Karachi: The Federal Board of Revenue (FBR) has issued new directives for tax filers.

According to GNN, the FBR directed the tax filers to update their profiles, otherwise the said persons would be declared as non-filers. The filers will now have to update their contact number, email ID, sources of income, profile, along will business name, address and nature of business.

Further, the tax payers will also have to tell about their utility bills, residential address, bank account IBAN number in the profile.

The name of legal representative, authorized representative and employer to be also told to FBR.

Sources said that tax filers will have to attach all the mentioned documents in the IRIS profile, and those tax-payers who will not update the corporate profile will be fined Rs10,000.

According to the report, a four-day surcharge will be levied on a corporate filer four days after the deadline, and a fine of Rs1,000 will be levied on an individual tax filer.

The FBR has set a March 31 deadline to update IRIS profile.

Downdetector and Speedtest sold to Accenture for $1.2 billion

- 11 گھنٹے قبل

PM Shehbaz Sharif announces 14-point austerity plan

- 2 گھنٹے قبل

Valve’s Steam Machine may not launch this year

- 20 گھنٹے قبل

Lee navigates wild round to lead LPGA in China

- 8 گھنٹے قبل

Pakistan Navy launches Operation Muhafiz-ul-Bahr to ensure maritime security

- 5 گھنٹے قبل

Special meeting on austerity policy: Federal Cabinet decides to forgo two months’ salaries

- 8 گھنٹے قبل

How to figure out your finances after a breakup

- 9 گھنٹے قبل

PM announces reward of Rs1.5m for each player of national hockey team

- 8 گھنٹے قبل

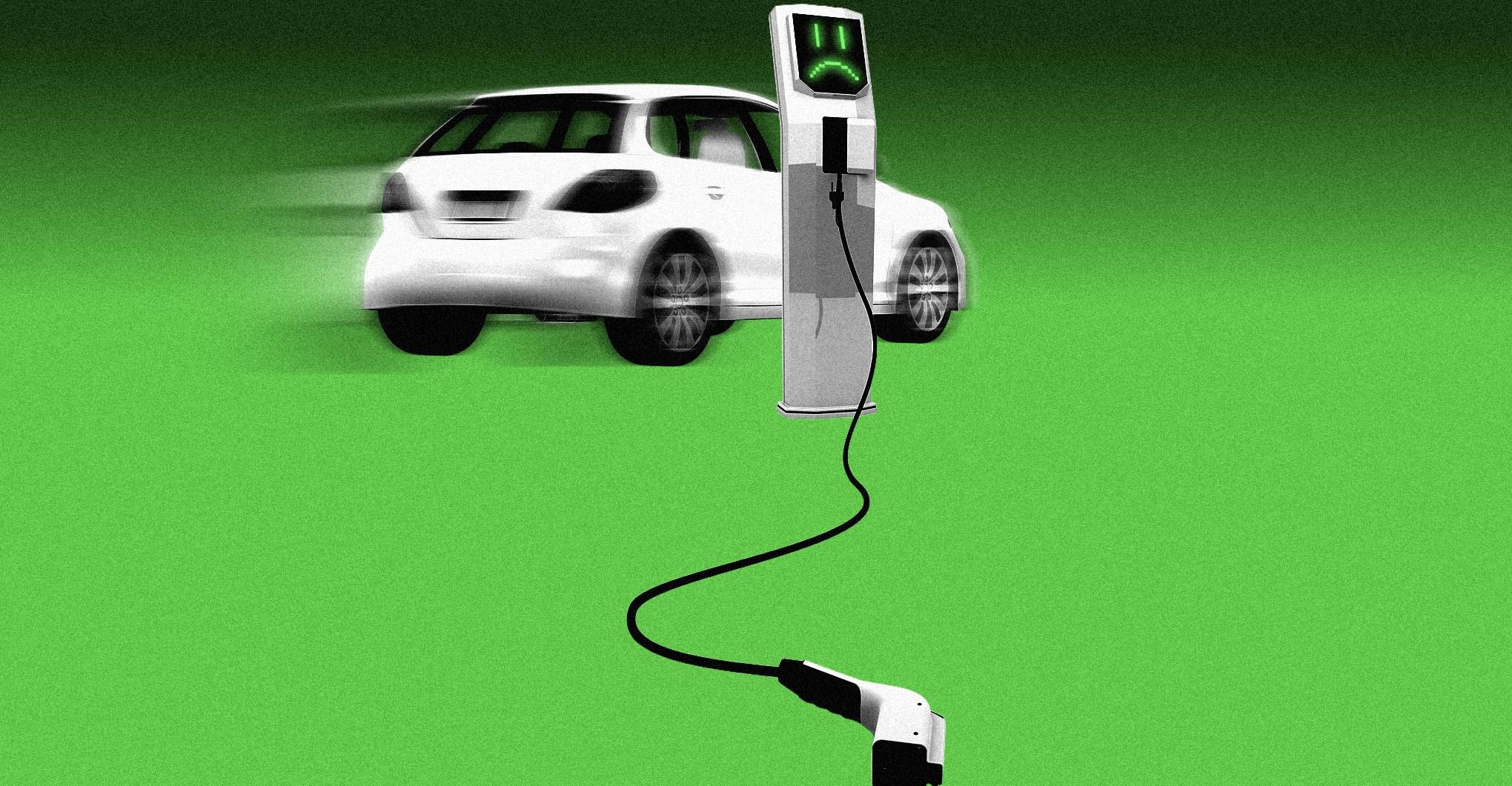

The uncomfortable truth about hybrid vehicles

- 11 گھنٹے قبل

Pakistan targeting militant hideouts in Afghanistan: Tarar

- 8 گھنٹے قبل

World leaders are almost never killed in war. Why did it happen to Iran’s supreme leader?

- 18 گھنٹے قبل

Berger in lead as rain takes teeth out of Bay Hill

- 8 گھنٹے قبل