Pakistan

Use of technology can take revenue collection to Rs8,000 billion per annum: PM Imran

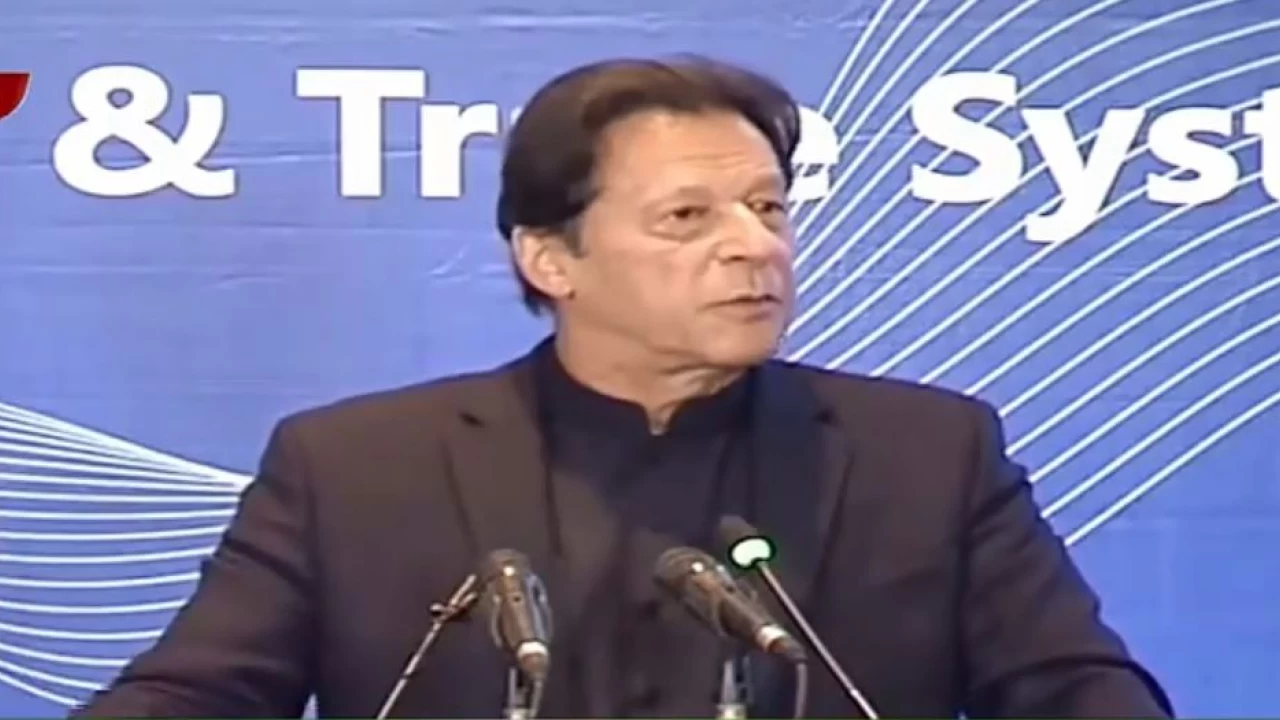

The premier's remarks came at the launching ceremony of FBR’s track & trace system.

Islamabad: Describing taxes vital for country’s economic stability and survival, Prime Minister Imran Khan on Tuesday hoped that the use of technology would help check tax-pilferage and take revenue collection to the tune of Rs8,000 billion per annum.

“Our biggest issue is that we have to take loans to run the country. Countries cannot be run without taxes. We have our stability at stake,” he remarked.

The Prime Minister expressed these views at the launching ceremony of the first-ever track and trace system introduced by the Federal Board of Revenue (FBR).

He congratulated Advisor on Finance Shaukat Tarin, FBR and other relevant institutions for introducing the technology based system for which the efforts were being done since 2008.

The Prime Minister said that the introduction of track and trace system was a big and positive achievement, which will have far-reaching impact.

According to details, the FBR’s track and trace system will ensure electronic monitoring of the production and sale of important sectors like tobacco, fertilizer, sugar and cement.

With the electronic monitoring of goods’ movement from production to the use of consumers, the track and trace system besides increasing country’s revenue will also help ensure transparency and check the pilferage of taxes.

After the implementation of track and trace system in tobacco sector, the FBR was now going to introduce this system in sugar sector, which will follow the implementation of electric monitoring of other sectors as well.

Under the new system, no sugar bag can be taken out of the production site, factory and manufacturing plant without stamp and individual identity mark. The FBR was also planning to implement the new system in beverages and petroleum sectors.

The Prime Minister said that with a reasonable tax-to-GDP ratio in the West and highest in Scandinavian countries, Pakistan could not promote the tax culture due to different reasons including the aristocratic lifestyle of the ruling elite in the past, which shattered the confidence of taxpayers in governments.

The practice of not paying due taxes was continuing since the colonial era, when people used to think that their hard-earned money was being taken out by the foreign rulers and they were not being provided basic facilities, he remarked.

Prime Minister Imran Khan said that contrary to the aristocratic lifestyle of ruling elite in our country, government ministers in the West including UK, which had 50 times more income [revenue] than Pakistan’s were reminded by people, if they ever indulge in high expenditures, that they were using public money.

“When government ministers in UK, a country of 60 million people and having 50 times more income than Pakistan, travel abroad, use economy class if the flight time is less than five hours,” he remarked.

The Prime Minister further said that as against the practice of Pakistani leaders in the past who used to spend ten times extra public money on foreign trips, the prime minister of UK preferred to stay in UK Embassy in the United States to save his country’s tax money.

He said that it was why, the country’s debt swelled from Rs. 6000 trillion to Rs. 3000 trillion in the ten years period [2008-18] of previous governments despite the fact that there was not a single mega development project or any dam.

The Prime Minister congratulated the FBR for the record revenue collection so far and hoped that the country will realize the tax collection of Rs. 6000 billion.

He, however, added that this revenue collection was not enough for providing basic facilities to 220 million people including in the areas of health and education because the government has to spend Rs. 3000 billion for debt-servicing of the loans taken by the previous governments.

The Prime Minister described FBR’s track and trace system as a big step forward and said that the use of technology in tax collection system will enhance revenue collection and check tax pilferage.

He recalled that with the automation in Shaukat Khanum Cancer Hospital, Lahore, 22 years back, the institution was made paperless, ensuring transparency.

The Prime Minister hoped that with the automation in FBR and reduction in contact between the taxpayers and collectors, Pakistan will achieve the revenue collection of Rs. 8000 billion per annum.

Describing the role of FBR as critical, he said, the country’s economic survival and security depended on enhanced revenue collection.

The Prime Minister said that with 65% of the country’s population comprising of youth less than the age of 30 years, it was an asset for Pakistan.

He said that the people of Pakistan very generously give money for charity but hesitate to pay taxes due to lack of trust in governments. “When we will spend on people, they will trust the government and system,” he remarked.

The Prime Minister said there was a need to make people realize that paying taxes was linked with the prosperity and future of the country, nation and their children.

“FBR has to give this confidence to the masses that their taxes will be spent on their welfare. I will personally monitor the results of this track and trace system and that how much revenue is increased due to this system,” he remarked.

Earlier, Advisor on Finance Shaukat Tarin in his remarks on the occasion said that the track and trace system was being introduced on the direction of Prime Minister Imran Khan to enhance revenue collection and ensure transparency.

He said it was a difficult task but was made possible due to efforts of FBR officials and the cooperation of relevant sectors and stakeholders.

With the inclusion of four sectors including tobacco, fertilizers, sugar and cement in the track and trace system, another four sectors will be added in the system, he pointed out.

The Advisor on Finance further said that with the current figure of 3 million active taxpayers, out of which only one million originally pay taxes, work was also in progress for the broadening of tax-net up to 15 million with the use of technology in cooperation with National Database and Registration Authority (NADRA).

Besides, he said, that in the retail sector FBR machines were being installed at various points across the country to capture the true potential of sales tax. He, however, made it clear that small traders will be placed in fixed tax category.

Shaukat Tarin further said that world class facility of a single-window system will be introduced in customs and trade sectors, which will put Pakistan in top ten countries of the world in tax-automation by 2024.

He said sugar was being sold at Rs 90 to 95 and it was expected that in coming weeks, the price of sweetener might came down to Rs 80 to 85 per kg.

The minister said prices of tomato, onion and garlic had decreased substantially with the food basket witnessed balance.

He said the government had launched two programmes to provide relief to the masses. The biggest issue right now was high prices of commodities in Sindh, especially in Karachi, he added.

Fawad said after 18th amendment, the federal government could only give policy on certain matters which the provinces had to implement.

He said Sindh was asked to release wheat and start sugarcane crushing in time but they did not follow the directives.

40 per cent of inflation data of Sensitive Price Index issued was consist of Karachi figures, he added.

He said in Lahore, wheat flour bag of 20 kg was available at Rs 1,100, whereas the same was available in Karachi at Rs 1460.

Sugar price in Karachi was Rs 107, whereas in major cities of Punjab and KPK, the commodity was being sold at Rs 90 per kg.

He urged the media to pressurize the Sindh government so that it could take action for providing relief to the people.

He said the federal government had been importing wheat worth $ 700 million, while on the other hand, the Sindh government said that the wheat was stolen from the province.

He said if the Sindh government failed to take any action then the federal government had to take the matter in its own hands.

Fawad Hussain said the cabinet was briefed on vacant seats in the ministries of Federal Education and Professional Training, and Industries and Production.

Approval for establishing Gems and Jewelry Development Authority had also been given to earn precious foreign exchange by boosting its export, he added.

The cabinet had accorded approval for a framework between Civil Aviation Authorities of Pakistan and the United Kingdom, he said, adding the agreement would be for three years to improve standards of commercial air lines.

The minister advised media to abstain from issuing stories on the cabinet’s agendas without confirmation.

He said the cabinet okayed appointments of the Electronic Certification Accreditation Council’s members for a period of three years.

Shehzad Sami Abdul Wahid Khan and Advocate Ghulam Mustafa were appointed members of the National Telecom Corporation, he said, adding Mian Muhammad Ahmed was appointed member of the Port Qasim Authority on temporary basis.

Fawad said the cabinet had given approval for inclusion of Pakistan into Riyadh MoU on Port State Control. It would enable direct communication between Karachi and Riyadh ports, he added. He said the cabinet gave approval for determining prices of 38 new medicines.

The pharma sector of Pakistan had posted substantial growth after price adjustments in medicine prices. The minister said he had requested Special Assistant to the Prime Minister on Health Dr Faisal Sultan to inform the public as to how the present government uplifted the pharma sector.

The Federal Cabinet, he said approved appointment of Saeed Ahmed as Chief Executive Officer (CEO) of Sukkur Electric Power Company for three years. The CEO of Hyderabad Electric Supply Company had been removed, while Noor Ahmed Soomro was appointed in his place, he added.

He said Jameel Akhtar had been appointed as member power of the WAPDA, whereas approval for Javed Akhtar Latif as its Member Water had been given by the cabinet.

The decisions taken by the Cabinet Committee on Energy (CCoE) on November 4 and 11 were approved by the cabinet, said Fawad, adding the government had ordered two inquiries one against sugar, while other on hoarding of fuel products by some Oil marketing companies (OMCs).

He said the inquiry against OMCs had been concluded. The details would be shared shortly, he added. The minister said the government had taken various measures to strengthen Oil and Gas Regulatory Authority (OGRA).

The government has sealed over 2,000 petrol pumps during the campaign. ORGA has stopped the issuance of licenses to more oil marketing companies.

He said a system had been devised to determine exact amount of oil reserves in the country and including its location.

Sharing brief detail of the inquiry committee, he said the OMCs had illegally earned Rs 5.52 billion by hoarding the oil.

After the inquiry, he said one CEO of an OMC had been apprehended, while four senior officers including Director General (Oil), OGRA were in jail.

OMCs assets worth Rs one billion had been frozen, he said, adding in second phase, the cases of seven OMC would be taken to logical conclusion.

Fawad said the cabinet okayed the decisions taken by the Economic Coordination Committee on November 15. He said the cabinet green lighted the payment of Rs 134 billion to Independent Power Producers as second installment.

Likewise, it had been decided to release funds worth Rs 10 billion for completing sustainable development goals initiatives, he added.

He said the cabinet okayed release of funds for establishing ‘Rehmatulil Alamin’ Authority in the country.

Public Procurement Regulatory Authority’s rules for urea had been relaxed to avoid creating any dearth of fertilizer in the country, he added.

A sum of Rs 4.7 billion was being released to Election Commission of Pakistan (ECP) for conducting Local Government elections in the country, he said, adding Islamabad Capital Territory Local Government Ordinance 2021 also got approval to pave way for holding LG elections in federal capital.

He said the cabinet approved appointment of members for the board of governor of Federal Government Properties Management Authority’s (FGPMA).

Its members included BOI Chairman, Naya Pakistan Housing Authority Chairman, Finance Secretary and Secretary Housing or their representatives.

About cadastral mapping of the state land, he said the Sindh government had refused to share data in that regard.

The reason of refusal was that the state’s forest land worth over Rs 5,000 billion was in illegal occupation in Sindh province, he added.

The state land worth Rs 5.6 trillion had been retrieved and forest would be grown on that land, he said.

To another query, the minister said Minister for Economic Affairs Omar Ayub Khan had informed the State Bank of Pakistan through a letter that funding of a programme recently held in a local hotel in Islamabad was ‘illegal’.

He reiterated that a thorough investigation would be conducted in the funding of that programme.

To another query, he said the PTI was the only party which had submitted complete record on foreign funding in the ECP.

Likewise, PM Imran Khan had also presented his money trail in the court, he added. He said the ECP should also seek details of foreign funding from other political parties.

The minister said the federal cabinet had allowed transportation of Indian food assistance to Afghanistan via Pakistan.

SOURCE: APP

-

World 2 days ago

World 2 days ago12 killed Mexican steel plant explosion

-

Pakistan 9 hours ago

Pakistan 9 hours agoNon-bailable arrest warrants of PTI leaders issued

-

Pakistan 1 day ago

Pakistan 1 day agoMay 9 vandalism case: Imran Khan provided copies of challan

-

Regional 1 day ago

Regional 1 day agoCrackdown against false number plates, tinted car windows in Karachi

-

Crime 1 day ago

Crime 1 day agoSeven killed, 15 injured in Mastung blast

-

Pakistan 2 days ago

Pakistan 2 days agoUS Congressmen letter for Khan’s release termed interference in domestic affairs

-

Pakistan 2 days ago

Pakistan 2 days agoPresident Zardari flies Dubai for private visit

-

Pakistan 2 days ago

Pakistan 2 days agoIHC orders facilities for Imran Khan as per jail manual