Taxing cigarettes in Pakistan declined smoking by 20 to 25 pc, reveals IMF

This revelation featured in Technical Assistance Report of the commission– Pakistan Tax Policy Diagnostic and Reform Options.

Islamabad: The International Monetary Fund (IMF) has revealed that following a significant increase in prices or taxes on tobacco products, the consumption of cigarettes in Pakistan has witnessed a notable decline of 20-25 percent.

This revelation featured in Technical Assistance Report of the commission– Pakistan Tax Policy Diagnostic and Reform Options. The report was released in February.

Earlier, the global lender advocated imposition of uniform excise rates on both local and foreign cigarette manufacturers.

The IMF's proposal, which advocates for equal taxation measures for all cigarette producers, aims to address health concerns associated with smoking while ensuring fair taxation practices. It suggests subjecting e-cigarettes to similar taxation as traditional tobacco products, citing comparable health impacts.

Capital Calling, an Islamabad-based think tank, has endorsed the IMF's recommendation, aligning it with the guidelines set forth by the World Health Organization (WHO). The objective behind these proposals is to establish equitable taxation across all cigarette products, regardless of their origin.

Health activists have rallied behind the IMF's stance, emphasizing the need for restructuring tobacco taxation in Pakistan.

At a recent event organized by the Society for the Protection of the Rights of the Child (SPARC), activists urged the Government of Pakistan to transition to a Single Tier Tobacco Taxation System, thereby eliminating the existing dual-tier system.

Country Head of Campaign for Tobacco Free Kids (CTFK), Malik Imran Ahmed underscored the alignment between the IMF's recommendations and ongoing discussions within Pakistan. These discussions aim to address fiscal and external sustainability weaknesses while promoting economic recovery and inclusive growth. Ahmed stressed the urgent need to reform Pakistan's cigarette taxation system as part of broader efforts to strengthen public finances and enhance debt sustainability.

The IMF's advocacy for taxation on tobacco products is not only aimed at reducing cigarette consumption but also at generating additional revenue for the government.

By implementing uniform excise rates and eliminating disparities between local and foreign cigarette manufacturers, Pakistan can streamline its taxation system and alleviate the healthcare costs associated with tobacco-related illnesses.

Ahmed said that as Pakistan continues to navigate economic challenges, it is imperative for policymakers to heed the IMF's recommendations regarding tobacco taxation. By prioritizing public health and fiscal sustainability, Pakistan can pave the way for a healthier and more prosperous future for its citizens.

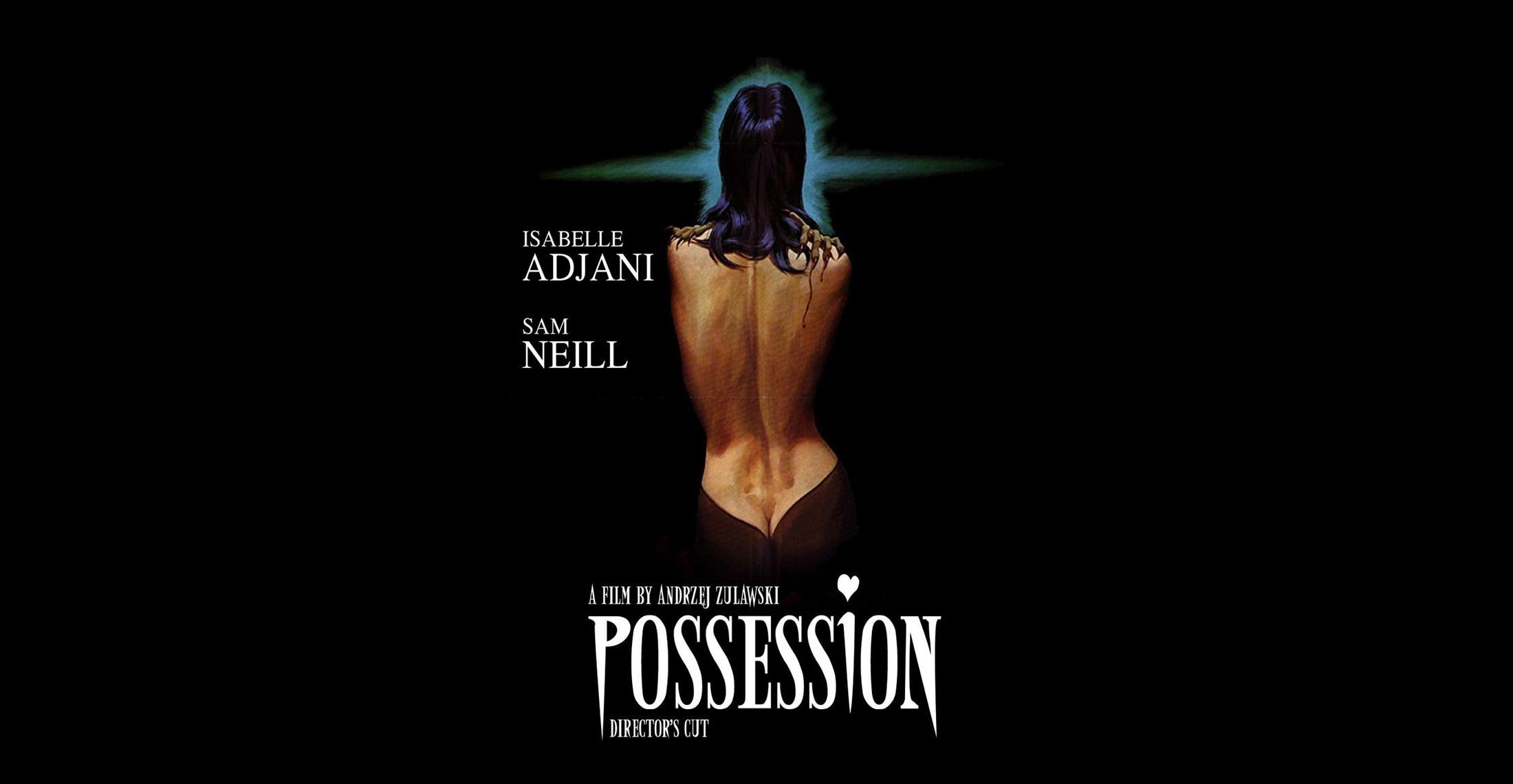

You need to watch the intensely surreal cult classic Possession

- 8 گھنٹے قبل

The world’s rainforests are vanishing. In this one country, they’re growing back.

- 6 گھنٹے قبل

Four terrorists killed in IBO in KP’s Lakki Marwat: ISPR

- 16 گھنٹے قبل

Pakistan, US ink pact to redevelop New York’s Roosevelt Hotel

- 17 گھنٹے قبل

Why are Epstein’s emails full of equals signs?

- 8 گھنٹے قبل

Apple’s first-gen AirTags are still worth buying now that they’re $16 apiece

- 8 گھنٹے قبل

Logitech’s new Superstrike is a faster, more customizable gaming mouse

- 8 گھنٹے قبل

The Brazilian playbook for defending democracy

- 6 گھنٹے قبل

Trump leads first meeting while Hamas tightens grip in Gaza

- 16 گھنٹے قبل

Scientists have found another alarming pattern in wildfires

- 6 گھنٹے قبل

America After Trump

- 6 گھنٹے قبل

A new Supreme Court gerrymandering case is nightmare fuel for Democrats

- 6 گھنٹے قبل