North American shippers are bracing for simultaneous stoppages at the Canadian operations

Houston (Reuters): A looming labor dispute at Canada's two main railroads is unlikely to significantly reduce oil exports to the United States due to excess capacity on Trans Mountain and other pipelines, people close to the matter said.

North American shippers such as fertilizer supplier Nutrien and U.S. logistics firm C.H. Robinson are bracing for simultaneous stoppages at the Canadian operations of Canadian National Railway and Canadian Pacific Kansas City (CPKC) that could cost the nation's economy billions of dollars.

A strike or lockout could start on Thursday.

But oil exports may be largely unscathed. U.S. rail imports of Canadian crude have fallen sharply in recent years, averaging around 55,000 barrels per day in May, U.S. Energy Information Administration data showed, the lowest since the pandemic price crash in 2020. The U.S. imports about 4.2 million bpd from Canada, mostly by pipeline.

"Anybody receiving crude by rail right now is figuring out what alternatives they have, whether it's an alternative grade that can be substituted on the pipeline, or if a buyer is willing to take something else," said Elliot Apland at MarbleRock Advisors, which helps negotiate rail supply-chain contracts.

Prices of Canada's Western Canadian Select crude typically fall during export logjams. However, Trans Mountain's expansion in May and available capacity on other pipes should limit deep discounting, industry experts and analysts said.

"Crude-by-rail is not as essential to the Canadian market as it was prior to the Trans Mountain expansion," said Jeremy Irwin, a senior oil markets analyst at consultancy Energy Aspects.

Trans Mountain's expansion nearly tripled the flow of crude from landlocked Alberta to the Pacific coast, to 890,000 bpd.

Maintenance at U.S. Midwest refineries, which buy and process Canadian crude, will also free pipeline space for additional barrels, Irwin added.

WCS for September delivery in Hardisty, Alberta, settled on Friday at $12.25 a barrel below U.S. West Texas intermediate crude, according to brokerage CalRock, compared to an average $18.65 discount in 2023. The relatively small discount indicates little market concern about moving Canadian crude.

Three Federal Constabulary personnel martyred in terrorist attack in KP’s Karak

- a day ago

Met office forecasts dry weather in most parts of country

- 3 hours ago

Senate passes resolution rejecting Israeli statement, reaffirms support for Palestine

- 4 hours ago

Gold prices continue to surge in Pakistan, global markets

- 3 hours ago

Imran Khan’s sister Noreen Niazi injured after falling into under-construction sewer line

- 3 hours ago

UN chief decries global rise of ‘rule of force’

- a day ago

Iran says any US attack including limited strikes would be ‘act of aggression’

- a day ago

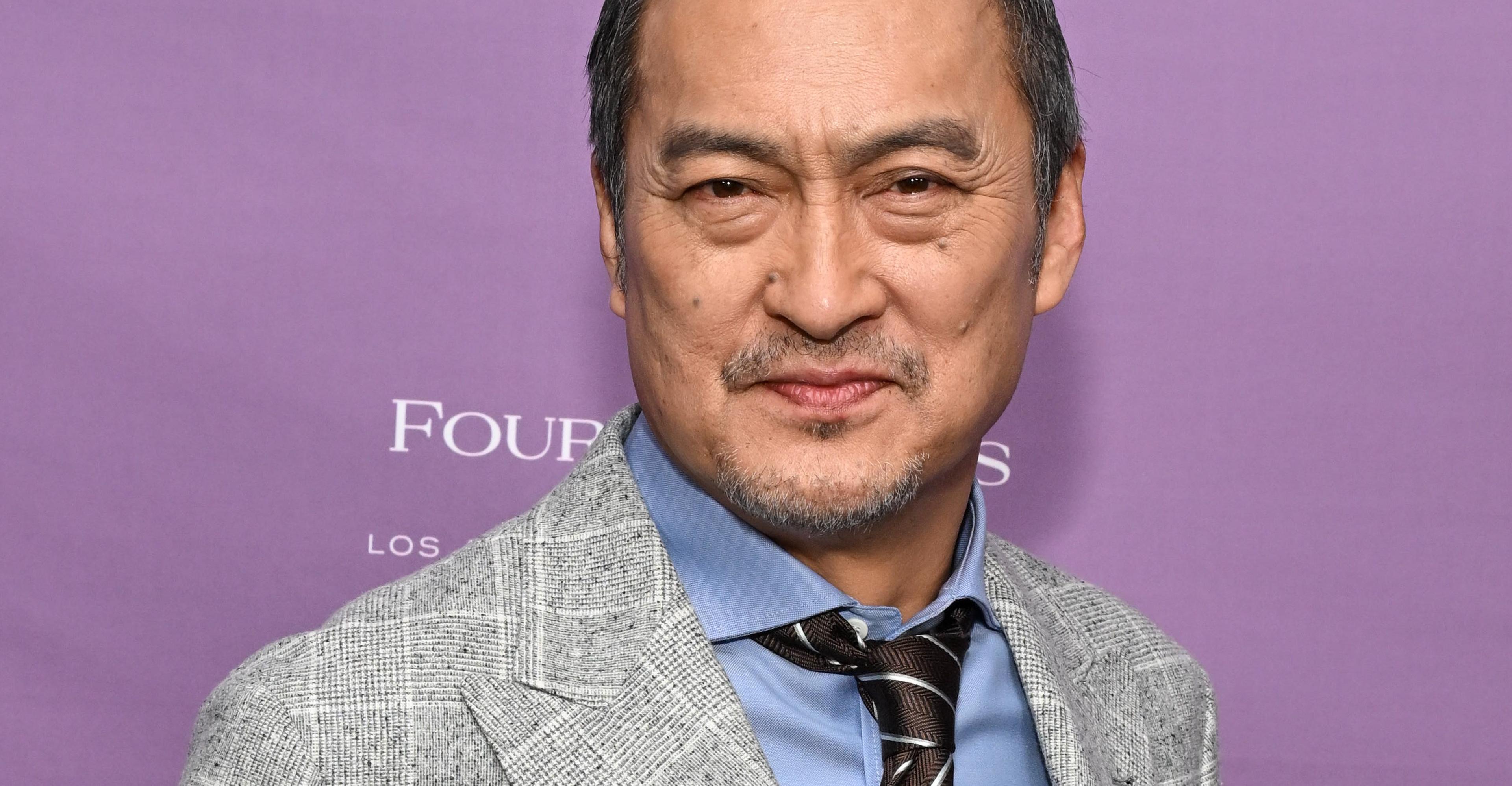

Ken Watanabe didn’t think a kabuki movie would work

- 13 hours ago

Nintendo’s next big Pokémon presentation is on February 27th

- 13 hours ago

Security forces kill four terrorists in DI Khan IBO: ISPR

- 3 hours ago

The Pixel 10A and Soundcore Space One are just two of the best deals this week

- 4 hours ago

Six cops including DSP martyred in Kohat attack

- 3 hours ago