent crude futures for January tumbled $4.07, or 4.7%, to $82.93 a barrel by 11:43 a.m. EST (1643 GMT). U.S. West Texas Intermediate (WTI) crude futures for December were down $4.48, or 5.6%, at $75.60 ahead of the contract's expiry later on Monday. The more active January contract was down $4.05, or 5%, at $76.04.

An increase of up to 500,000 barrels per day (bpd) will be discussed at the OPEC+ meeting on Dec 4, The Wall Street Journal reported.

Reuters was not immediately able to verify the report.

"It's hard to believe they're going into a market that is basically trading in contango," said Bob Yawger, director of energy futures at Mizuho in New York, referring the effect of current oil futures trading at a discount to later dated contracts. "That's playing with fire."

The Organization of the Petroleum Exporting Countries (OPEC) and its allies, together known as OPEC+, recently cut production targets and de facto leader Saudi Arabia's energy minister was quoted this month as saying the group will remain cautious.

Releasing more oil at the same time as weak Chinese fuel demand and U.S. dollar strength could move the market deeper into contango, encouraging more oil to go into storage and pushing prices still lower, Yawger said.

Expectations of further increases to interest rates have buoyed the greenback, making dollar-denominated commodities like crude more expensive for investors.

The dollar rose 0.9% against the Japanese yen to 141.665 yen, on pace for its largest one-day gain since Oct. 14.

"Apart from the weakened demand outlook due to China's COVID curbs, a rebound in the U.S. dollar today is also a bearish factor for oil prices," said CMC Markets analyst Tina Teng.

"Risk sentiment becomes fragile as all the recent major countries' economic data point to a recessionary scenario, especially in the UK and euro zone," she said, adding that hawkish comments from the U.S. Federal Reserve last week also sparked concerns over the U.S. economic outlook.

New COVID case numbers in China remained close to April peaks as the country battles outbreaks nationwide.

The front-month Brent crude futures spread narrowed sharply last week while WTI flipped into contango, reflecting dwindling supply concerns.

SOURCE: REUTERS

T20 World Cup: Pakistan warn England’s flaky batting to expect a trial by spin

- ایک دن قبل

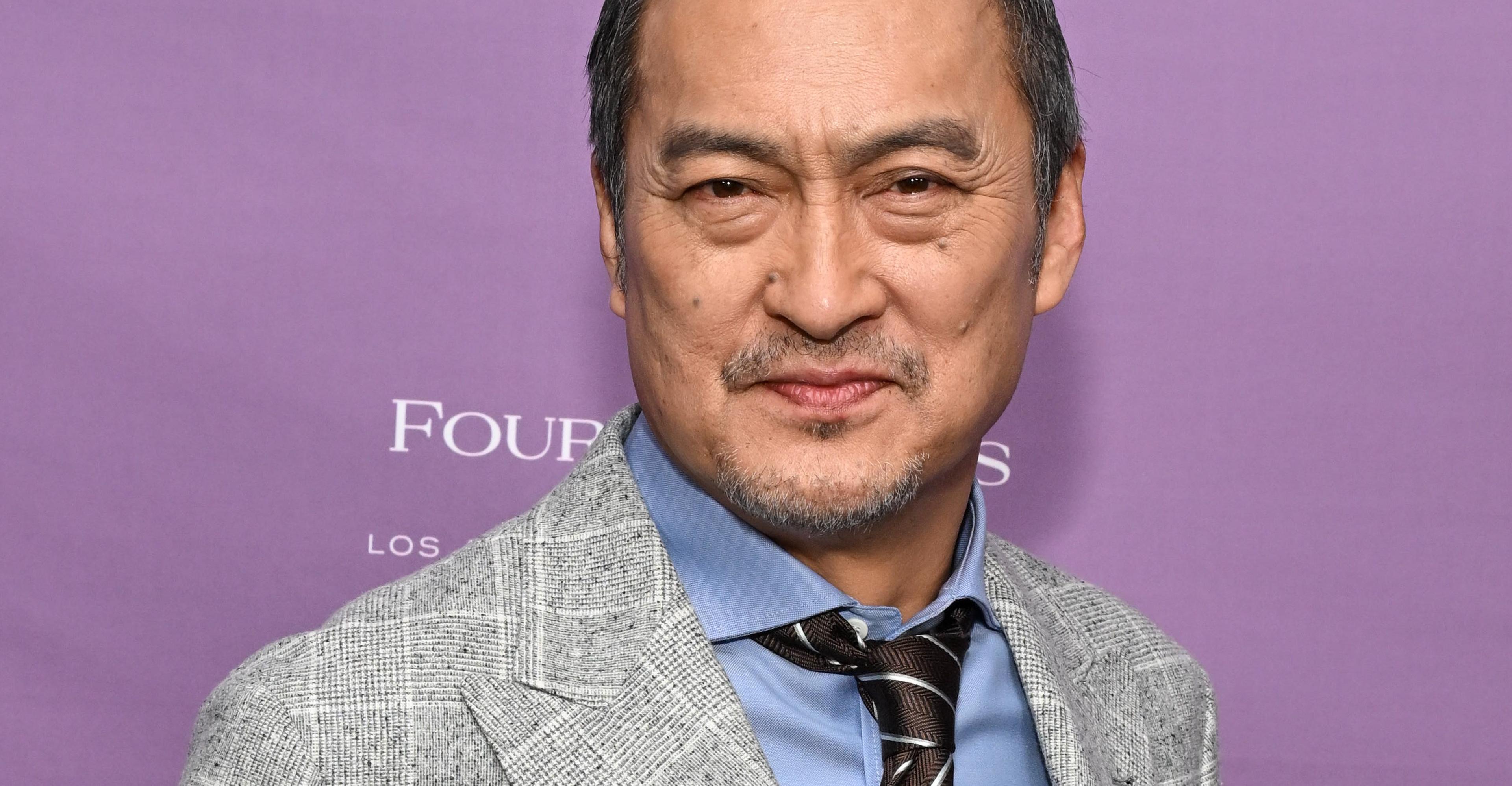

Ken Watanabe didn’t think a kabuki movie would work

- 11 گھنٹے قبل

Nintendo’s next big Pokémon presentation is on February 27th

- 11 گھنٹے قبل

Three Federal Constabulary personnel martyred in terrorist attack in KP’s Karak

- ایک دن قبل

Six cops including DSP martyred in Kohat attack

- 20 منٹ قبل

Gold prices continue to surge in Pakistan, global markets

- 7 منٹ قبل

UN chief decries global rise of ‘rule of force’

- 20 گھنٹے قبل

The Pixel 10A and Soundcore Space One are just two of the best deals this week

- 2 گھنٹے قبل

Met office forecasts dry weather in most parts of country

- 14 منٹ قبل

Security forces kill four terrorists in DI Khan IBO: ISPR

- 16 منٹ قبل

Senate passes resolution rejecting Israeli statement, reaffirms support for Palestine

- ایک گھنٹہ قبل

Iran says any US attack including limited strikes would be ‘act of aggression’

- ایک دن قبل