LCCI President Kashif Anwar emphasized the Chamber's dedication to ensuring the success of the Tajir Dost Scheme

Lahore: The Lahore Chamber of Commerce & Industry (LCCI) organized an awareness seminar focusing on the Tajir Dost Scheme, SRO 350, and other legal amendments.

The event was chaired by LCCI President Kashif Anwar, with Chartered Accountant Umar Zaheer Meer, Pakistan's representative on the Global Tax Forum, providing insights into the Tajir Dost Scheme.

LCCI Vice President Adnan Khalid Butt, along with Amjad Ali Jawa, Ashraf Bhatti, Zaheer Babar, S.M. Akhtar, and various market presidents and general secretaries, actively participated in the seminar.

In his address, LCCI President Kashif Anwar emphasized the Chamber's dedication to ensuring the success of the Tajir Dost Scheme. He stressed the importance of government consultation with stakeholders to incorporate their feedback before implementation. Although the scheme may not directly affect Chamber members, LCCI is committed to its success.

President Anwar highlighted the need to include Chambers' input in expanding the tax net, suggesting that broadening the tax base is essential to reducing the burden on existing taxpayers. He noted that offering policy advice is a Chamber responsibility, and addressing issues like audits, penalties, surcharges, bank attachments, inquiries, statements, returns, and withholding taxes is crucial for building taxpayer trust.

Umar Zaheer Meer shared FBR data indicating that 3.6 million small shopkeepers are currently outside the tax net. The Tajir Dost Scheme, now law under SRO 420, includes all shops operating from fixed locations. FBR is authorized to register shops that do not voluntarily comply. The tax under this scheme will be based on 10% of the market value of the business premises.

President Anwar suggested that taxes be collected through commercial electricity bills, which can be adjusted in the annual income tax return. He proposed incentives for registered retailers, such as audit exemptions and lower tax rates, similar to the 2016 VTCS, to encourage more registrations.

Meer also explained that under SRO 350, electronic return filing will require the commissioner's approval if sales exceed five times the capital. This SRO mandates that individuals, association members, or single shareholder companies and directors submit a balance sheet and undergo biometric verification at NADRA’s e-Sahulat centers every July. Failure to meet these requirements will prevent electronic return filing without prior approval. Additionally, if the seller fails to file sales tax returns on time, the buyer will not receive input credit, and the seller's invoices will be canceled, increasing the buyer's tax liability.

The seminar also covered the Tax Law Amendment Act 2024, including changes to the tax appeal system. LCCI President Kashif Anwar and participants stressed the need to address fundamental issues such as the unlimited powers of tax laws and ensure business community consultation, particularly with the Chambers, to make these changes effective.

Pakistan targets 7 TTP, ISKP hideouts in border operation

- 2 days ago

Iran says any US attack including limited strikes would be ‘act of aggression’

- 13 hours ago

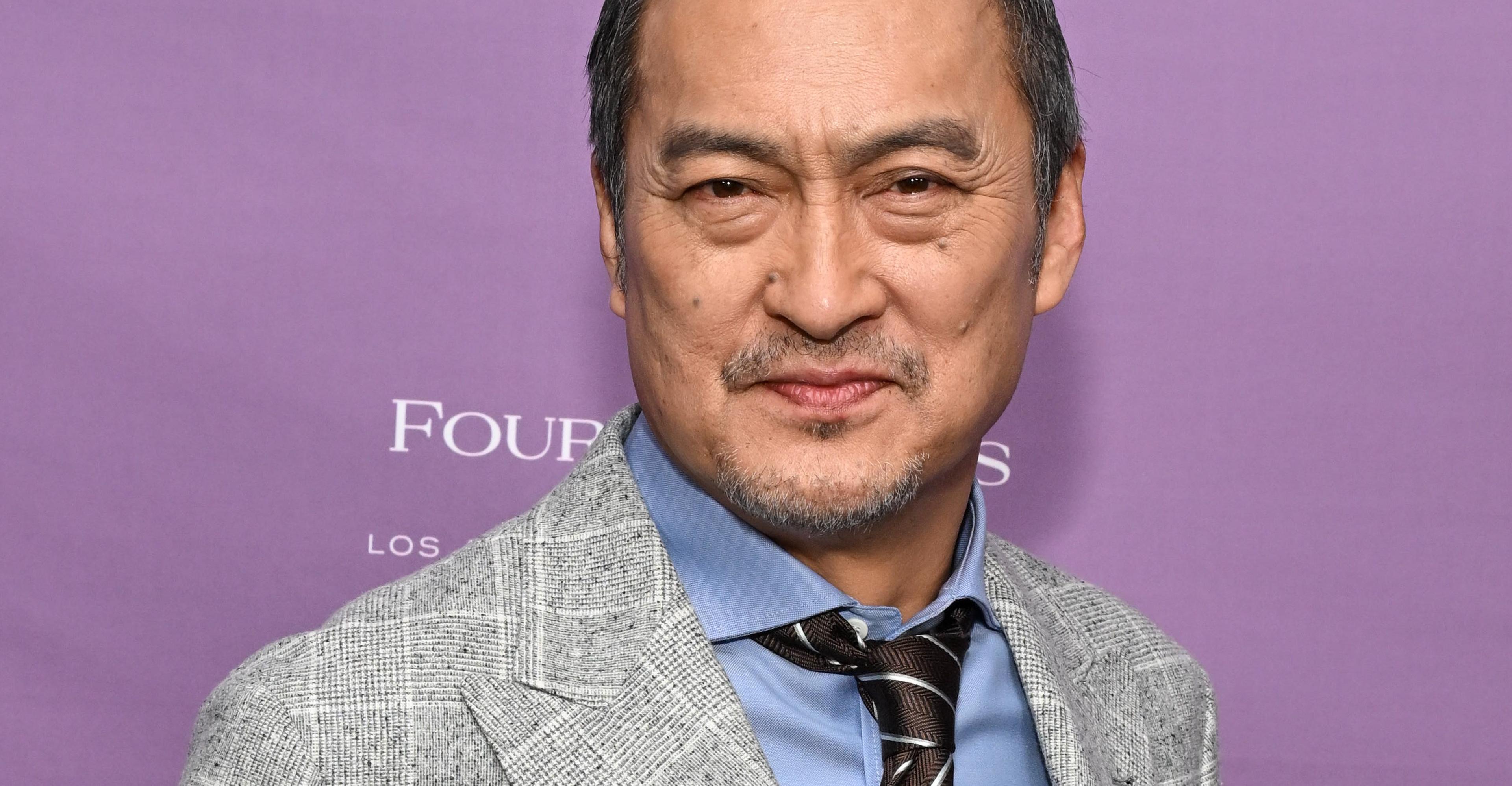

Ken Watanabe didn’t think a kabuki movie would work

- 42 minutes ago

Pakistan, Bangladesh to expand cooperation across diverse sectors

- a day ago

Nintendo’s next big Pokémon presentation is on February 27th

- 42 minutes ago

Super eight: spinners’ magic works as England beat Sri Lanka by 51 runs

- a day ago

President, PM urge Scouts to assist Govt in dealing with challenges

- 2 days ago

UN chief decries global rise of ‘rule of force’

- 10 hours ago

Security forces neutralise four Indian-sponsored terrorists in Pishin IBO: ISPR

- 13 hours ago

What are gold rates in Pakistan, global markets today?

- 13 hours ago

Three Federal Constabulary personnel martyred in terrorist attack in KP’s Karak

- 13 hours ago

T20 World Cup: Pakistan warn England’s flaky batting to expect a trial by spin

- 13 hours ago