As 2024 ends, Pakistan finds itself in a comfortable state, marked by hard-earned progress amidst persistent challenges

Pakistan's economic landscape reflects positive changes, where steady steps are underway to achieve development goals. The confidence of international financial institutions and achievements of economic reforms are leading Pakistan to a bright future.

Major Economic Indicators FY-24 and FY-25

GDP forecast for FY-25, IMF is 3.2%, ADB is 3%, and World Bank is 2.8%.

Pakistan Stock Exchange (KSE-100 Index) in FY24 crosses 58000 points and surpassed 100K milestone in FY25.

SBP Forex Reserves $7 billion in FY24 and SBP Reserves was $12.05 billiom in FY25 and total forex reserves is $16.601 billion.

Inflation was 29.2% in FY24 and FY25 was 7.88%.

Interest Rate was 22.5% in FY24 and 13% in FY25

Exports was $12.162 billion in FY24 and $13.721 billion in FY25 with an increase of 12.82%.

Remittances in FY24 was $11.1 billion and was $14.8 billion in FY25 with an increase of 33.6%. Forecast was $35 billion.

Current Account in FY24 was $1.68 billion negative and in Deficit, while in FY25 was $944 million in surplus.

Roshan Digital Account was $7.195 billion in FY24 and crossed $9 billion in FY25.

As 2024 ends, Pakistan finds itself in a comfortable state, marked by hard-earned progress amidst persistent challenges.

The country's economic narrative reflects a cautious optimism as it navigates through structural hurdles toward recovery.

The turning point of 2024 came with the $7 billion bailout package from the International Monetary Fund (IMF), providing a vital lifeline.

IMF projected GDP growth of 3.2% for fiscal year 2025; modest yet encouraging compared to earlier projections.

The World Bank and Asian Development Bank echoed this optimism by revising their growth forecasts upward to 2.8% and 3%, respectively, for fiscal year 2025.

These revisions were attributed to eased import restrictions, reduced inflation, and an improved business environment.

The Pakistan Stock Exchange (PSX) experienced a historic bullish trend, with the KSE-100 index surging from 58,000 to over 117,000 points by year-end.

This reflected improved investor confidence, bolstered by an increase in foreign reserves from $7 billion to $12 billion, enabling a 2.5-month import cover.

Inflation saw a dramatic reduction from 29.2% in 2023 to 4.9% in 2024, alongside a significant cut in interest rates from 22% to 13%. These measures eased out macroeconomic pressures.

The external sector showed promise, with remittances increasing by 34.7% year-over-year to $11.84 billion and exports growing by 12.57% to $13.7 billion between July and November 2024.

Fiscal Reforms: Fiscal reforms targeted sectors like retail, wholesale, and agriculture, broadening the tax base.

Outlook for 2025

The government remains optimistic, projecting GDP growth to recover to 3.2% if fiscal discipline and reforms continue.

Economists, however, emphasize the importance of sustained efforts in tax reforms and industrial recovery.

As political stability improves, Pakistan’s economy holds the potential for accelerated growth, paving the way for a more resilient future.

T20 World Cup: Pakistan warn England’s flaky batting to expect a trial by spin

- 16 hours ago

Pakistan, Bangladesh to expand cooperation across diverse sectors

- 2 days ago

Super eight: spinners’ magic works as England beat Sri Lanka by 51 runs

- 2 days ago

Iran says any US attack including limited strikes would be ‘act of aggression’

- 16 hours ago

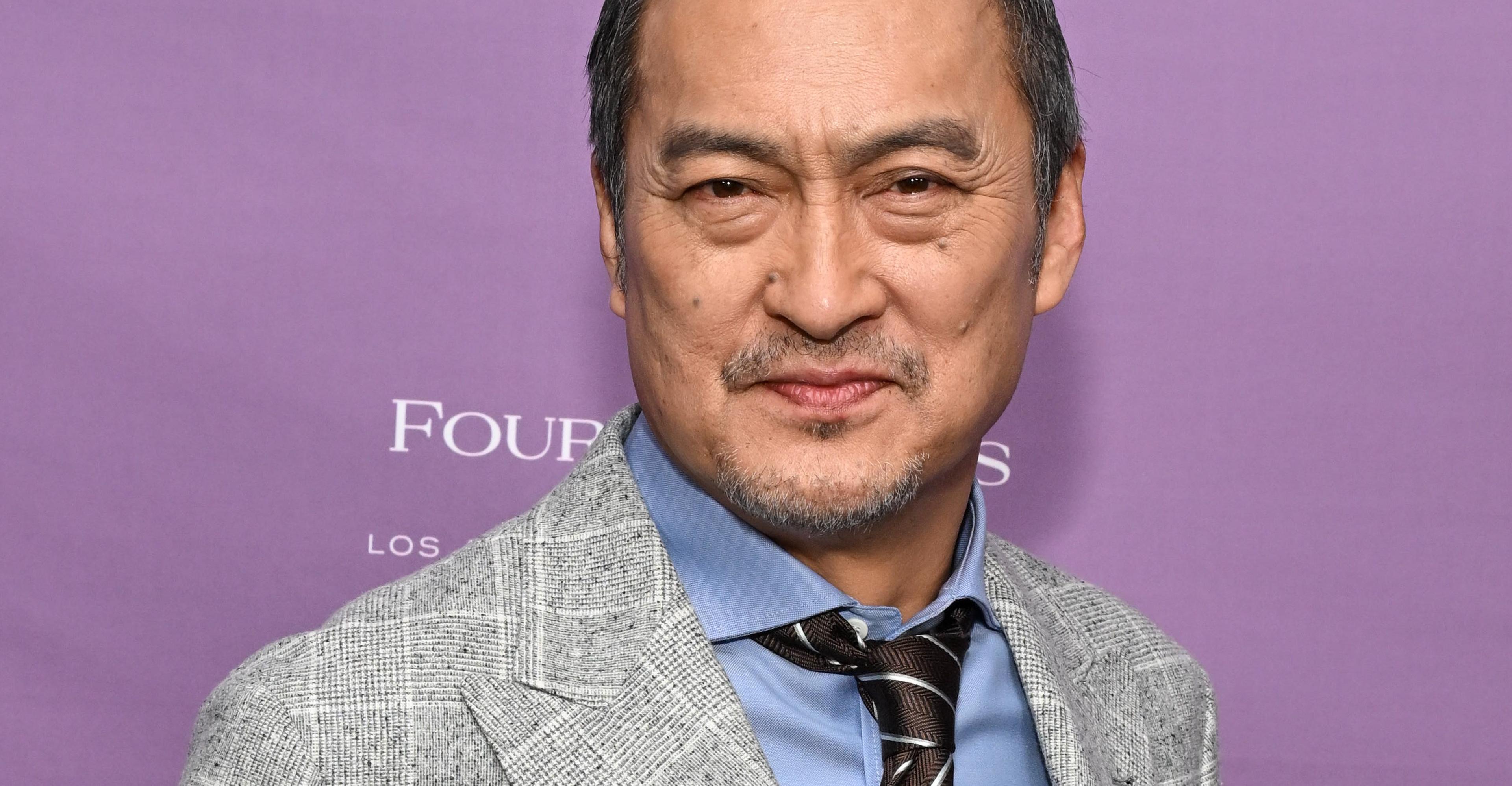

Ken Watanabe didn’t think a kabuki movie would work

- 4 hours ago

Pakistan targets 7 TTP, ISKP hideouts in border operation

- 2 days ago

Three Federal Constabulary personnel martyred in terrorist attack in KP’s Karak

- 16 hours ago

UN chief decries global rise of ‘rule of force’

- 13 hours ago

President, PM urge Scouts to assist Govt in dealing with challenges

- 2 days ago

Security forces neutralise four Indian-sponsored terrorists in Pishin IBO: ISPR

- 16 hours ago

What are gold rates in Pakistan, global markets today?

- 16 hours ago

Nintendo’s next big Pokémon presentation is on February 27th

- 4 hours ago