Federal Finance Minister Ishaq Dar said that the government is utilizing all of its energy to bring the economy back on rail.

Lahore: Lahore Chamber of Commerce and Industry President Kashif Anwar on Tuesday presented a set of Budget Proposals to the Federal Finance Minister Ishaq Dar.

LCCI Senior Vice President Zafar Mahmood Chaudhry, Vice President Adnan Khalid Butt, Executive Committee Members Ibrahim Sheikh, Waseem Yousaf, Mujahid Maqsood Butt, Mian Ateeq ur Rehman and Khalid Mahmood Butt were also present on the occasion.

Speaking on the occasion, Federal Finance Minister Ishaq Dar said that the government is utilizing all of its energy to bring the economy back on rail. He said that everyone is aware of the situation prevailing in the country. He said that all segments of society would have to join hands to get ourselves out of this difficult situation.

Ishaq Dar spoke highly about the role of LCCI saying that it is a matter of pleasure for him that he is also the former president of the Lahore Chamber of Commerce and Industry. He said that the LCCI is playing an important role in economic wellbeing of the country. He said that the LCCI Budget proposals would be made part of the budget document.

He said that the upcoming Federal Budget will be business friendly. He said that we should not go into the blame game but take the country forward. He said that the IMF program is taking time but all formalities for 9th review program have been done.

The Finance Minister said that it was being said a couple of months ago that Pakistan is going to default but The Almighty Allah saved the country. He said that the country was facing restrictions in 1999 but tackled. He said that on time payments are top priority of the government.

LCCI President Kashif Anwar said that since the position of foreign reserves is improving, the Govt. should take measures including trade in local currency where ever possible and barter trade mechanism to mitigate the prevailing foreign exchange crisis.

He said that for broadening of tax base and better documentation, there should be facilitation in the form of declaration scheme which must be introduced to bring undeclared foreign reserves, local assets and wealth in economic circle for injection of liquidity in economy.

To reduce the cost of doing business, Anwar emphasized the need to align Pakistan's interest rates with regional economies. He also urged the government to lower the refinance rate, introduce soft policies for small and medium-sized enterprises (SMEs), and provide special financing schemes with low markup rates and no collateral requirements. The LCCI President emphasized on the importance of reducing the cost of doing business, particularly energy costs and land expenses, to promote industrialization and private sector growth in line with regional economies.

In order to enhance tax compliance and documentation, he proposed the introduction of a declaration scheme. This scheme would encourage individuals to bring undeclared foreign reserves, local assets, and wealth into the economic system, injecting liquidity into the economy. President LCCI stressed the importance of raising awareness among non-filers about the benefits of entering the tax net.

He suggested expanding the tax base by bringing individuals with industrial or commercial electricity or gas connections into the tax net. He recommended charging a 25% income tax on the bills (electricity/gas) of non-filers and emphasized the need for a National Tax Number (NTN) for new commercial electricity/gas connections.

The LCCI President also called for the reduction of fines, penalties, and surcharges imposed on taxpayers. He suggested rationalizing penalties based on revenue loss and adjusting determined advance tax against pending refunds. He emphasized the importance of establishing a committee to clear the refund backlog promptly.

Kashif Anwar highlighted the need to expedite the resolution of tax revenue claims and proposed active engagement with the Alternative Dispute Resolution Committee (ADRC). He suggested granting chambers of commerce representation in the ADRC and ensuring that its decisions are binding and not challengeable by tax forums.

Regarding tax exemptions, Anwar recommended against extending the sales tax and income tax exemptions granted to industries in the erstwhile FATA/PATA region beyond June 30, 2023. He called for simplifying the sales tax system and reducing the high sales tax rate on inputs for export-oriented industries.

Kashif Anwar suggested removing area specifications for Tier-1 retailers and exempting one-shop retailers from point-of-sale (POS) integration. He proposed using electricity consumption units as a parameter instead of the cost of electricity and reducing the import sales tax on capital goods, plant, and equipment to zero percent.

The LCCI President highlighted the high corporate tax rate in Pakistan and suggested gradually reducing it to 15%. He called for minimizing withholding taxes for active taxpayers.

President LCCI concluded by recommending automation of the process of income tax refunds under section 170 for faster processing and to address liquidity issues.

The Brazilian playbook for defending democracy

- 16 minutes ago

Logitech’s new Superstrike is a faster, more customizable gaming mouse

- 2 hours ago

A new Supreme Court gerrymandering case is nightmare fuel for Democrats

- 17 minutes ago

Trump leads first meeting while Hamas tightens grip in Gaza

- 10 hours ago

America After Trump

- 16 minutes ago

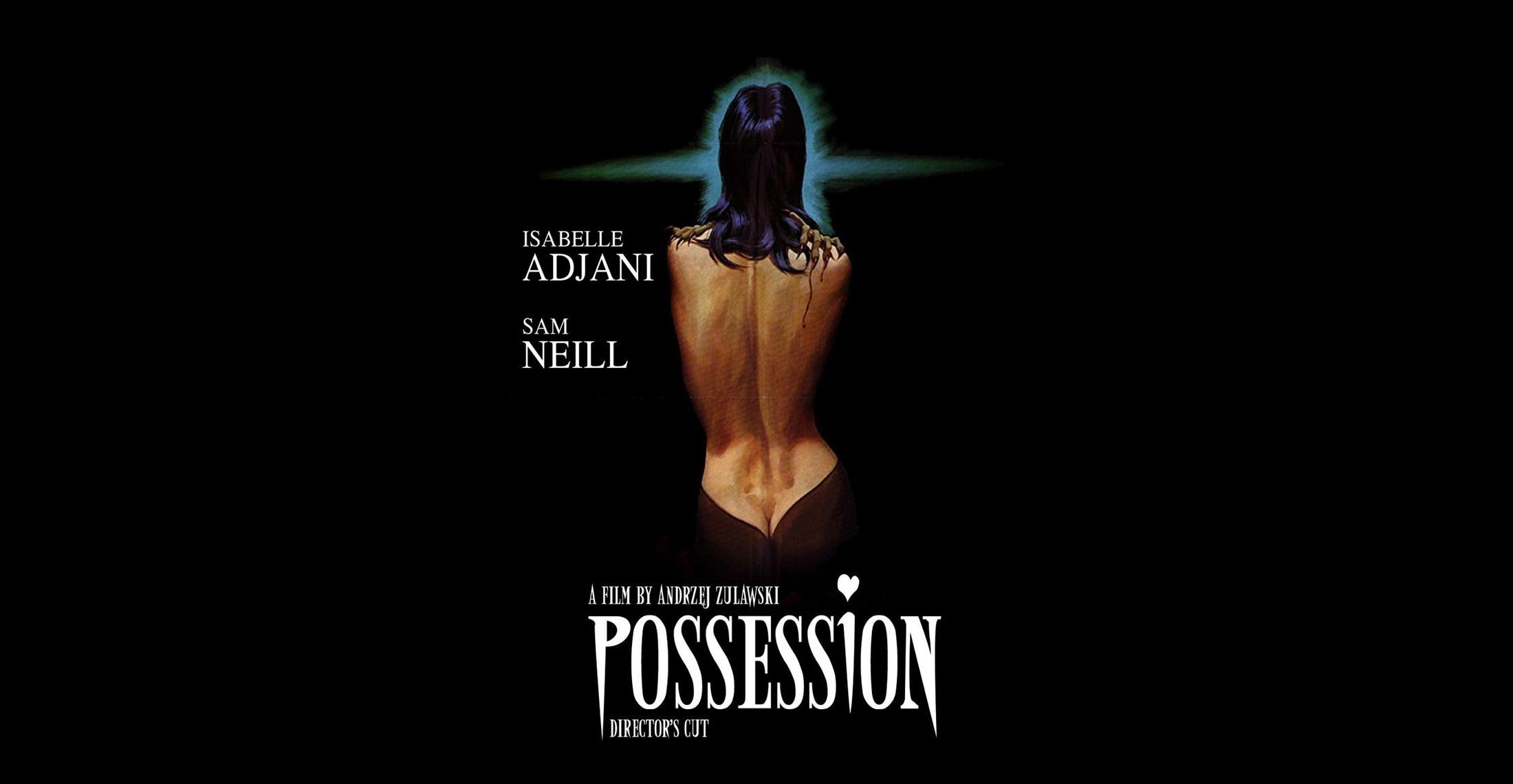

You need to watch the intensely surreal cult classic Possession

- 2 hours ago

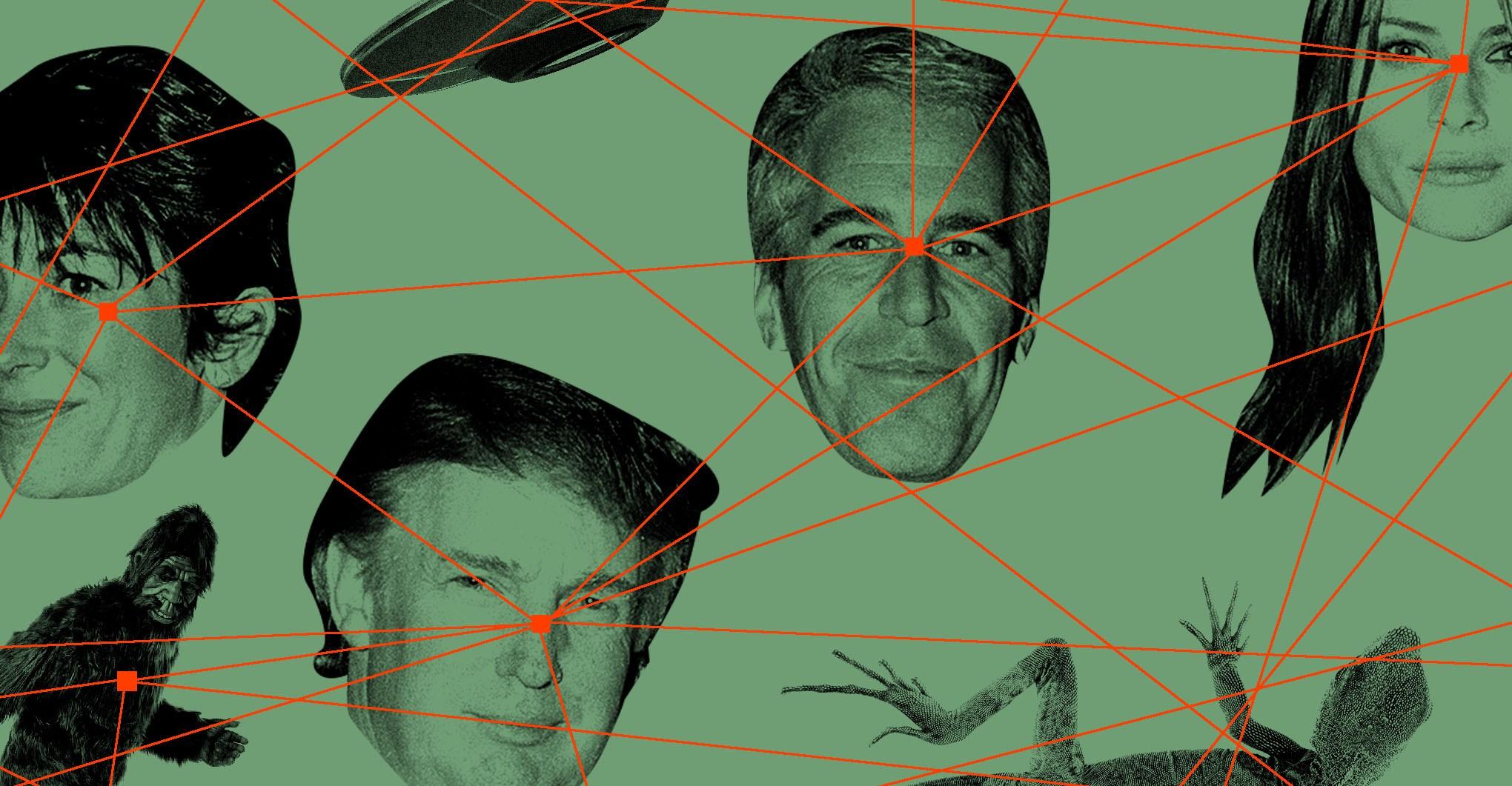

Why are Epstein’s emails full of equals signs?

- 2 hours ago

Apple’s first-gen AirTags are still worth buying now that they’re $16 apiece

- 2 hours ago

Pakistan, US ink pact to redevelop New York’s Roosevelt Hotel

- 10 hours ago

Four terrorists killed in IBO in KP’s Lakki Marwat: ISPR

- 10 hours ago

The world’s rainforests are vanishing. In this one country, they’re growing back.

- 17 minutes ago

Scientists have found another alarming pattern in wildfires

- 16 minutes ago