Real interest rate is the difference between the nominal policy rate and inflation

Islamabad: The unexpected decline in inflation pushed real interest rates to 10.1 percent, giving the State Bank of Pakistan (SBP) ample room to introduce a significant cut in the policy rate, the fifth consecutive cut since June.

The real interest rate is the difference between the nominal policy rate and inflation, it is the actual return on a loan or bond.

The central bank has cut interest rates from 22 percent to 15 percent in four intervals since June, according to a media report. But it has failed to track a sharp decline in the consumer price index, which hit a 78-month low of 4.9 percent in November.

Government and market experts expect CPI-based inflation to be in the range of 6-8 percent.

The fiscal expansion (which reflects economic activity) showed a negative growth of Rs210 billion and Rs800 million from July 1 to November 15, compared to a negative growth of Rs81 billion last year.

The fiscal expansion in fiscal year 2024 was Rs5,000 billion, compared to Rs3,900 billion in fiscal year 2023, but most of the money was taken for budget support, which is considered unproductive for the economy.

In the fiscal year 2024, the amount of budget support reached Rs7,400 billion, while in the fiscal year 2023, it was Rs3,740 billion. Economic growth in fiscal year 2024 was 2.52 percent, while the economy shrank by 0.6 percent in the fiscal year 2023.

With the inflation rate falling to 4.9 percent in November, traders and industrialists have demanded a major reduction in interest rates, while monetary easing is expected from the SBP.

United Business Group (UBG) Patron-in-Chief SM Tanveer has demanded the government to reduce the policy rate of the State Bank by 500 basis points.

He said that low inflation is a sign of stability, but for high growth rates, interest rates need to be brought into single digits.

Khurram Shahzad, the new advisor to the finance minister, said on the social media platform X that the reduction in inflation rates should result in ‘further monetary easing’ by the central bank.

The State Bank’s Monetary Policy Committee will meet on December 16, however, experts believe that the State Bank should proceed cautiously to ensure long-term stability and growth.

Senate passes resolution rejecting Israeli statement, reaffirms support for Palestine

- 7 hours ago

Gold prices continue to surge in Pakistan, global markets

- 6 hours ago

Pakistan set 165-run target for England in Super 8 clash

- an hour ago

Pakistan, Qatar review trade & economic cooperation

- an hour ago

Security forces kill four terrorists in DI Khan IBO: ISPR

- 6 hours ago

Imran Khan’s sister Noreen Niazi injured after falling into under-construction sewer line

- 6 hours ago

The Pixel 10A and Soundcore Space One are just two of the best deals this week

- 7 hours ago

Met office forecasts dry weather in most parts of country

- 6 hours ago

Nintendo’s next big Pokémon presentation is on February 27th

- 16 hours ago

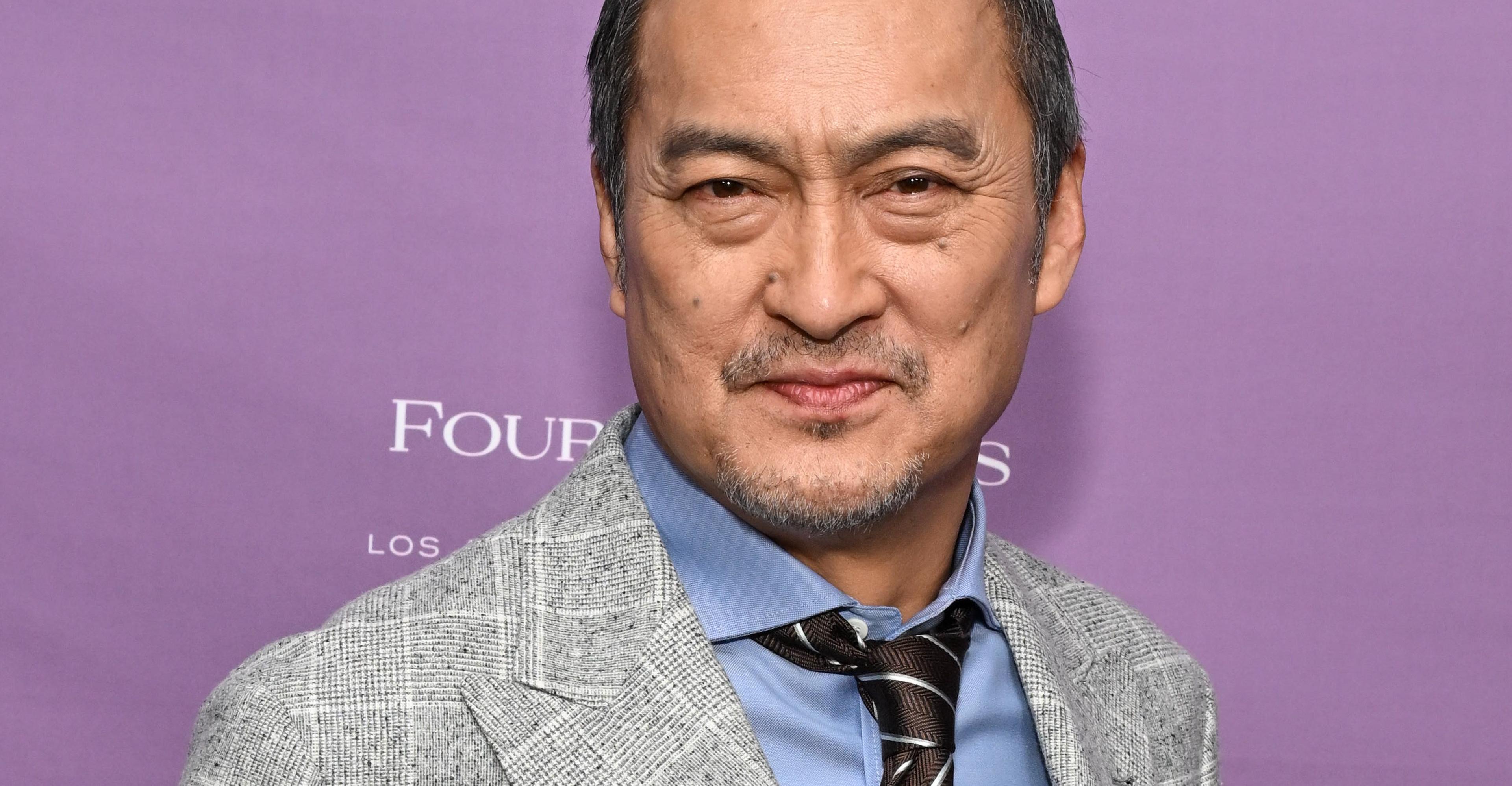

Ken Watanabe didn’t think a kabuki movie would work

- 16 hours ago

Six cops including DSP martyred in Kohat attack

- 6 hours ago

USS Gerald Ford, world’s largest aircraft carrier, at US base on Crete

- an hour ago