The price of 10 grams of 24 karat gold also decreased by Rs258 to Rs219,907

Islamabad: The per tola price of 24 karat gold decreased by Rs300 and was sold at Rs256,500 on Monday compared to its sale at Rs256,800 on last trading day.

The price of 10 grams of 24 karat gold also decreased by Rs258 to Rs219,907 from Rs220,165 whereas the prices of 10 gram 22 karat gold went down to Rs201,582 from Rs201,817, the All Sindh Sarafa Jewellers Association reported.

The price of per tola and 10 gram silver remained constant at Rs2,900 and Rs2,486.28 respectively.

The price of gold in the international market decreased by $16 to $2,427 from $ 2,443, the Association reported.

Gold prices fell more than 2% in volatile trading on Monday as investors liquidated positions in tandem with a broader equities selloff, though analysts said bullion’s safe-haven appeal remains strong as U.S. recession fears mount.

Spot gold was down 2% at $2,393.66 an ounce by 1139 GMT. U.S. gold futures lost 1.4% to $2,434.10.

“There’s some truth in the old chestnut that all correlations go to one in a crash, and with traders needing to liquidate winning positions to cover margin calls on other assets, gold’s volatility signals the level of panic hitting equity markets,” said Adrian Ash, director of research at Bullionvault.

Stock markets tumbled, with Japanese shares exceeding their 1987 Black Monday loss at one point, as fears of a U.S. recession prompted investors to offload risk assets.

Asia gold: India premium drops as buying moderates; China demand lags

Data on Friday showed that the U.S. unemployment rate jumped to 4.3% in July, raising the likelihood of a Federal Reserve cut to interest rates in September, with markets now expecting the central bank to cut by as much as 50 basis points.

“Elevated geopolitical tensions and recent hopes for even greater Fed rate cuts should create supportive conditions for bullion. Ultimately, gold should be able to post a new record high once nerves settle,” said Han Tan, chief market analyst at Exinity Group.

Bullion, often used as a hedge against geopolitical and economic risks, thrives when interest rates are low.

Prices of other precious metals also slumped as recession worries dampened the demand outlook.

Spot silver was down 5.7% at $26.92 while platinum fell 4.1% to $918.35 and palladium lost 4.5% to $849.05 after hitting its lowest since August 2018.

Platinum and palladium, both used in engine exhausts to reduce emissions, have come under pressure from the long-term risk presented by the transition to net zero emissions.

However, there are massive short positions that will eventually be unwound, so there is a good chance that both will reach around $1,000, said StoneX analyst Rhona O’Connell.

Thieves drill into German bank vault and make off with millions

- 5 hours ago

UAE says it is disappointed with Saudi Arabia’s statement on Yemen

- 6 hours ago

Rodeo is an app for making plans with friends you already have

- 7 minutes ago

PM Shehbaz reiterates resolve to elevate Pak-UAE longstanding ties

- 4 hours ago

Ubisoft shuts down ‘Rainbow Six Siege’ servers following hack

- 7 minutes ago

GOG’s Steam-alternative PC game store is leaving CD Projekt, staying DRM-free

- 7 minutes ago

Turn your PC into a Super Nintendo with Epilogue’s new USB dock

- 7 minutes ago

.webp&w=3840&q=75)

PM reiterates resolve to elevate Pak-UAE longstanding ties

- 8 hours ago

Karachi lawyers to boycott city court over FIR delay against YouTuber Rajab Butt

- 6 hours ago

I’m The Verge’s Senior Internet Typist, ask me anything while Nilay’s away!

- 7 minutes ago

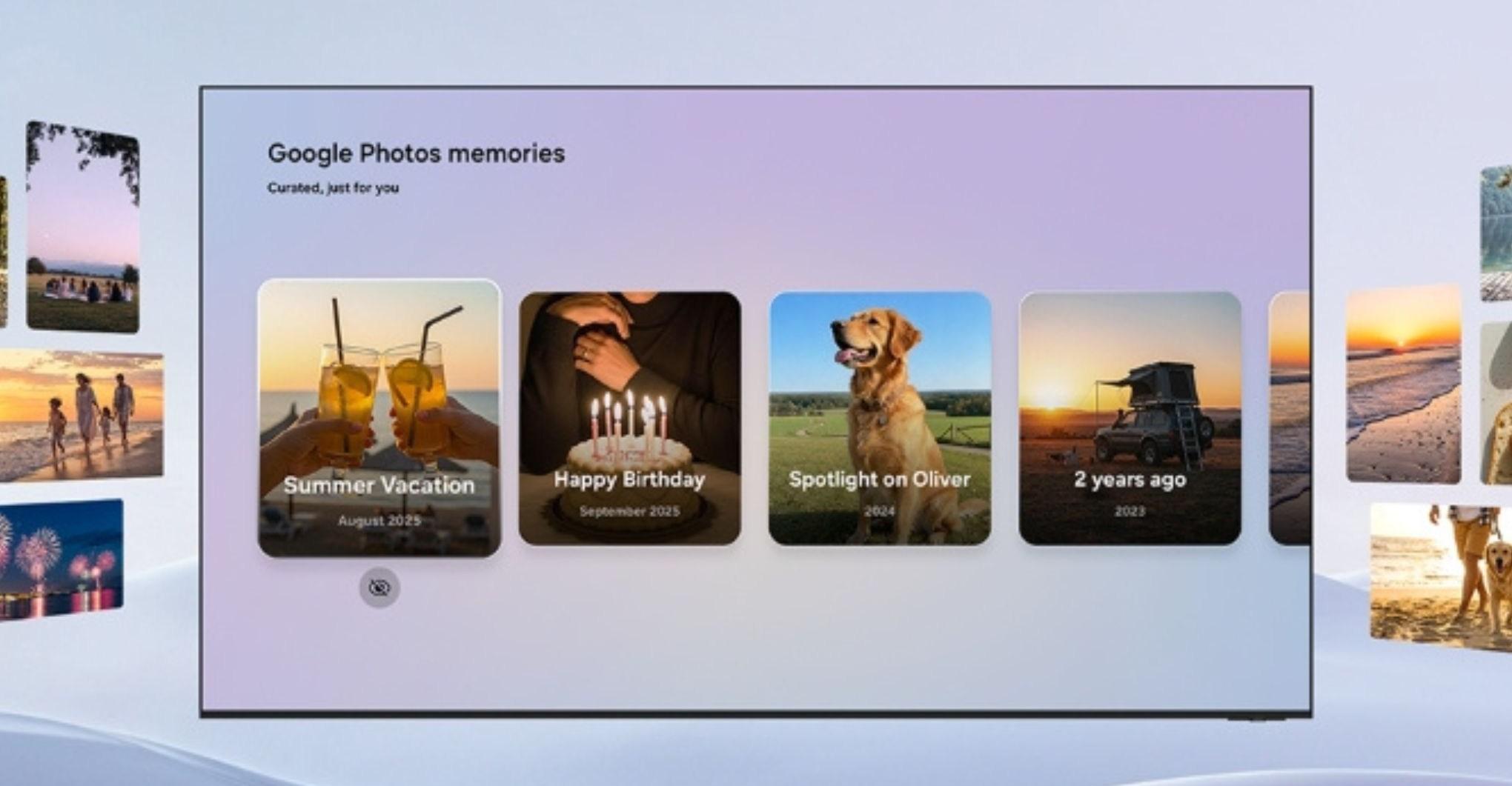

Google Photos is coming to Samsung TVs in 2026

- 7 minutes ago

Meta to buy Chinese founded startup Manus to boost advanced AI

- 5 hours ago